- Democrats have proposed erasing up to $50,000 in student-loan debt per borrower.

- About 360 high-ranking Hill staffers reported student-loan debt in their official financial filings.

- Those aides have access to debt-shaving programs that experts say they should take advantage of.

If you're a congressional staffer saddled with student-loan debt, you likely have several repayment benefits not available to the general public.

That's a big advantage for the legions of indebted Capitol Hill aides, as their bitterly divided bosses don't appear anywhere close to agreeing on whether to forgive student-loan debt.

About 360 high-ranking congressional staffers reported student-loan debt in their official financial filings, including a handful who've been paying off loans since 1989, according to an analysis of nearly 2,200 congressional financial records performed as part of Insider's Conflicted Congress project. Some of them could help Congress shape a debt-cancelation deal for regular Americans.

A senior Democratic staffer who graduated from law school with $160,000 in student-loan debt said he struggled during his first few years on Capitol Hill because of his monthly payments.

"My income wasn't enough to pay student loans and have a social life," he told Insider, adding that he still owes a significant amount because of the interest accruing on the loans. The staffer did not want to be identified because of the sensitivity of this issue.

As part of its Conflicted Congress project, Insider reviewed financial-disclosure reports for top-ranking staffers to determine whether they had student-loan debt, a topic of significant debate on Capitol Hill.

The analysis uncovered staffers at every level who are burdened with tens of thousands — and sometimes hundreds of thousands — of dollars in nagging student-loan debt.

Congressional staffers who are just beginning to repay their loans have especially crucial decisions to make.

Martin Lynch, the president of the nonprofit Financial Counseling Association of America, and Barry Coleman, the vice president of counseling and education programs at the nonprofit National Foundation for Credit Counseling, gave Insider a crash course in how congressional staffers can manage student-loan debt, even breaking down the pros and cons of the expanded Public Service Loan Forgiveness program that President Joe Biden recently threw into the mix.

Loan-debt logistics

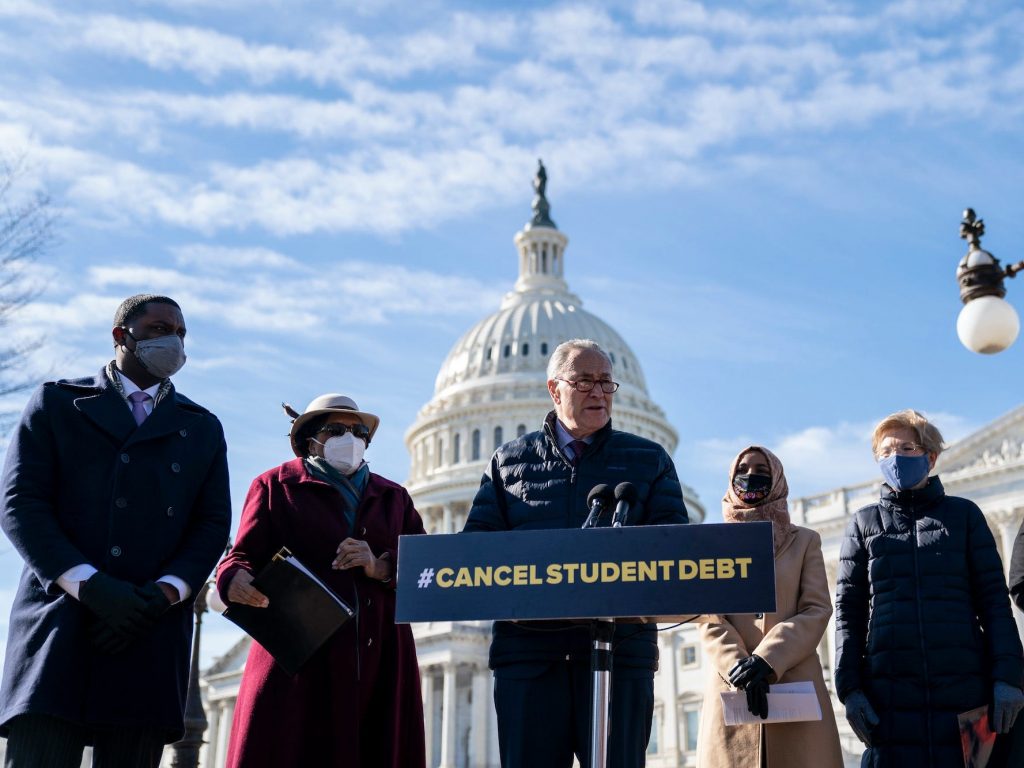

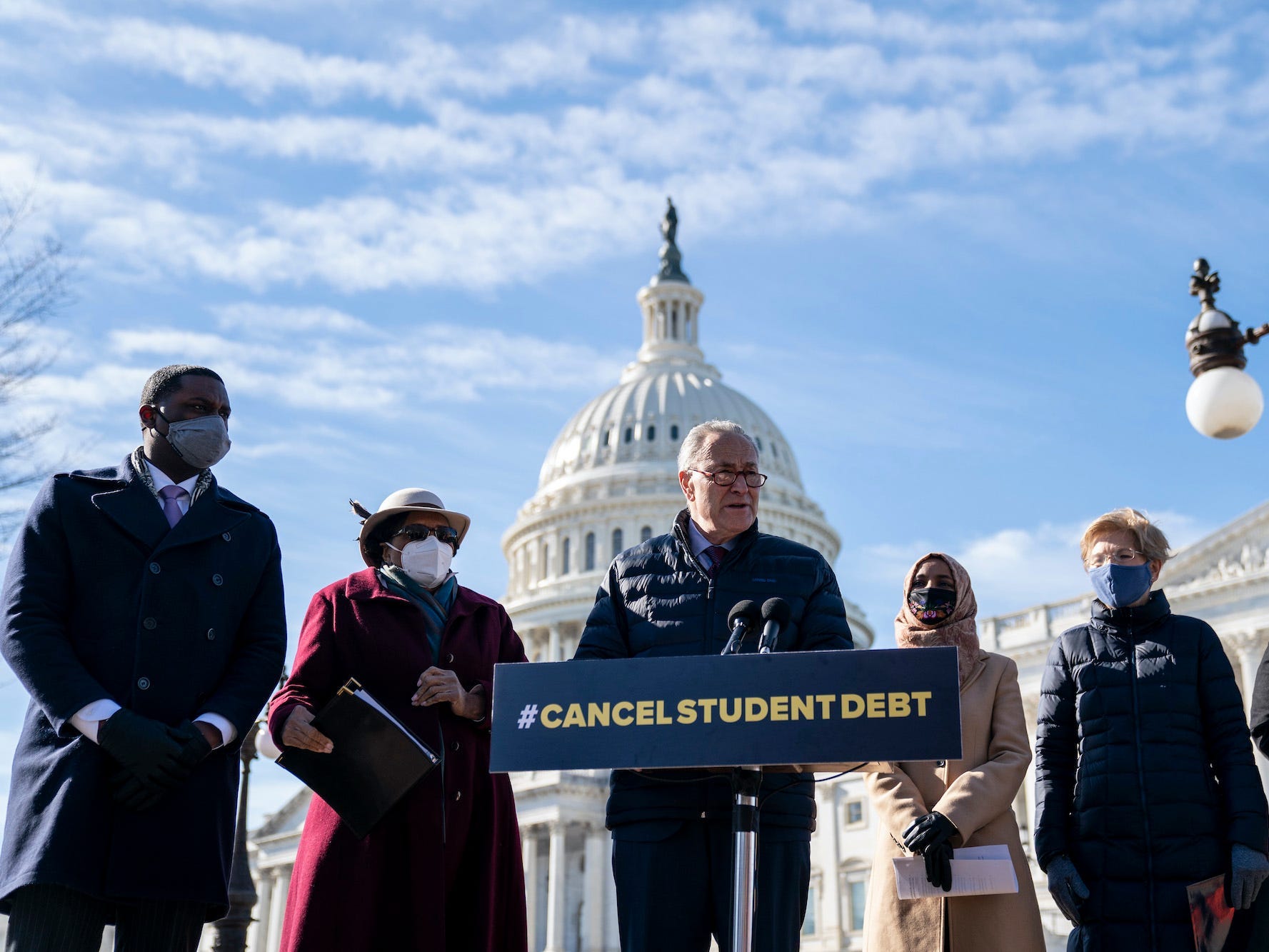

Democrats continue to spar over how much educational debt lawmakers can realistically erase for borrowers across the US.

Biden campaigned on erasing up to $10,000 owed per borrower. Progressives, including Sen. Elizabeth Warren of Massachusetts and Rep. Ilhan Omar of Minnesota, want relief of up to $50,000.

Biden bought himself a little time by extending pandemic-sparked relief that froze student debt payments in March 2020 until January 31, 2022. White House Press Secretary Jen Psaki told reporters at her December 13 briefing that debt-cancellation proposals have been under review for months, but said it's up to lawmakers to take the next step.

"If Congress sends him a bill, he's happy to sign it,"Psaki said, signalling that the Biden administration won't be extending its student loan payment relief program beyond the end of January 2022.

Regardless of what happens, student-loan-laden congressional staffers already wield some powerful tools.

An Education Department aide confirmed that congressional staffers are eligible for the Public Service Loan Forgiveness program, which absolves full-time federal workers of any remaining obligations after they make qualifying monthly payments for 10 years.

"Only elected members of Congress are excluded from PSLF eligibility; congressional staffers are eligible just like other federal employees," the aide told Insider of the program, enshrined in the Higher Education Act of 1965.

Congress also provides internal help through a debt-retirement plan coordinated by the House chief administrative officer and the secretary of the Senate, CQ Roll Call reported in 2019.

A House CAO aide confirmed that the in-house program, which is capped at $80,000 for qualifying House staffers and $40,000 for Senate staffers, is funded by tax dollars. The aide told Insider that lawmakers could allocate a portion of their office budget to the debt-retirement program, so long as they don't exceed the limit for each qualifying staffer.

Coleman and Lynch stressed that using these programs is not the same as waving a magic wand — borrowers still have to put in work and make timely payments.

The Biden administration recently opened up the Public Service Loan Forgiveness program to federal workers who consolidated outstanding loans. Certain types of refinancing had made student-loan holders ineligible for government-sponsored debt relief, so eliminating the technicalities is great news for staffers, Lynch said.

But it's not a panacea.

Lynch said one pitfall is that "consolidating resets the clock on the 120 eligible payments you need to make," adding that starting over would likely work better for people just entering a repayment plan than those who've been at it for a while. "Don't consolidate and inadvertently put yourself back at square one."

Coleman said the updated program had another hang-up: Borrowers have to stay put in their careers.

"Borrowers cannot leave public-service jobs while working towards PSLF without affecting their eligibility for forgiveness," Coleman said. He urged staffers to consider the higher salaries they could command in the private sector "versus remaining in public service for 10 years and earning less."

Outside help

Refinancing a student loan through private lenders may appeal to congressional staffers seeking more immediate relief, Lynch said.

"If you're not a PSLF candidate or aren't confident that the Biden administration will grant a lump-sum forgiveness anytime soon, then a private consolidation could certainly result in a much lower interest rate and save you money," Lynch said.

Tapping alternative funding sources is the best way to stay on top of your finances over the long run, according to Coleman.

"A borrower should fully exhaust any scholarships, grants, and personal savings before turning to student loans," he said, encouraging people to "shop around" for affordable federal and private loans. Coleman advised those who do pursue loans to avoid borrowing "more than they truly need."

Many borrowers can jump-start debt retirement on their own, Lynch said. Some of the aggressive repayment techniques he prescribed include:

- Making extra monthly payments whenever possible (just alert your loan provider ahead of time so it can adjust its records).

- Committing to a 10-year repayment plan to minimize accrued interest.

As for congressional perks, the senior Democratic staffer still wrestling with law-school loans said that the repayment assistance coordinated by the House chief administrative officer provided a big incentive to stay put.

"It's not a stretch to say that I would have rethought a career on Capitol Hill if I did not have that program," the staffer said.