- Apple is launching its new credit card, the Apple Card, this month, after announcing it in March.

- The card lives entirely on your iPhone in Apple’s Wallet app, where you can easily see how you’re spending your money, pay your balance, and more.

- There’s also a physical titanium card for instances where you can’t use your phone to make a purchase.

- There are benefits and drawbacks of having a credit card that’s so dependent on your phone. If you lose access to your phone, for example, paying your balance and locking your card isn’t as seamless as it would be on competing cards.

- Visit Business Insider’s homepage for more stories.

“Our vision is to replace this,” Apple CEO Tim Cook said in September 2014 alongside an image of a wallet. He was unveiling Apple Pay, Apple’s mobile payment system that makes it possible to pay for goods and services just by holding your iPhone near the card reader at a checkout counter.

While Apple Pay has certainly come a long way since its 2014 debut, it would be nearly five years until Apple made its next major step in replacing the traditional wallet. Apple Card, which the company announced in March, started rolling out to select users in August, and Apple is planning a broader rollout later this month.

The new credit card lives entirely in your iPhone’s Wallet app, allowing you to make purchases, view your transactions, and pay your balance directly from your mobile device. The company also offers a physical card made of titanium that you can order through the app for times when you can’t or don’t want to pay with your iPhone.

The Apple Card offers 3% back, in the form of “Daily Cash,” whenever you make a purchase from Apple, whether from the Apple Store, iTunes, the App Store, or subscriptions like Apple Music or iCloud. You get 2% back whenever you make a purchase using Apple Pay and 1% when you use the physical Apple Card.

There are also no fees for the Apple Card, including international or over-the-limit fees.

Read more: Here are all the new products Apple is expected to launch by the end of the year

The Wallet app is also designed to make it as easy as possible to pay off your balance and see where you're spending your money. The Apple Card's privacy-oriented features also make it a compelling option in an era when data breaches are increasingly common. Unlike other cards, Apple's physical credit card doesn't have any numbers on it whatsoever, reducing the chance that a thief will swipe your credit-card number and security code.

But like with many Apple products, you get the most out of it only if you spend all or most of your time in Apple's ecosystem. And its cash-back rewards aren't as generous as those of some competing credit cards.

Here's a closer look at what it's been like to use the Apple Card.

Applying for the Apple Card

Applying for an Apple Card is almost as simple as adding a new card to your Wallet in Apple Pay.

The process entails launching the Wallet app, pressing the button to add a new card, and selecting Apple Card. From there you'll be asked to enter some personal details, and if you're approved you'll receive an offer from Goldman Sachs in moments.

Once you accept the offer, you'll be able to start using Apple Card on your iPhone immediately. You can then order a physical Apple Card from within the Wallet app; mine arrived in about five days.

It was by far the fastest credit-card application process I'd ever experienced.

The app

One of the main benefits of the Apple Card is how easy it is to manage and view your transactions.

While some other credit-card apps also show your recent purchases and categorize your transactions, Apple Card displays a visual representation of how you're spending your money front and center as you open the Wallet app.

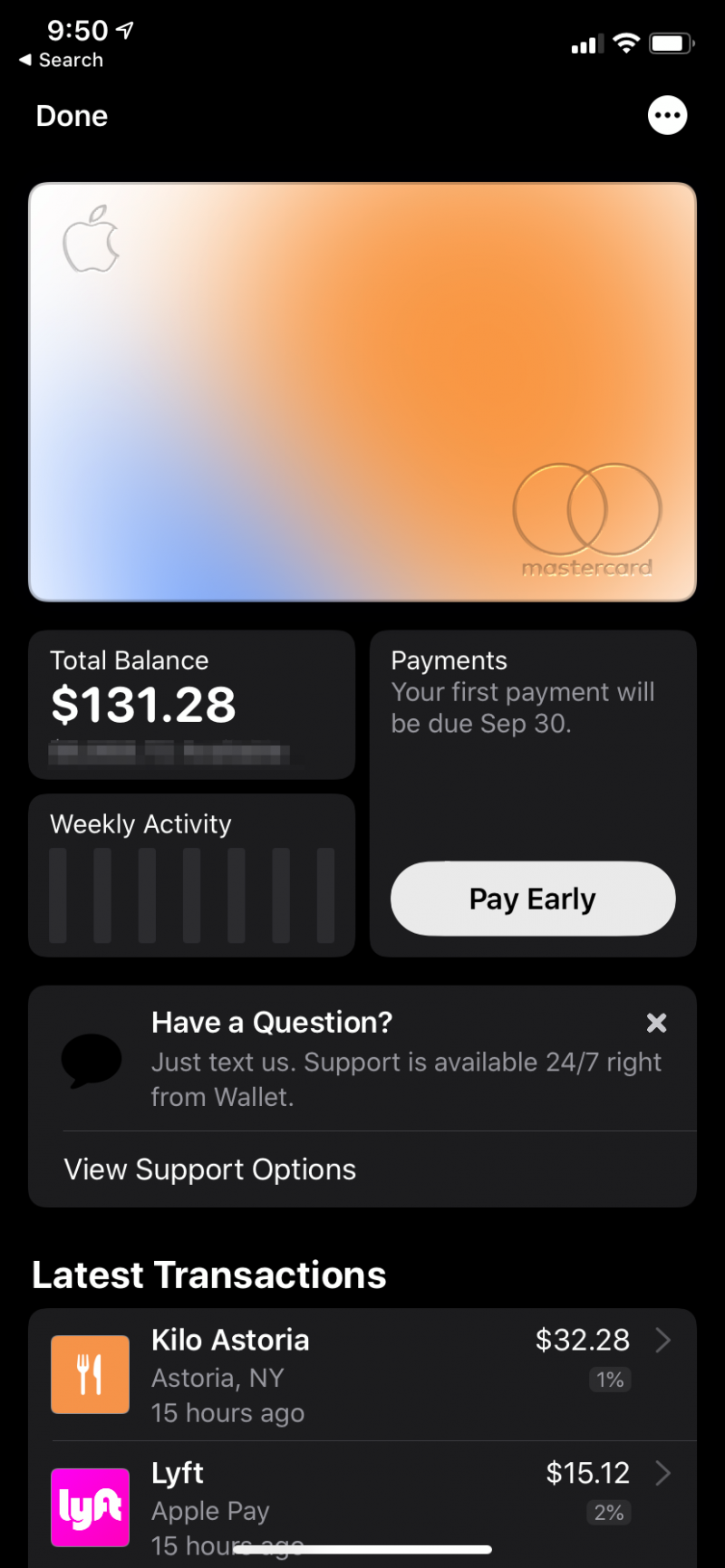

An image of your card is displayed at the top of the screen, and you may notice that its color changes over time. That's because Apple assigns specific colors to certain spending categories, like food and drink, entertainment, and transportation, among others, and your transactions are reflected in the image of your card.

My Apple Card is mostly orange, for example, because I've been spending a lot of money at restaurants and bars. This was apparent from the moment I opened the Wallet app, unlike in the Citi Mobile app, where I have to tap my card and scroll to the bottom of the screen to see my monthly purchases organized by category.

Your balance is displayed just beneath your card, along with a graph showing your weekly activity, recent transactions, and options for paying off your balance and contacting support.

Daily Cash rewards versus the competition

When you make purchases using the Apple Card, your Daily Cash rewards are added to another virtual card in the iPhone's Wallet app, called Apple Cash. You can use the funds on your Apple Cash card through Apple Pay just as you would any other credit card saved in the Wallet app. You can also put that amount toward paying off your Apple Card balance or send it to a linked bank account.

The Daily Cash rewards show up on your Apple Cash card almost instantly, which is convenient. But it's really the Apple Card's lack of an annual fee that gives it a leg up over some competitors, considering that some rivals with better rewards usually require a fee after the first year.

The Blue Cash Preferred card from American Express offers 6% back on subscriptions to certain streaming services and US supermarkets on up to $6,000 per year in purchases, for example. It also offers 3% cash back on transportation spending, though it does carry a $95 annual fee.

The Apple Card also isn't as flexible as other cards in terms of the types of rewards you can earn and how you can redeem them. You can't get airline miles through the Apple Card, for example, as you could with rivals such as the Capital One Venture Rewards card, which offers two miles back on every purchase but requires a $95 fee after the first year.

Using it

If you've ever used Apple Pay with a different credit card, using the Apple Card will feel very familiar.

The process works exactly the same way, except of course you'll want to choose your Apple Card when checking out instead of any other cards you have saved in the Wallet app. You can choose to make your Apple Card the default option for Apple Pay when setting up the card, or you can do so later in the Wallet & Apple Pay section of the settings menu.

To use the Apple Card on your iPhone via Apple Pay in a physical retail store, just hold your phone near the payment terminal, double-press the side button, and authenticate via Face ID, Touch ID, or your passcode. When you're making an online purchase through your iPhone, just use Apple Pay during checkout and make sure your Apple Card is selected.

But there may be times when you're making a purchase through a website or vendor that doesn't support Apple Pay. If you still want to use your Apple Card, you can do so by using the credit-card number stored in the Wallet app.

Just open the app, choose your Apple Card, and press the three dots in the upper-right corner of the screen. Then tap "card information" and authenticate to see your credit-card number, expiration date, and other information.

One benefit of this system is that if someone does happen to get ahold of your card information, you can render that card number obsolete and request a new one immediately by contacting Apple Support, which is available 24 hours a day, seven days a week through the app. That means you can continue using your card even if it's compromised.

The physical card

Apple's titanium credit card drew attention when the card was announced in March, and for good reason. The card has the polished, lightweight feel you'd expect from an Apple product, even though its metal design makes it heavier than your average credit card.

With nothing but your name, the Apple logo, and a payment chip visible on the front, the card has a sleek and minimalist aesthetic. Its heft is especially noticeable when you drop it on a surface like a table, making it feel almost like a status symbol. When you make a purchase with the physical card, you also get a notification immediately.

The activation process is also just as simple. The card comes in colorful packaging that matches the hues Apple uses to categorize your purchases. You activate the card simply by opening the Wallet app, pressing the button to activate your card, and holding your phone near the packaging as indicated. The option to activate your card will pop up in a window on your iPhone, similar to how a prompt appears when you're pairing your AirPods.

It's an easy and intuitive process, though the actual activation took slightly longer than I had expected.

Overall thoughts

When Apple announced the Apple Card several months ago, it wasn't immediately clear why it chose to do so.

But after I used the card for just a week, the answer became increasingly obvious. Having your primary credit card tied to your iPhone encourages you to use your iPhone for everything, making it even more indispensable than it already was. And it provides further incentive to keep you locked into Apple's ecosystem versus switching to compelling rivals from Samsung, Google, and others.

With the Apple Card, it feels as if Apple envisions a future in which using our phones for payment isn't an afterthought, but the primary way we make daily purchases, much like the way the WeChat app is used for everything in China.

That, of course, has its benefits and drawbacks. The privacy the Apple Card offers is probably its biggest advantage. By keeping critical information like your card number, expiration date, and security code buried within the Wallet app, Apple Card discourages you from sharing your information with third parties each time you want to make a purchase.

Apple also generally does a better job of putting the important information you need to see front and center, such as how you're spending your money and the amount of interest you'll be responsible for if you don't pay your balance in full.

But of course, there are some concerns that come with having a credit card that's so reliant on your smartphone. If you lose access to your phone, you'll need to call Apple Card support or use another iOS device to pay your balance and report your card stolen.

In a hypothetical scenario where you lose your bag, which probably includes both your titanium Apple Card and your iPhone, your best bet is to put your iPhone in "lost mode" to suspend Apple Pay. The Wallet app has a phone number for Apple Card support, which I'd recommend keeping handy should you lose access to your phone.

Other credit cards make it easier to pay your balance or keep track of transactions on any device should your card go missing.

The Apple Card is certainly an ambitious step for Apple in replacing the physical wallet with a digital one. But its usefulness relies on just how committed you're willing to stay to Apple.