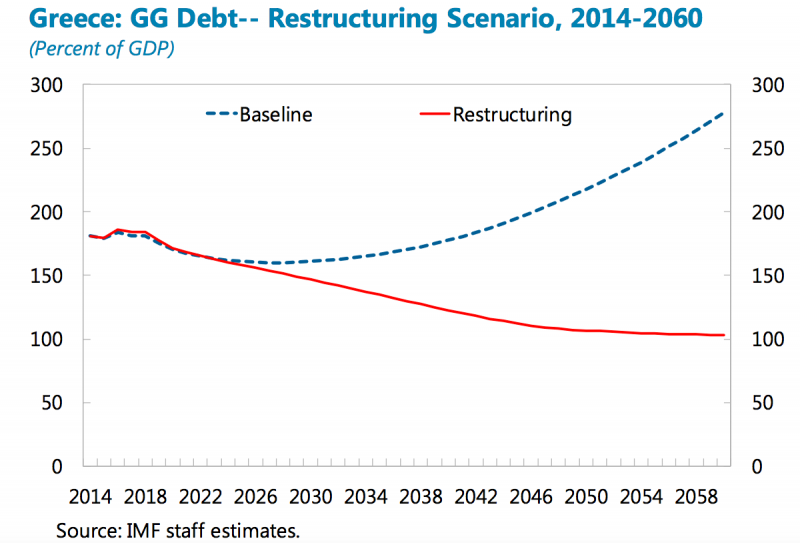

LONDON – Greece’s national debt is unsustainable and liable to become “explosive” once the country tries to refinance its loans at market interest rates from 2030, the International Monetary Fund said in a staff report.

The IMF staff said that additional austerity measures and spending cuts would not improve Greece’s financial prospects in the longer term.

“The analysis suggests that Greece’s public debt is highly unsustainable,” the IMF said.

“Even with full implementation of policies agreed under the ESM program, public debt and financing needs will become explosive in the long run, as Greece will be unable to replace highly subsidized official sector financing with market financing at rates consistent with sustainability.”

The organisation called on Greece’s euro area peers to offer “significant debt relief” and hold back on forcing through more austerity reforms.

"Greece has made enormous sacrifices to get to where it is now," the IMF said. "But the significant achievements in balancing the budget, closing the current account deficit, and improving the flexibility of the labor market have taken a heavy toll on the society and tested its endurance."

Here is the IMF chart showing the diverging paths of the future of Greece's national debt. The scenario without additional help from other European countries is shown in the dotted blue line:

Eurogroup President Jeroen Dijsselbloem, the chairman at meetings of eurozone finance ministers, dismissed the IMF's warnings, according to a report in The Telegraph.

"It's surprising because Greece is already doing better than that report describes," said Dijsselbloem.

The report on Greek debt was prepared by IMF staff, and not all the directors of the fund agreed with everything it said.

"Most Executive Directors agreed with the thrust of the staff appraisal while some Directors had different views on the fiscal path and debt sustainability," the IMF said.