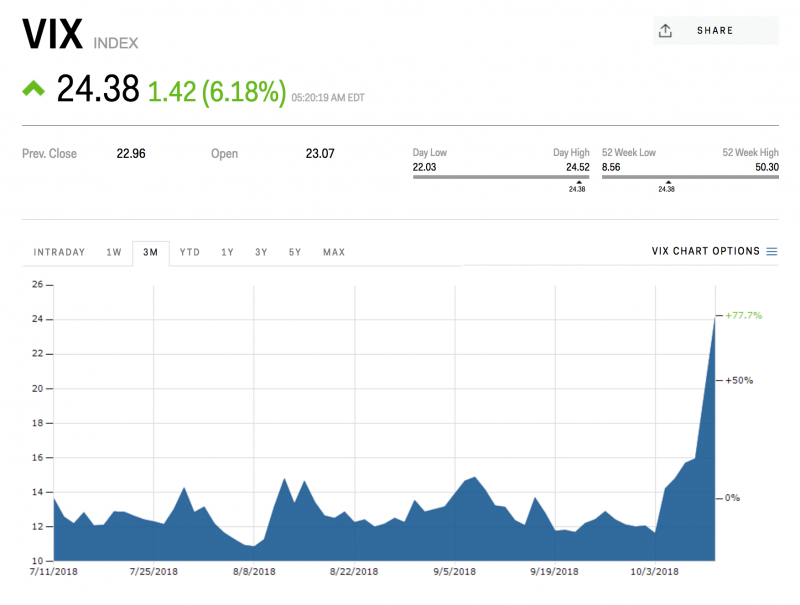

- The Cboe Volatility Index, or VIX, has more than doubled in the past week.

- The spike in volatility comes with fears of a major market correction at the forefront of investors’ minds.

- The VIX has hit 24.38, its highest level since the market sell-offs in February and March.

- You can follow the VIX at Markets Insider.

Volatility is returning to the stock market in a big way.

The Cboe Volatility Index, or VIX, has more than doubled in the past week, and it added another 6% on Thursday as fears of a major market correction came to the forefront of investors’ minds.

The VIX reflects expectations for volatility in the S&P 500, and it trades inversely to the benchmark roughly 80% of the time. The index is often known as the stock market’s “fear index” because it tends to jump during periods of uncertainty and worry.

At the root of the selling are concerns over inflation and rising interest rates, which have caused a major sell-off in global equity markets over the past two trading sessions, with US futures pointing to another big drop once North American trading begins later Thursday.

By 10:30 a.m. BST (5:30 a.m. ET) the VIX was at 24.38 - its third-highest level of the year, beaten only by major spikes in March and February, when the VIX hit a peak of 29, its highest level since the Chinese market sell-off in August 2015.