Drew Angerer/Getty Images

- Bank of America initiated coverage of Virgin Galactic on Monday with a “buy” rating and a $35 price target, representing 113% upside potential from Friday’s close.

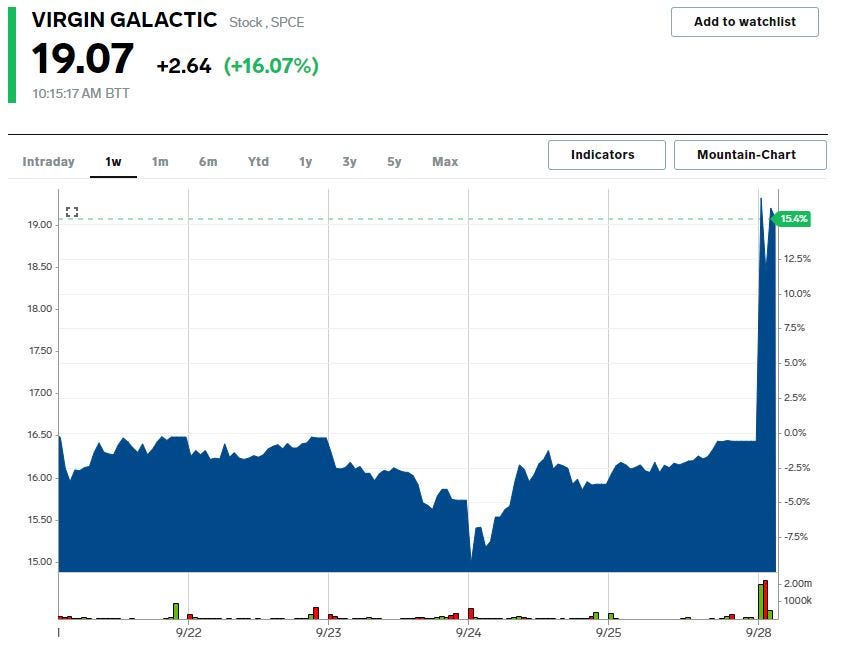

- Shares of Virgin Galactic jumped as much as 16% on Monday following the analyst commentary.

- Bank of America called Virgin Galactic’s growth potential “unparalleled” though it isn’t yet operational.

- Here are five reasons Virgin Galactic can move higher as it begins to serve customers in 2021, according to Bank of America.

- Visit Business Insider’s homepage for more stories.

Virgin Galactic, the space-exploration company that went public via a special-purpose acquisition company in 2019, has plenty of room for upside even though it isn’t operational yet.

That’s according to Bank of America, which in a note on Monday initiated coverage of Virgin Galactic with a “buy” rating and a $35 price target, representing potential upside of 113% from Friday’s close.

The analyst coverage from Bank of America, in addition to a positive note from Susquehanna, sent shares of Virgin Galactic soaring as much as 16% on Monday.

Virgin Galactic is focused on both space tourism (sending passengers into space) and hypersonic point-to-point travel (developing Mach 3 aircraft).

Bank of America called Virgin Galactic’s growth potential “unparalleled” but said investors needed to be aware of risks, such as the potential for a fatal accident, that could suppress consumer demand for flying into space.

Here are five reasons Virgin Galactic can move higher as it begins to serve customers in 2021, according to Bank of America.

1. A lack of competition.

"Virgin Galactic has a unique business with leading market position. The only sub-orbital space tourism competitor in existence (Blue Origin) has not ever flown passengers," the note said.

2. Extraordinary growth potential.

"The long-term opportunities in space tourism and hypersonic point to point travel are nearly revolutionary," the firm said. "Purchasing shares of Virgin Galactic today offers investors the opportunity to get into a company at the very beginning of its growth story. No company in our coverage universe has anywhere near comparable growth potential."

3. An experienced and compelling management team.

Bank of America said Virgin Galactic has a strong management team that includes Chief Space Officer George Whitesides, who spent more than 20 years at NASA, and CEO Michael Colglazier, who spent more than 30 years at Disney, most recently managing its international parks division.

4. Vertical integration capabilities.

"Virgin Galactic's technology and vertical integration capabilities are unparalleled," Bank of America said. "There is no company in the world that designs and builds its own aircraft end-to-end and then operates that vehicle commercially. In our view, the steps Virgin Galactic has taken over the past decade to vertically integrate somewhat mitigate execution risk."

5. A robust total addressable market.

"The company's target audience is adults with a total net worth of over $10mn, of which there are currently 2mn worldwide," Bank of America said.

"However, we note that the company has mentioned that many customers have an estimated net worth of materially lower than $10mn (~$1mn+). In this case the future astronauts are likely space enthusiasts with a lifelong dream of experiencing the 'planetary perspective.'"

Still, according to the bank, there are other risks associated with a high-flyer like Virgin Galactic, including that it has no financial or operating history and that its valuation could be a challenge since there are no directly comparable companies.