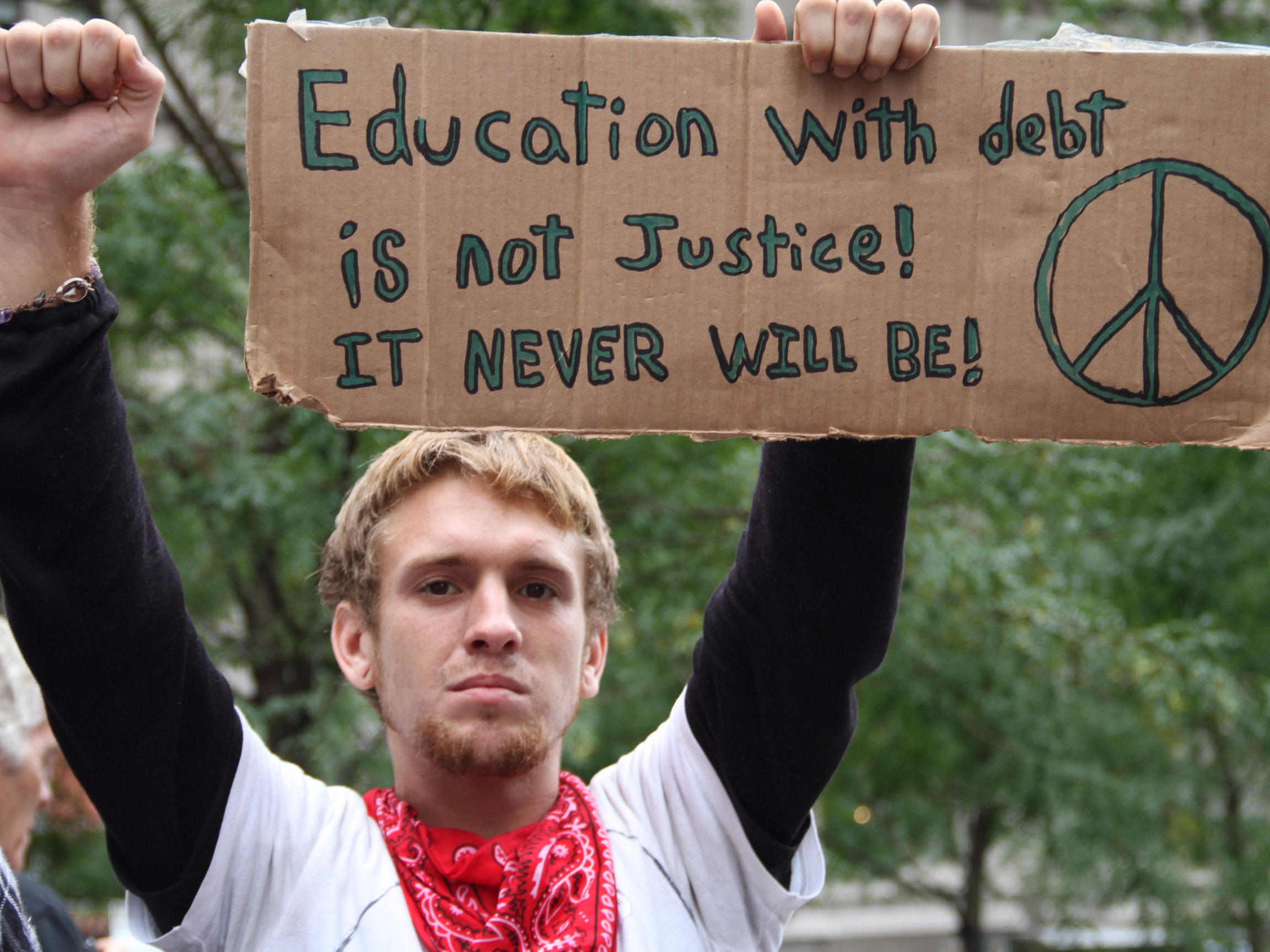

A new analysis of data on the financial health of young people in the United States tells a frightening story about declining opportunity in America – a story of a generation saddled with crippling debt and forced to compete with older members of the workforce during a time of deep economic uncertainty.

The data was compiled by the Washington, DC-based think tank Young Invincibles.

Thanks to macroeconomic forces, like the Great Recession, and technological change, millennials are “the most educated, most diverse, and most indebted generation in America’s history.”

What’s worse, little is being done on Capitol Hill – or in state capitols around the country – to secure their futures and the future of this country. Young Invincibles looked at a number of economic statistics for 25- to 34-year-olds in 2013 and compared them with the same age group in 1989.

“The declines across education levels were so steep that young people today that have a degree with debt earn roughly the same as young workers with no degree in the late 1980s,” the report said.

Racial disparities, especially between white Americans and black Americans, worsened dramatically. For example, white young adults accumulated four times as many assets and are twice as likely to own a home as black Americans and Latinos, according to the report.

So it's not a pretty picture.

Millennials have accumulated about half the assets their parents had in 1989. They also make about $10,000 less on average.

Median income declined dramatically for white Americans, less so for African Americans. Latinos, who started with a significant disadvantage in 1989, saw gains.

Young adults with debt and a degree today make about the same as young adults with no degree in 1989. That said, it's still much better to have a degree than not.

In fact, student debt is so significant that assets for young student borrowers declined even faster than those for young people with no degree at all.

It's now much harder to own a home without having a college degree. Overall 46% of 25-34 year olds owned homes in 1989. That number fell to 43% in 2013.

Despite those disadvantages, young adults now are saving much more than their peers in 1989, on average saving $14,596 and $5,616 respectively. Among the college educated the difference is even more stark.

Now, all of this is pretty bleak, but a lot can be done to rectify the situation as long as we confront some uncomfortable truths.

Like the fact that states need to start reinvesting in higher education. As the report points out, "for the Boomers we measured in 1989, average tuition at 4-year public colleges was $3,454 in today's dollars."

The report also suggests:

- Creating two-year certificate programs to prepare people for middle skill jobs that don't require a four-year college degree. "These jobs are distributed across diverse types of occupations, including sales, health care, information technology, transportation, production, and installation and repair. Our educational system must be re-aligned to connect young people to these opportunities."

- Encouraging college completion to ensure that more people can pay back their student loans.

- Raising the federal minimum wage.

- Expanding the earned income tax credit to individuals without children. Both President Barack Obama and Paul Ryan have proposed ways to do this.

- Allowing credit agencies to accept rent payment as trade lines on credit reports.

The report also suggests improving financial literacy and creating state-sponsored retirement plans for workers who don't get them through their employers. Of course, measures like that would likely help all Americans, and we have the ability to invest in them.

It's just a question of whether or not those in power have the will to do so.