- The Lyft IPO is all about destroying car ownership as we know it.

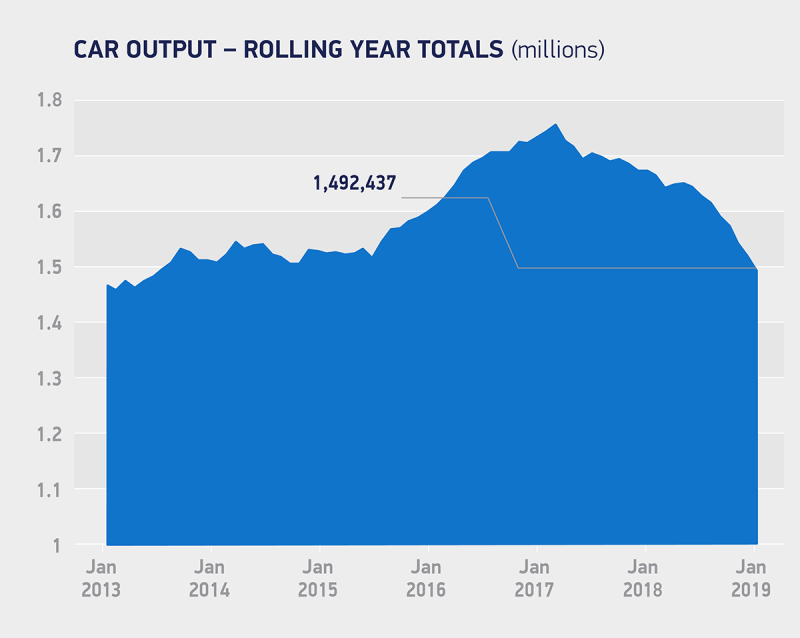

- Car sales in Britain declined 18.2% in January. It was the eighth successive month of decline.

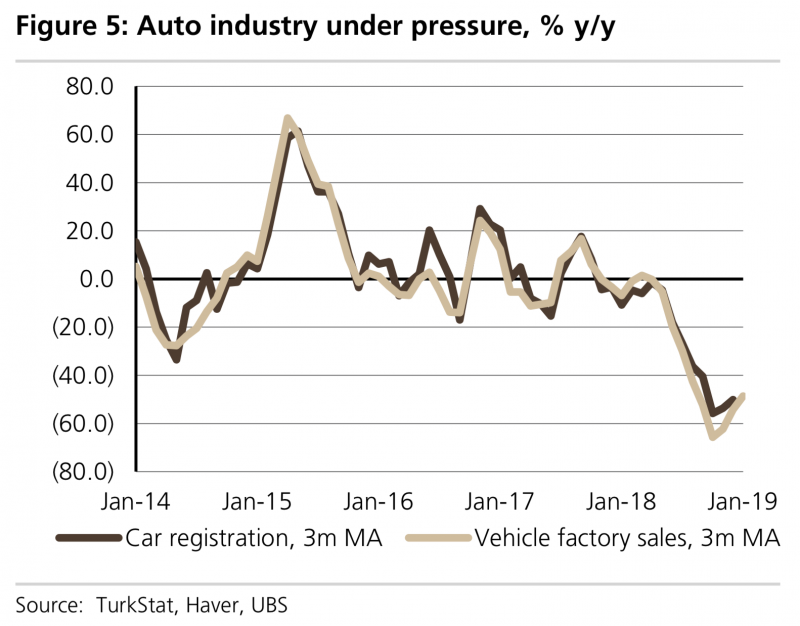

- Sales in Turkey declined 60%.

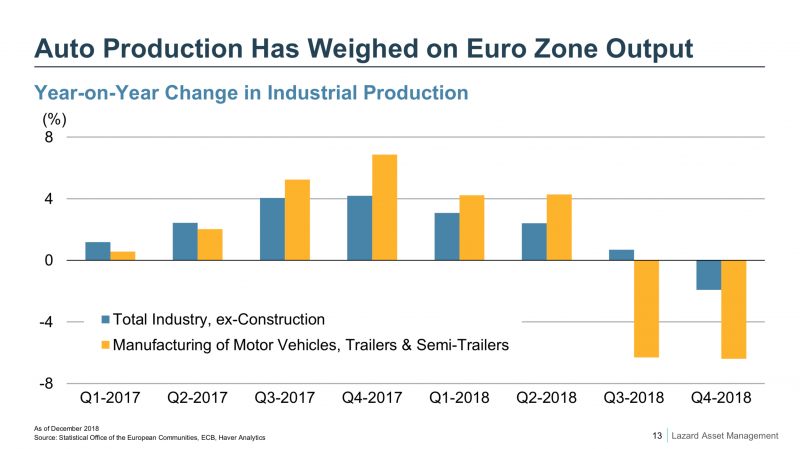

- Europe-wide, sales are down around 6%.

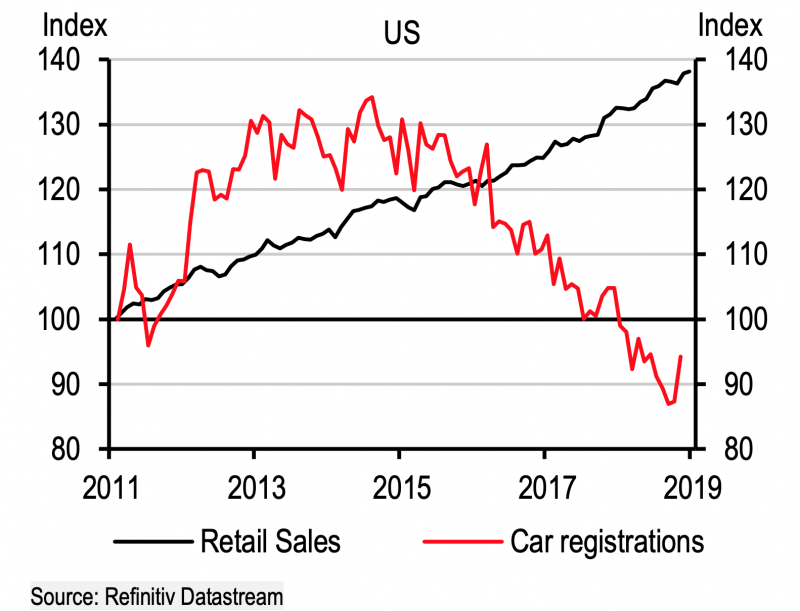

- In the US, total car registrations have declined by about 10%

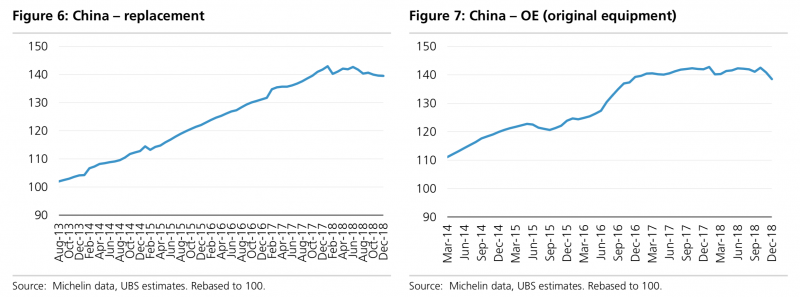

- Tire sales – a proxy for vehicle production – are down in China, too.

- People just don’t want cars that much anymore. Uber and Lyft are reducing the need for new cars. Automobiles could be entering an historic decline.

The founders of the ride-sharing app Lyft filed their IPO papers last week, and their vision for the company is dramatic. Lyft (which works a bit like Uber) is not just about getting you from A to B, they say. Rather, founders Logan Green and John Zimmer believe that car ownership is in permanent decline and they want to help it die, they write in their S-1 filing.

“We believe that the world is at the beginning of a shift away from car ownership to Transportation-as-a-Service, or TaaS. Lyft is at the forefront of this massive societal change,” they told investors. “Car ownership has … economically burdened consumers. US households spend more on transportation than on any expenditure other than housing. … On a per household basis, the average annual spend on transportation is over $9,500, with the substantial majority spent on car ownership and operation.”

Cars create “inequality,” they argue. “The average cost of a new vehicle in the United States has increased to over $33,000, which most American households cannot afford,” the IPO says. “We estimate over 300,000 Lyft riders have given up their personal cars because of Lyft.”

They may be right.

If there is an historic moment at which the car industry goes the way of the newspaper, this is it.

For example, in January, car sales in Britain declined 18.2%, to 1.49 million vehicles annually.

It was the eighth successive month of decline, according to SMMT, the industry body which tracks automobile data.

The group blamed Brexit. "The clear and present danger remains the threat of a 'no deal' Brexit, which is monopolising time and resources, undermining competitiveness," said Mike Hawes, SMMT's CEO.

It's not just Brexit, of course. There has been "weaker demand in both UK and key export markets," SMMT said. In fact, car sales in Britain have been declining since 2017.

While an 18% drop sounds calamitous, it's mild compared to what's going on in Turkey, where consumers have cut their car purchases by a staggering 60% since January 2018, according to data collected by UBS analyst Gyorgy Kovacs and his team.

Turkey, of course, is in the middle of a grinding recession due to the collapse of its currency, the lira. GDP growth for the year 2019 is set to decline -2.9%, Kovacs predicts.

Although extreme, Turkey proves one thing. Today's cars last so long that if bad times happen consumers can simply stop buying new ones and get along just fine with their old ones.

The UK and Turkey can be written off as special cases. Most countries aren't grappling with Brexit or the lira crisis. But it turns out that "special cases" are now the rule, not the exception, for the car industry.

Here's the car data for the entire eurozone, the 19 countries in Europe that use the euro as a currency, supplied to Business Insider by Lazard Asset Management. Car sales are down across the board:

The shape of that chart bears a resemblance to this next one, from HSBC, which tracks total car registrations in the US, indexed to 2011. The data was collected by HSBC analysts Janet Henry and James Pomeroy. This chart is surprising because, for decades, Americans have regarded their cars as extensions of their cultural identity.

And yet, they don't want them the way they used to:

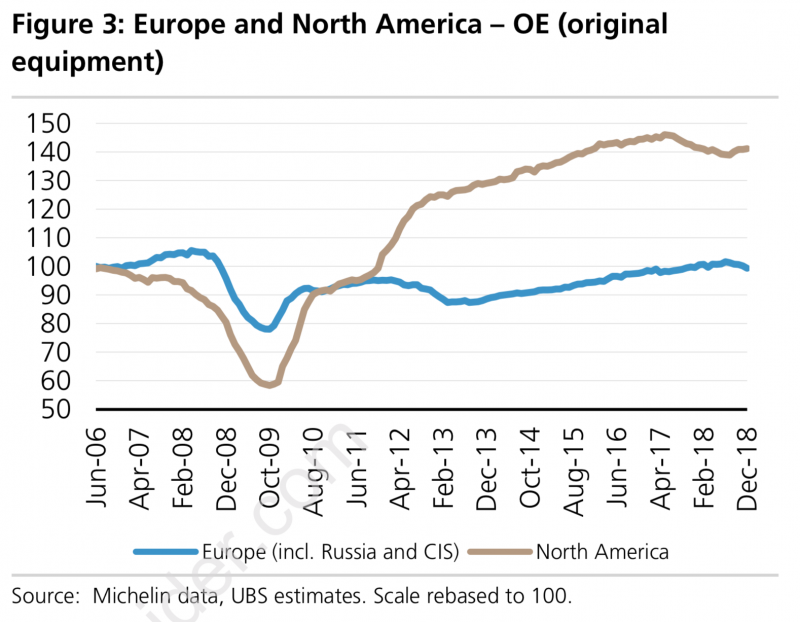

Both Europe and America have taken clear steps back from car-buying. This next chart shows sales of new tires on new vehicles - a directional proxy for car sales - indexed to a start-point in 2006. It comes from UBS analyst David Lesne and his team. After the financial crisis of 2008 tire sales rebounded, especially in the US. In Europe (the blue line), sales took a clear step down in 2013 and then continued in a lower gear. In North America (the brown line), it looks like the downward step-change occurred in 2017:

New car sales recently peaked in the US. But this year - 2019 - they took a sudden dip. Auto sales were down 1% in February and down 3% in January, according to JD Power and LMC Automotive. More than 7 million Americans recently went into "serious delinquency" on their car loans, a new high since the financial crisis, according to the Federal Reserve Bank of New York.

Finally, here are the tire-sales data for China. Both new and replacement tires have taken a dip inside the world's second-largest economy:

All around the world, employment is at record highs. The Chinese economy is still growing at a rate of 6% per year. There is wage growth in most Western economies. Consumers should be feeling very confident about buying new cars. Yet the auto business is behaving as if it's already in a recession, with plant closings and global layoffs in the thousands.

This is worrying for recession-watchers.

Cars are such big purchases that they can have a macro effect on the economy.

Germany and Britain are the Detroits of Europe. They depend on each other for parts, manufacturing, and sales. Yet - due to Brexit - the relationship is falling apart. Britain's departure from Europe will wipe points off its GDP growth no matter how good a trade deal prime minister Theresa May can get. But Germany will lose too, as logistical and tax barriers go up between it and its most important car-making partner. According to Reuters:

"A no-deal Brexit ... would push up British import tariffs for German cars to roughly 10 percent. For trucks and pick-ups, tariffs of up to 22 percent would apply. ... the combined impact could chop off up to 0.7 percentage points from Germany's gross domestic product (GDP) growth in the long term, separate estimates from Commerzbank and the Ifo institute show."

A thoughtful article from Bloomberg argued recently that the popularity of rideshare services like Uber and Lyft is driving the decline. Business Insider has argued that case before, too. Uber has all but admitted that it wants to end private cars driven by humans in favour of a driverless fleet, ending 40,000 jobs in London alone.

The guys at Lyft are right. Automated, driverless transport services will likely reduce the demand for cars in the future.

It's hard to say whether car manufacturing is hurting because the greater global economy is faltering, or whether the faltering economy is hurting cars.

Either way, it's not good. We're looking at the end of an era.

Buckle up. We're in for a bumpy ride.

Read more about the decline of cars:

The failing automobile industry is pushing us toward a global recession

Cars are driving us toward recession

Apps like Uber and DriveNow may be hurting the demand for new cars, studies suggest