- Worldpay on Monday agreed to be bought by Fidelity National Information Services in a $43 billion that included debt.

- The deal is the second-largest transaction announced so far in 2019, boosting the total value of global deals to a year-to-date total of $345.3 billion.

- More broadly, the global mergers and acquisitions market has slowed down a bit from year.

- Most of the mega deals this year are in the healthcare and financial sectors.

Worldpay on Monday agreed to be bought by Fidelity National Information Services (FIS) in a deal that was valued at $43 billion, including debt.

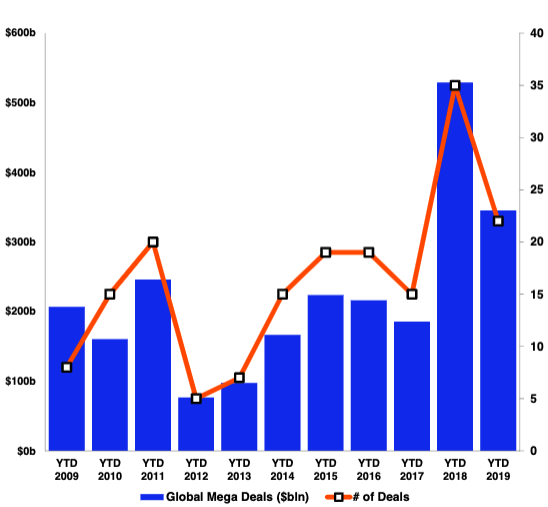

The deal is the second-largest transaction announced during 2019, boosting the value of the 22 global mega deals to $345.3 billion.

Looking broader, the global mergers and acquisitions market has slowed down a bit – at least rom a year ago. At this point last year, the total value of global deals was more than $500 billion.

Here are the nine largest M&A deals so far this year, most of which have been in the healthcare and financial sectors, in ascending order of their valuation size:

Ahli United Bank/Kuwait Finance House

Sector: Financials

Target name: Ahli United Bank

Target nation: Bahrain

Acquirer name: Kuwait Finance House

Acquirer nation: Kuwait

Deal value net debt: $7.7 billion

Date Announced: January 14, 2019

Source: Refinitiv

Ascendas-Singbridge/CapitaLand

Sector: Real Estate

Target name: Ascendas-Singbridge

Target nation: Singapore

Acquirer name: CapitaLand

Acquirer nation: Singapore

Deal value net debt: $7.9 billion

Date Announced: January 14, 2019

Source: Refinitiv

Ultimate Software/Hellman & Friedman

Sector: High technology

Target name: Ultimate Software

Target nation: United States

Acquirer name: An investor group led by Hellman & Friedman

Acquirer nation: United States

Deal value net debt: $11.2 billion

Date Announced: February 4, 2019

Source: Refinitiv

Goldcorp/Newmont Mining

Sector: Materials

Target name: Goldcorp

Target nation: Canada

Acquirer name: Newmont Mining

Acquirer nation: United States

Deal value net debt: $13 billion

Date Announced: January 14, 2019

Source: Refinitiv

GE's biopharma business/Danaher

Sector: Healthcare

Target name: GE's biopharma business

Target nation: United States

Acquirer name: Danaher

Acquirer nation: United States

Deal value net debt: $21.4 billion

Date Announced: February 25, 2019

Source: Refinitiv

SunTrust Banks/ BB&T

Sector: Financials

Target name: SunTrust Banks

Target nation: United States

Acquirer name: BB&T

Acquirer nation: United States

Deal value net debt: $28.3 billion

Date Announced: February 7, 2019

Source: Refinitiv

First Data/Fiserv

Sector: Financials

Target name: First Data

Target nation: United States

Acquirer name: Fiserv

Acquirer nation: United States

Deal value net debt: $38.7 billion

Date Announced: January 16, 2019

Source: Refinitiv

Worldpay/ Fidelity National Information Services

Sector: High technology

Target name: Worldpay

Target nation: United States

Acquirer name: Fidelity National Information Services

Acquirer nation: United States

Deal value net debt: $42.7 billion

Date Announced: March 18, 2019

Source: Refinitiv

Celgene/ Bristol-Myers Squibb

Sector: Healthcare

Target name: Celgene

Target nation: United States

Acquirer name: Bristol-Myers Squibb

Acquirer nation: United States

Deal value net debt: $93.4 billion

Date Announced: January 3, 2019

Source: Refinitiv

SEE ALSO: