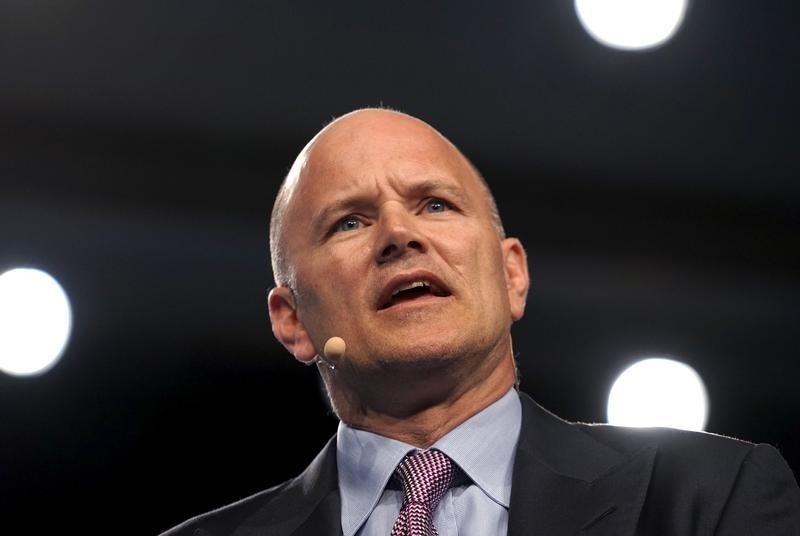

- Mike Novogratz has led a $52.5 million fundraise for crypto-lending startup BlockFi, the company announced Tuesday.

- The firm will use the funds to expand its lending platform outside the US and to support more digital assets.

- BlockFi allows crypto investors to borrow against their holdings.

Mike Novogratz’s merchant bank Galaxy Digital has led a $52.5 million fundraising round for crypto-lending startup BlockFi, the firm announced on Tuesday.

The New York-based firm offers corporate and retail clients loans on their crypto holdings, with a loan book in the millions.

Founded by former Cognical senior vice president Zac Prince, the firm has raised money in two rounds this year. In February, it raised $1.55 million from ConsenSys Ventures, SoFi, and Kenetic Capital, as CoinDesk previously reported.

The most recent round comes as BlockFi eyes expansion in new states and international markets, and the addition of new products. It is also looking to support more cryptocurrencies.

Potential new business opportunities are in fixed-income and debt investments, as well as lines of credit and a credit card, Prince told Business Insider.

To that end, the firm has brought on former Bank of America managing director Rene van Kesteren, who ran a seven-person equity-structured financing business before joining BlockFi in May.

Currently, BlockFi allows investors to take out a loan as high as $10 million using either bitcoin or ethereum as collateral. That lets investors retain ownership of their crypto and not miss out on the next potential price surge, but also have cash on hand to pay employees or go on a vacation, for instance.

This marks the most recent investment for Novogratz's Galaxy, which has been pouring money into crypto firms at a fast clip. In June, Galaxy invested $35 million into virtual-reality firm High Fidelity, and $15 million in AlphaPoint, a New York firm building out a platform for tokenized assets.

As Business Insider previously reported, Galaxy, which has businesses in asset-management, trading, and investing, has made a significant number of investments in the market for digital coins which have not yet been disclosed publicly.

People familiar with the firm's operation said the principal-investment team has purchased stakes in high-volume initial coin offering projects and has a significant portfolio of early stage ventures.

Novogratz notably made $250 million from cryptocurrency ether and now holds 10% of his entire net worth in digital assets.

As for BlockFi, Novogratz said: "A robust lending market is the keystone for financial systems and BlockFi's institutional approach and deep lending expertise were key drivers in our decision to partner with them."