- Wharton economist Jeremy Siegel said the Federal Reserve should raise interest rates by 100 basis points.

- The Fed meets Wednesday to discuss policy to help it tame red-hot inflation, which hit 8.6% in May.

- Billionaire investor Bill Ackman and 'Bond King' Jeff Gundlach have also called for a percentage point hike.

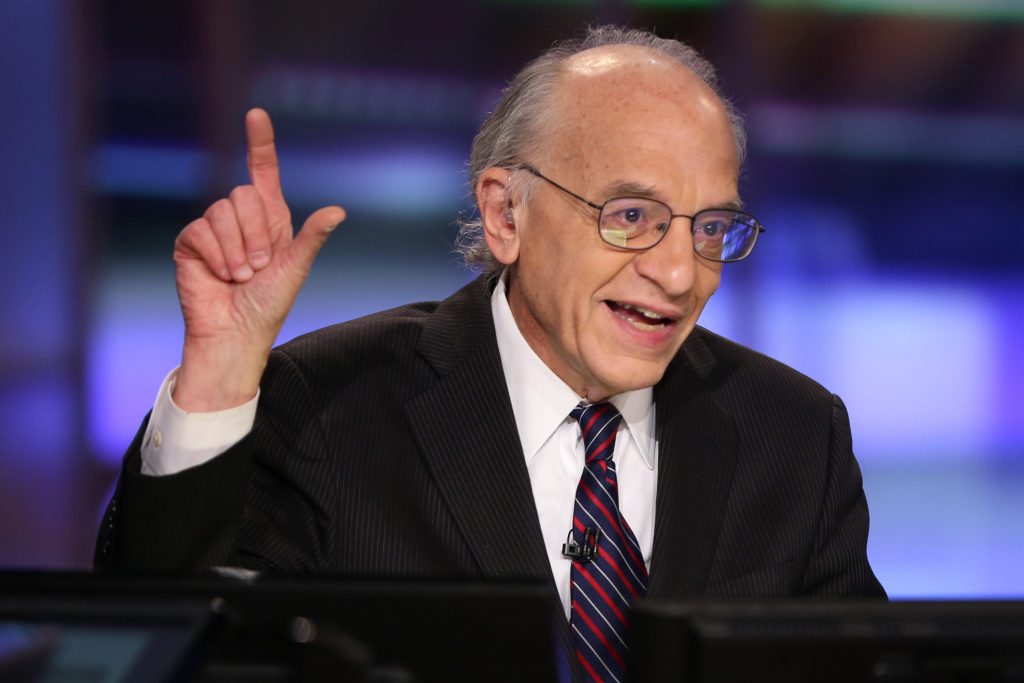

Jeremy Siegel is the latest high-profile investor to call on the Federal Reserve to raise interest rates by 100 basis points at this week's June meeting.

The closely followed economist joined Pershing Square founder Bill Ackman and DoubleLine Capital chief Jeff Gundlach in urging the Fed to tighten monetary policy more aggressively as it tries to curb soaring inflation.

"The Fed needs to grab the narrative of inflation — it knows it was way too late," Siegel, a professor of finance at the Wharton School, told CNBC's "Squawk Box Asia" on Wednesday. "They've got to go forcefully right now."

Fed Chair Jerome Powell had previously committed to raise interest rates by 50 basis points in June, and then again by 50 basis points in July. Siegel said the US central bank should instead raise rates by 100 basis points immediately, without committing to another hike next month.

"[Powell] could say he's bringing July's rate increase forward … without committing to another hike in July," he told CNBC. "He's not really deviating, other than accelerating from the path he was on."

An accelerated hiking schedule became more likely after the publication of US inflation numbers on Friday. The latest consumer price index data showed it rose 8.6% in May, which represents a 41-year high.

Markets have wobbled in the past few weeks, but US stock futures climbed Wednesday ahead of the Fed's interest rate decision. Siegel believes that even riskier assets would ultimately respond positively to an aggressive 100 basis point hike.

"At first, you'll see a downward movement in the risk markets, but I think it would turn around," he told CNBC. "You could see a big rally this afternoon — first a downshoot, then a rally after."

"If [Powell] only does 50 [basis points], there will be disappointment. They'll say he doesn't have control," Siegel added. "You have to take your medicine now to get cured."

Siegel warned back in February that the Fed was likely to prove more aggressive than most investors expected - and said he'd added value stocks that will resist rate hikes to his portfolio.