Happy Friday eve, readers. I'm Phil Rosen, coming to you from New York. Tomorrow, Jerome Powell will speak at Jackson Hole, Wyoming, and likely dash hopes for a potential Fed pivot.

Be sure to check your inbox ahead of the key speech Friday — I'll be breaking down everything you want to know from how stocks and currencies could react to what top analysts are thinking.

But today, I want to bring your attention to one Wall Street research firm that this week drew comparisons between TikTok and "crack cocaine."

At the ready, team…

If this was forwarded to you, sign up here. Download Insider's app here.

1. TikTok's dominance is getting noticed on Wall Street. With over 1 billion users logging on to the app per month, every major US social media brand is trying to replicate the success of the Chinese video platform.

It's proven so popular that Bernstein analysts published a note this week arguing that TikTok exhibits some of the same attributes as a drug, specifically likening the app to crack cocaine.

"The algorithm pushed the most viral content directly to the user delivering endorphin hit after hit with each swipe," the authors wrote.

It's an extreme comparison; the real crack epidemic devastated communities and killed thousands. While the note doesn't suggest TikTok will kill anyone, it does present a severe description of the app's addictiveness.

I sat down with Bernstein senior analyst Mark Shmulik for a deeper dive.

"If you look at stocks like Meta and Snapchat, they've underperformed, and that's in part because of TikTok," Shmulik told me.

Though shares of TikTok parent ByteDance are not public, its meteoric rise is in stark comparison to the sagging fortunes of its competitors. Shares of Meta have dropped more than 50% so far this year, and Snap has seen a 76% decline.

"Really, it's something new that's come around and displaced the giants."

Competitors like YouTube, WeChat, and others are diving into this "digital epidemic", as he describes it, trying to grab TikTok's ballooning share of social media users.

"You get these hits every video, and it's really easy to access," Shmulik said. "It's about a faster, shorter high, with a lot of addictive properties."

The internet-stock expert also touched upon why TikTok has sparked such a dramatic ripple across Wall Street.

TikTok, ultimately, has emerged as a master attention-grabber — and eyeballs are a key currency for investors.

"If you think about how those stocks trade, it starts with user engagement," he said. "Anything that's shown exponential growth that takes away attention from your company can change how investors feel about long-term potential."

What do you think of TikTok? Has it impacted your outlook on Big Tech investing? Email me at [email protected] or tweet @philrosenn.

In other news:

2. US stock futures rise early Thursday, as investors brace for the key speech by Federal Reserve Chair Jerome Powell tomorrow. Meanwhile, China moved to prop up the yuan after it fell to a 2-year low against the dollar. Here are the latest market moves.

3. On the docket: Toronto-Dominion Bank, Dollar General Corporation, and VMware Inc., all reporting. Plus, the Jackson Hole economic policy symposium commences today.

4. A growing number of indicators show that the housing slowdown is starting to look more like the 2008 crash than many originally expected. Mortgage rates are jumping in 2022, and that's pushed some experts to predict more home price declines ahead. Here are eight signals that suggest the ongoing downturn may resemble the previous crisis.

5. Soaring electricity prices amid the global energy crunch have led to 20 million American households falling behind on their utility bills. Costs are beginning to take a toll on Americans, and both summer heat waves and Russia's war on Ukraine have exacerbated the effects.

6. Russia is eyeing a sale of yuan-denominated bonds as local trading in China's currency soars. Ruble-yuan trading volumes have grown by 40 times in 2022, and now, the Kremlin may look to the Chinese currency to play a larger role in its debt.

7. The euro won't rebound from its slide against the dollar if Europe's gas crisis drags on, Societe Generale said Wednesday. The pressure on prices is "crushing" the common currency, and analysts don't anticipate it to bounce back anytime soon. This week, the euro hit parity with the greenback for the second time this year and then moved below it.

8. A 21-year-old firefighter and first-time homeowner made it through a childhood of homelessness and foster care to reach financial stability. He explained that keeping a sharp focus on his dream helped him push through times when money was tight. Here's his story, and what he plans to do next.

9. These dividend stocks are set to surge as a new bull market kicks off, according to a portfolio manager whose fund has crushed 96% of competitors this year. Ryan Kelley's mutual fund has outperformed most others so far this year — and these are the five companies that his model is bullish on right now.

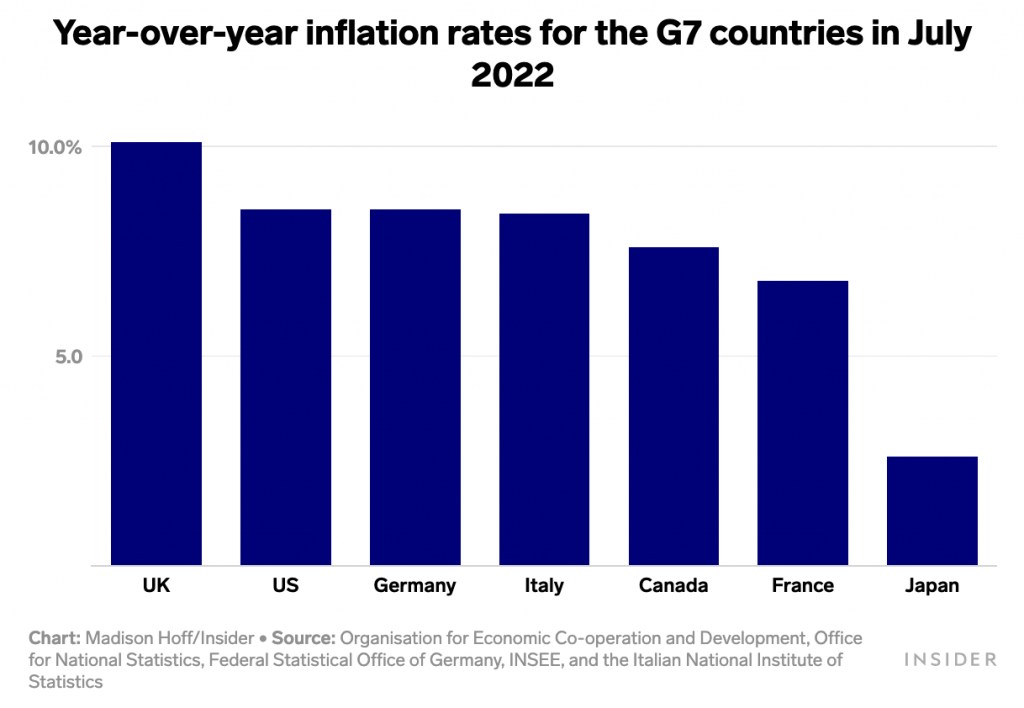

10. This chart explains where your spending power is dwindling the fastest in the world's biggest economies. From Japan to the US, your wallet now takes you a shorter distance than before. Dig through the data here.

Keep up with the latest markets news throughout your day by checking out The Refresh from Insider, a dynamic audio news brief from the Insider newsroom. Listen here.

Curated by Phil Rosen in New York. (Feedback or tips? Email [email protected] or tweet @philrosenn).

Edited by Max Adams (@maxradams) in New York and Hallam Bullock (@hallam_bullock) in London.