- Warren Buffett’s Berkshire Hathaway bought a stake in Barrick Gold in the second quarter, a Friday SEC filing showed.

- Barrick Gold more than 10% in premarket trading Monday.

- The total stake in Barrick Gold was worth about $564 million, according to the Friday filing.

- Watch Barrick Gold trade live on Markets Insider.

- Read more on Business Insider.

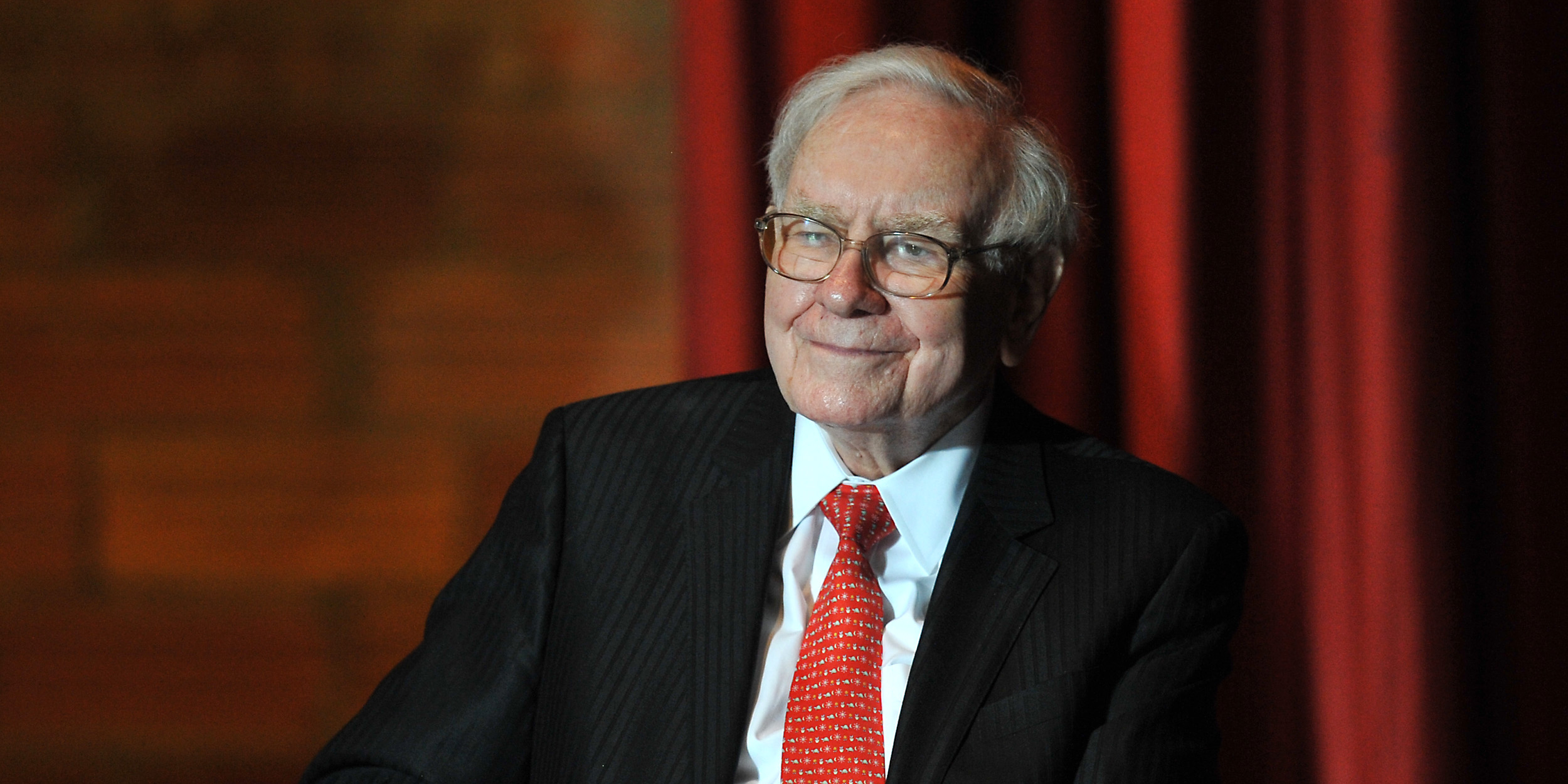

Barrick Gold surged more than 10% during premarket trading Monday after Warren Buffett’s Berkshire Hathaway revealed it bought a stake in the mining company.

Berkshire Hathaway bought 21 million shares of the gold and copper miner worth roughly $564 million in the last quarter, according to a Friday filing with the Securities and Exchange Commission.

The buy comes as a bit of a surprise, as Buffett has been a critic of gold in the past, saying that it isn’t as good of an investment as businesses, farms, and real estate. Still, the precious metal has been on a tear this year, as coronavirus pandemic panic has sent investors rushing into the so-called safe-haven asset.

While the stake in Barrick Gold is small for Berkshire Hathaway - the entire portfolio is worth about $202 billion - Buffett's company is now the eleventh-largest shareholder for the miner.

Beyond the investment in Barrick Gold, Buffett's Berkshire Hathaway trimmed stakes in big banks such as Wells Fargo and JPMorgan, and exited Goldman Sachs.

Barrick Gold has surge 45% year-to-date through Friday's close.