- Bittrex emails users to “discourage any type of market manipulation, including pump groups.”

- Email follows BI investigation that exposed widespread “pump and dump” scams in parts of the $300 billion cryptocurrency market.

LONDON – The world’s third-largest cryptocurrency exchange has written to users warning them against market manipulation, a week after a Business Insider investigation that found “pump and dump” scams operating on the platform.

Bittrex wrote an email to users on Friday notifying them of several changes to the service aimed at “improv[ing] the overall trading experience.”

The notice also included a warning to customers that they could be banned or have their accounts frozen if they artificially manipulate the price of coins trading on its platform.

“Bittrex actively discourages any type of market manipulation, including pump groups,” the email from Bittrex “Consistent with our terms of service, we will suspend and close any accounts engaging in this type of activity and notify the appropriate authorities.”

The email follows an investigation by Business Insider earlier this month that found traders are colluding in groups on chat app Telegram to inflate the price of digital coins on platforms such as Las Vegas-registered Bittrex and Russian exchange Yobit. The aim is to make a quick profit by selling the coins on to new investors attracted by the price rise.

Securities lawyers contacted by Business Insider dubbed the actions "market manipulation 101" and suggested that financial regulators should take the same approach to the activities as is does in the stock market, where this type of market manipulation is illegal.

A spokesperson for Bittrex told BI: "To ensure an optimal trading experience and protect our service and users from harm, Bittrex regularly reviews and updates its policies for placing orders on our exchange, as well as conducts periodic compliance reviews.

"As part of that process, we recently alerted Bittrex customers of several policy initiatives, including the removal of orders that are more than 28 days old; an increase in the minimum trade size; the creation of a minimum tick size; and a reminder to our customers that any kind of market manipulation is strictly prohibited by our terms of service."

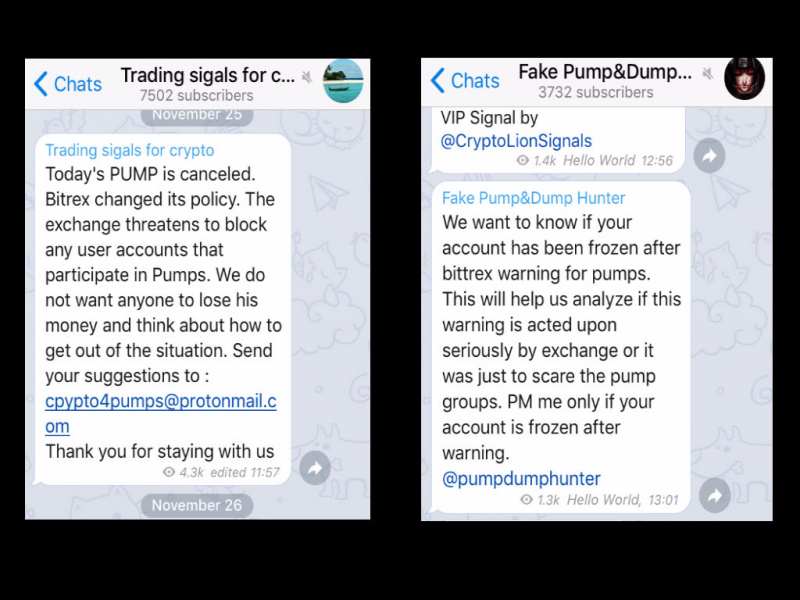

Messages on "pump and dump" chat groups on Telegram, seen by Business Insider, show that traders involved in manipulation tactics have taken notice of the warning.

Despite pausing activities, at least one pump channel, "Trading signals for crypto", said it would continue organising "pumps" on Bittrex and sent instructions to its more than 7,000 members to pump the price of a coin on Bittrex on Tuesday.

Bittrex, which was founded by former Amazon security engineers, is the world's third-largest fee-charging cryptocurrency exchange by volume, according to data provider CoinMarketCap.com. As much as $1 billion is traded on the platform each day.

Cryptocurrencies have exploded in popularity this year thanks to the success of so-called initial coin offerings (ICOs), in which startups issue new digital coins in exchange for real money used to fund their ideas. These coins can be traded on online exchanges, offering greater liquidity to investors in private companies.

The total cryptocurrency market recently reached $300 billion and there are now over 1,300 cryptocurrencies in circulation, according to CoinMarketCap.com.

However, several companies that issued coins manipulated in "pump and dump" scams have contacted us. Representatives for Belize-based ChillCoin and Singapore-based Indorse expressed surprise and alarm that their coins were being manipulated in such a way on the secondary market. There is no suggestion that the companies that issue the coins are involved in any way.

You can read BI's full investigation into cryptocurrency "pump and dump" scams here.