- Matt Hougan is the chief investment officer for the $1.2 billion crypto asset manager Bitwise.

- In a webinar, he and analyst David Lawant shared their bull case for decentralized finance.

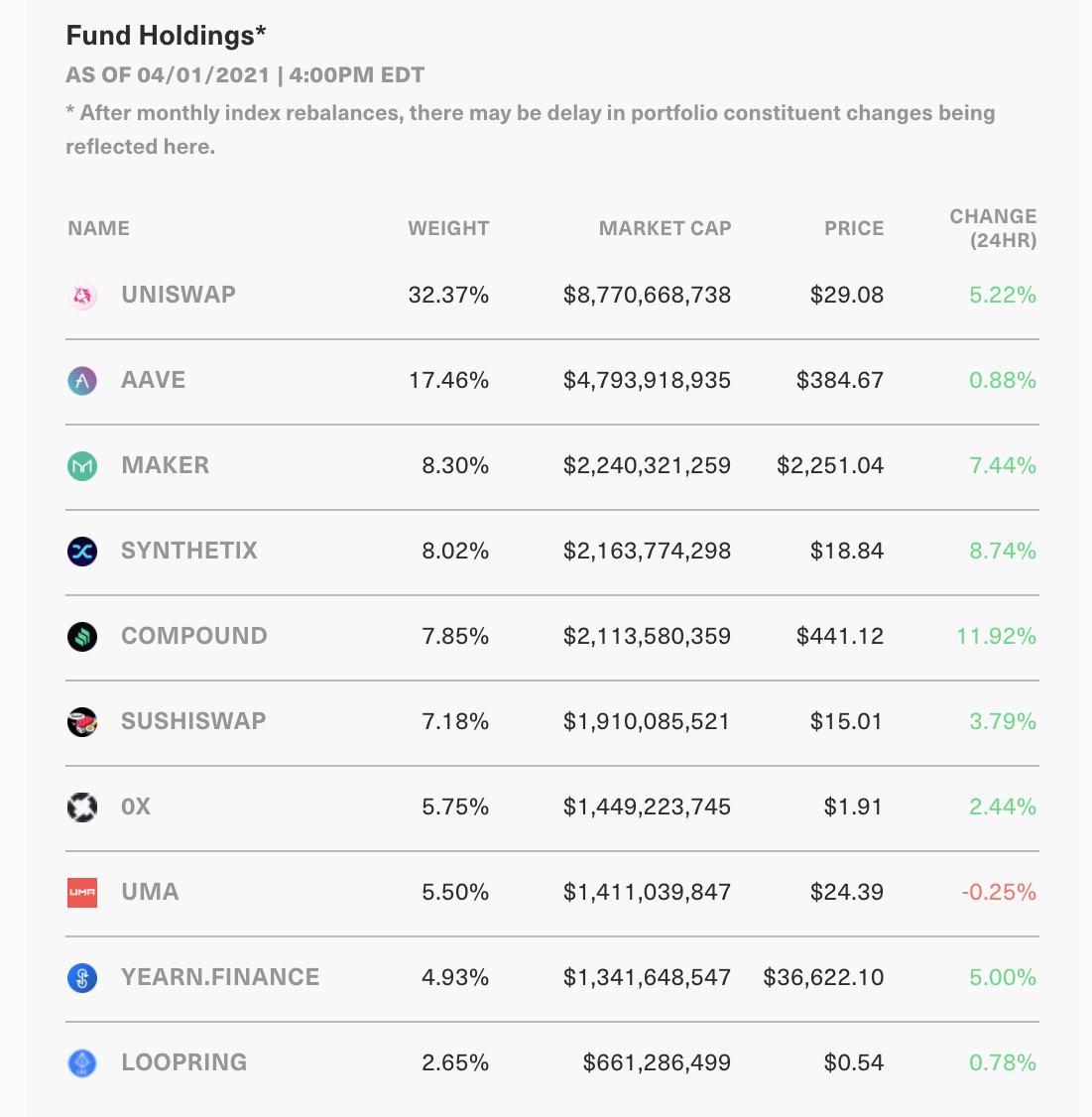

- They also broke down the ten largest DeFi assets that have seen enormous growth and innovation.

When you have billionaire investor Mark Cuban talking about DeFi reminding him of the early days of the internet, and Bank of America issuing a report about DeFi’s radical challenge to modern finance at the same time, you know a paradigm shift is likely on the horizon.

DeFi or decentralized finance refers broadly to blockchain-based trading or lending platforms that are automated by software instead of being executed by human employees. DeFi applications are mostly built on the ethereum network. (Ether, the digital token for the ethereum network and second-largest cryptocurrency behind bitcoin, shot above $2,000 for the first time ever on Friday.)

“Finance has been one of the sectors of our economy that hasn’t been disrupted by software and automation, almost every other sector of our economy has been disrupted significantly by software and automation,” Matt Hougan, chief investment officer of Bitwise Asset Management, said in a Thursday webinar with Fundstrat Global Advisors.

San Francisco-based Bitwise, which has seen its assets balloon to $1.2 billion from $120 million since its flagship Bitwise 10 Crypto Index Fund started trading over-the-counter in December last year, launched the world's first DeFi index fund in February.

Hougan thinks that while Amazon has reshaped the retail industry with technology, financial activities such as banking, lending, and trading are still controlled by hundred-year-old Wall Street institutions. However, more and more crypto investors are viewing it as the last piece of the pie to be eaten by software.

"So much of the cost of today's traditional financial services is not embedded in what it actually does," he said. "It's embedded in that high-price suit and in that trust that's conveyed through traditional human channels and through traditional brands."

On the other hand, DeFi applications were born out of the desire to disintermediate the middlemen on Wall Street by using blockchain and software to automate the process, which is an idea that can be applied to almost every vertical in finance, he added.

Breathtaking growth backed by permissionless innovation

As a sector, DeFi barely existed even as late as June last year, but since then it has grown into a $42 billion market.

"DeFi would rank the 55th largest US bank as a category by assets of $42 billion; that's happened in just a year and that's pretty incredible" Fundstrat's lead digital asset strategist David Grider said on the same webinar.

Hougan, who finds such growth "breathtaking," said a lot of it has to do with the kind of "permissionless innovation" taking place in the DeFi space.

"Imagine if you wanted to build a new product in collaboration with JPMorgan today, you'd have to go engage in a multi-year business development process," he said. "You'd have to have the right backers, the right venture capitals in order to integrate with them and let them give you access to their customers, their client accounts, or their internal systems so you could build an incremental advantage on what they're doing."

Most entrepreneurs would balk at the lengthy, multi-step process that would likely take years to come into fruition. In DeFi, however, anyone can see what the largest players are doing and then build their applications on top of it without engaging in the business development process.

"So it's unleashing these incredible entrepreneurial capabilities," Hougan said. "There's more news in this space in a week than there is in the traditional financial industry in a year. And part of that reason is just this unlocking of permissionless innovation that really means something here."

Breaking down the 10 largest DeFi assets

The major DeFi assets are now appreciating at a breakneck speed, but the ecosystem has been quietly building up its products for the past few years.

One such example is Uniswap, the Coinbase of the crypto market. The decentralized exchange started with a $100,000 grant from the Ethereum Foundation in 2017, but it has generated over $100 million in fees just in the past seven days, according to David Lawant, a research analyst at Bitwise.

The combination of DeFi's enormous growth and multi-year track record means that there is a fairly large investable universe in the space, but the newly-emerging corner of the crypto market is also subject to high technological, regulatory, and security risks.

To capture the growth of the sector in a risk-aware manner, Bitwise's index fund tracks the 10 largest DeFi assets as weighted by market capitalization. As of April 1, these DeFi holdings are shown in the chart below.

Uniswap, SushiSwap (a fork of Uniswap), 0x, and Loopring are all decentralized exchanges or what Lawant calls "infrastructure plays" in the DeFi space.

Aave, Maker, and Compound are three of the biggest protocols that focus on the lending space. Meanwhile, Synthetix and Uma are about derivatives and issuance of synthetic assets, according to Lawant.

Last but not least is Yearn.Finance, which can be thought of as an aggregator or asset manager that "allows their users to go for the best yields and the best opportunities," he said.