- With Biden set to decide on student debt forgiveness soon, opponents see higher inflation as a key risk.

- Republicans argue debt cancelation could boost demand and worsen price increases.

- The White House might resume payments after canceling debt to counteract a possible surge in spending.

Every element of broad student-loan relief is fodder for debate, from how much to forgive to who should receive forgiveness. And right now, the impact debt cancellation could have on the economy is adding another layer to the mix.

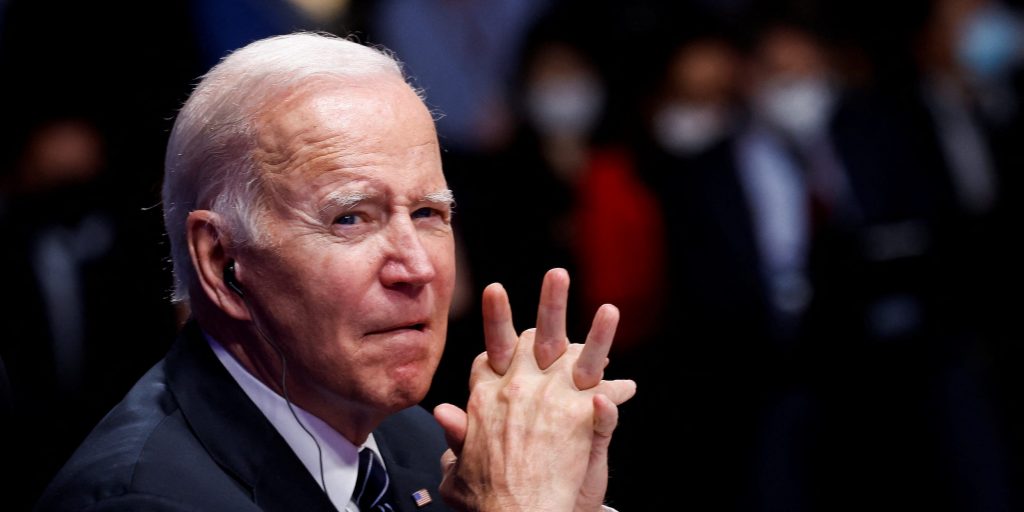

On the campaign trail, President Joe Biden pledged to voters with federal student debt that they would see a $10,000 reduction of their balances — but it's been over two years, and millions of borrowers are still waiting for that relief. Most recent reports have suggested the president is considering $10,000 in forgiveness for borrowers making under $150,000 a year. Forgiving $10,000 per borrower would wipe out $321 billion in federal student loans, according to researchers at the Federal Reserve Bank of New York.

But with the US facing 40-year-high inflation, that potential burst of new spending power from consumers who'd instantly see their net worth jump by thousands of dollars could send the cost of common goods and services even higher. Prices soared 8.6% in the year through May, powered by an abundance of consumer demand and woefully insufficient supply.

The possible inflationary spike gives the GOP a new talking point in the debate over broad forgiveness. Forgiving hundreds of billions of dollars in debt, Republicans argue, will only boost demand and exacerbate already stifling inflation, but Democratic lawmakers have stressed the need for relief, and the economic stimulus it would bring.

The Biden administration is working on a fairly tight schedule. The freeze on student-loan payments is set to expire after August 31, and many lawmakers and advocates worry payments will resume before any broad relief is fully implemented.

For the White House, though, resuming payments after canceling some student debt might be necessary to fight rising inflation.

Jared Bernstein, a member of the White House Council of Economic Advisers, previously told The New York Times that "the key economic fact here is that if debt payment restart and debt relief were to occur at roughly the same time, the net inflationary effect should be neutral."

Those against forgiveness are also pushing for a reversal of the payment freeze, arguing that ending the pandemic-era policy could cool demand further as Americans shift their budgets back toward making those payments.

Top Republican on the House education committee Virginia Foxx has repeatedly slammed the idea of any broad student-loan forgiveness and continued payment pauses, citing the $150 billion cost to taxpayers that accompanied Biden's latest extension of the payment pause and the potential inflationary impact further relief would bring.

"Taxpayers have been footing the student loan bill for graduate students and Ivy League lawyers to the tune of $5 billion every month while their wallets are being drained by skyrocketing inflation," Foxx previously said.

The Committee for a Responsible Federal Budget — a conservative think tank — also wrote in a report that broad student-debt cancellation is a poor economic stimulus, putting $90 billion per year back into the economy while costing the US around $1.5 trillion in uncollected loan repayments.

Student-loan forgiveness 'could be good for the economy'

Still, as Insider reported, some experts think broad relief is something the government can afford to implement.

Marshall Steinbaum, an economics professor at the University of Utah, previously said the economy has been "more than fine" without student debt payments, and some members of the Biden administration see a clear benefit from moving forward with forgiveness efforts. Treasury Secretary Janet Yellen said such a move "could be good for the economy" by removing a "substantial burden" from millions of Americans' financial lives.

While it appears Biden plans to restart student-loan payments on September 1 to ease concerns over inflation, it's still unclear if even that will happen. Education Secretary Miguel Cardona recently said another extension of the pause is not off the table, and advocates argue that a continued freeze — and broad debt cancellation — could help borrowers deal with the rising prices that are draining their wallets right now.

"We strongly urge your administration not to threaten the financial security of people with student debt as a tactic to fight inflation," nearly 200 organizations, including the NAACP, recently wrote to Biden. "Instead our organizations urge you to enact robust student debt cancellation that is not means-tested and does not require an opt-in for participation and to fully implement this policy before any student-loan bill comes due."

Whether forgiveness exacerbates inflation or not, it's up to the Fed to slow the price surge. Officials have already raised interest rates at the fastest pace in nearly three decades in hopes of closing the gap between supply and demand. Chair Jerome Powell emphasized the importance of cooling inflation in a Wednesday panel hosted by the ECB, saying there's "a clock running" before faster price growth turns permanent.

Yet for all the talk of forgiveness posing new inflation risk, the central bank is steering clear of taking a side on the matter. When asked by Republican Rep. John Rose of Tennessee whether canceling student debt would worsen inflation, Powell deferred, leaving the potentially risky decision to the Biden administration and Congress.

"I'm going to leave that to CBO to score, and also the Office of Management and Budget," Powell said at the June 23 hearing. "To be independent, we need to be out of these very difficult fiscal issues, which are really your job."