Warren Buffett isn’t your typical billionaire.

The so-called Sage of Omaha, who turns 87 on Wednesday August 30, has a net worth of more than $75 billion, but lives a modest lifestyle.

Buffett still lives in the house he bought in 1957 for $31,000, forgoes private jets for public transportation, and plays bridge instead of throwing parties.

And it is that juxtaposition of vast wealth and a desire to live simply that has captured the awe of people around the world.

His lifestyle was recently showcased in the HBO documentary “Becoming Warren Buffett.”

Following are interesting things we've gleaned from the billionaire's eventful, 87-year-long life.

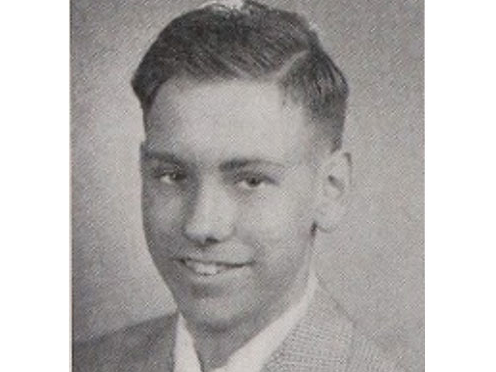

The "Oracle of Omaha" was born in 1930 in Omaha, Nebraska, to Howard and Leila Buffett. His father was four-term US congressman from Nebraska and a stockbroker.

Source: Investopedia

While most kids were playing stickball out in the street, Buffett was rubbing elbows with Wall Street's most powerful players.

At age 10, Buffett had his "road to Damascus" moment, on Wall Street.

During a visit to New York City, Buffett and his father joined At Mol, a Dutchman who was a member of the New York Stock Exchange, for lunch.

"After lunch, a guy came along with a tray that had all these different kinds of tobacco leaves on it," Buffett recalled. "He made a cigar for Mr. Mol, who picked out the leaves he wanted. And I thought, this is it. It can't get any better than this. A custom-made cigar."

It was at that moment Buffett realized he would dedicate his life to making money.

Source: Business Insider

Buffett caught the investing bug early. When he was 11 years old he purchased his first stock.

He bought three shares of Cities Services Preferred at $38 per share. The young Buffett held on to them despite a quick price drop, to $27 per share, but sold them as soon as they reached $40.

Buffett's small profit could have been tremendous if he had waited it out a little longer, as the price of Cities Services Preferred's stock ultimately soared to nearly $200 per share.

The experience imparted an important financial lesson, which has informed his investment decisions to this day: Buy and hold.

Source: Biography.com

Buffett's hustle game was strong as a youth. While he was a high-school student he and a friend operated a lucrative pinball business.

When Buffett was in high school he pitched the following business scheme to his friend Don Danley after he purchased a $25 used pinball machine:

"I bought this old pinball machine for 25 bucks, and we can have a partnership. Your part of the deal is to fix it up. And lookit, we'll tell Frank Erico, the barber, 'We represent Wilson's Coin-Operated Machine Company, and we have a proposition from Mr. Wilson. It's at no risk to you. Let's put this nickel machine in the back, Mr. Erico, and your customers can play while they wait. And we'll split the money."

The duo struck a deal with Erico and the machine was an immediate hit, raking in $4 bucks on the first night.

Rather than spending their earnings, the young partners reinvested it in more machines.

In a couple of months, Buffett was a pinball kingpin with several machines operating at barbershops across his town. Buffett sold the business for over $1,000 after a year.

In addition to the pinball business, Buffett undertook a number of odd business ventures during his childhood such as delivering newspapers, selling gum and soda, and washing cars.

Source: Business Insider

Through his various business endeavors, Buffett amassed a small fortune of $53,000 (in today's money) by the time he was 16.

He accumulated so much money as a teenager that he didn't see the point in accepting his offer of admission from the prestigious Wharton School of Business at the University of Pennsylvania.

But he ultimately gave into the will of his father and went off to college, only to return to Nebraska two years later, at which point he attended the University of Nebraska.

Source: New Republic

After completing his undergraduate studies, Buffett moved to New York to attend Columbia's School of Business.

The catalyst for Buffett's decision to move to the Big Apple was a well-known Wall Street book titled, "The Intelligent Investor." Buffett, an avid reader, said he first picked up the book when he was 19, and its philosophy of "value investing" changed his life.

He enrolled at Columbia after he learned that the book's author, Ben Graham, was a professor there. Despite the fact that Buffett was the sole student to earn an A+ in one of Graham's classes, Graham refused to hire Buffett at his firm. He even advised Buffett to completely avoid a career on Wall Street.

As such, after he earned his master's degree in 1951, Buffett moved back and sold securities for Buffett-Falk & Co., his father's brokerage firm in Omaha, for three years.

Source: Biography.com, CNBC

Buffett got hitched in 1952.

In 1952, while he was working for his father's company, Buffett married Susan "Susie" Thompson. The couple had three children: Susan, Howard, and Peter.

Things were not easy for the young couple right after their nuptials. They lived extremely modestly in a small three-room apartment, which they rented for $65 a month.

In 1957, Buffett purchased a five-bedroom home in Omaha for $31,500. He still lives there.

Warren and Susie had a complicated relationship, to say the least. Although they remained married until Susan's death in 2004, they didn't live together for more than half of their marriage.

Mrs. Buffett left her husband when she was 45. She remained married, to Warren, but lived in San Francisco. The two remained close and spoke frequently on the phone and even went on vacations together. Ultimately it was Susie who set Warren up with Astrid Menks, a waitress who moved in with Buffett and then married him after Susie died.

Source: Investopedia

Buffett moved back to the Big Apple.

Ultimately, Graham had a change of heart and in 1954 he offered Buffett a job in New York. So the family packed their bags and moved to the Big Apple.

Buffett worked for his mentor for two years as an analyst at Graham-Newman Corp., where he made the modern-day equivalent of $105,000 a year.

Source: Biography.com

When Benjamin Graham closed his partnership in 1956, Buffett started his own company back in his beloved Omaha: Buffett Partnership Ltd.

Source: Investopedia

He was a millionaire by age 32.

By the end of the 1950s, Warren had opened seven partnerships. He became a millionaire in 1962 as a result of his earnings from those partnerships.

Source: thefamouspeople.com

Buffett merged all his partnerships into one and invested in a textile-manufacturing firm, Berkshire Hathaway.

In 1962, Buffett decided to merge all of his partnerships into one and invested in a textile-manufacturing firm called Berkshire Hathaway. He started buying up shares of Berkshire Hathaway during the early 1960s and ultimately took complete control of the firm.

Today, the company has the highest stock price. As of February 2, 2017, it stood at a whopping $245,600 a share.

Source: thefamouspeople.com

In the late 1960s, Buffett shifted Berkshire Hathaway from textiles to insurance.

Source: Investopedia

For Buffett, the '80s were roaring.

While some were flaunting mullets, legwarmers, and neon attire, Buffett was making money. In 1982, Buffett's net worth stood at $376 million. It increased to $620 million in 1983.

And in 1986, at 56, Buffett became a billionaire, despite his humble $50,000 salary from Berkshire Hathaway.

Source: Valuewalk.com

Buffett owned about 7% of Coca-Cola Co. by 1988. It ended up being one of his best investments.

"Buffett's [$1 billion investment] in Coca-Cola grew nearly 16 times over the ensuing 27 years when accounting for dividends. This is an annualized gain of 11%, approximately."

Source: Investopedia

In 2008, Buffett became the richest person in the world.

"He became the richest person in the world in 2008 with a total net worth estimated at $62 billion by Forbes, overtaking Bill Gates who had been the No.1 on Forbes list for the past 13 years. The very next year, Gates regained the first position and Buffett moved to second place."

Source: thefamouspeople.com

In 2010, Buffett and Bill Gates created the Giving Pledge.

Buffett's frugality is a trademark of his "brand." The 89-year old doesn't own a cellphone and prefers to travel on public transportation. This does not mean Buffett is a stingy miser.

In 2016, he beat his own personal philanthropic record by donating $2.86 billion worth of Berkshire Hathaway stock to numerous charities, including The Bill and Melinda Gates Foundation. That donation brought his lifetime givings to more than $28.5 billion.

In addition, Buffett and fellow billionaire Bill Gates agreed to donate at least half of their fortunes to charity when they created and signed the Giving Pledge.

Since 2010, over 150 people have made the pledge, including Facebook's Mark Zuckerberg.

Source: Forbes

Buffett was presented with the Presidential Medal of Freedom by President Obama in 2011.

Source: WhiteHouse.gov

Buffett has purchased $12 billion of stock since Trump's win in November.

Despite his liberal leanings and reservations about President Trump, Buffett appears to be bullish about the new administration.

In a recent interview with Charlie Rose, Buffett said that Berkshire Hathaway purchased about $12 billion of common stocks since Trump's surprise victory in November.

It has been an eventful few months for Buffett, who sold his investment in GE, became Bank of America's top shareholder, and missed out on a big deal.

Buffett cashed out of his $315 million position in General Electric in the second quarter, signaling the end of an era for the $220 billion conglomerate.

Then, in August, Buffett's Berkshire Hathaway was outbid for Oncor, a power transmission company. Sempra Energy said it would buy Oncor for $9.45 billion in cash. And this week, Buffett became Bank of America's top shareholder after exercising its right to acquire 700 million shares at a steep discount.