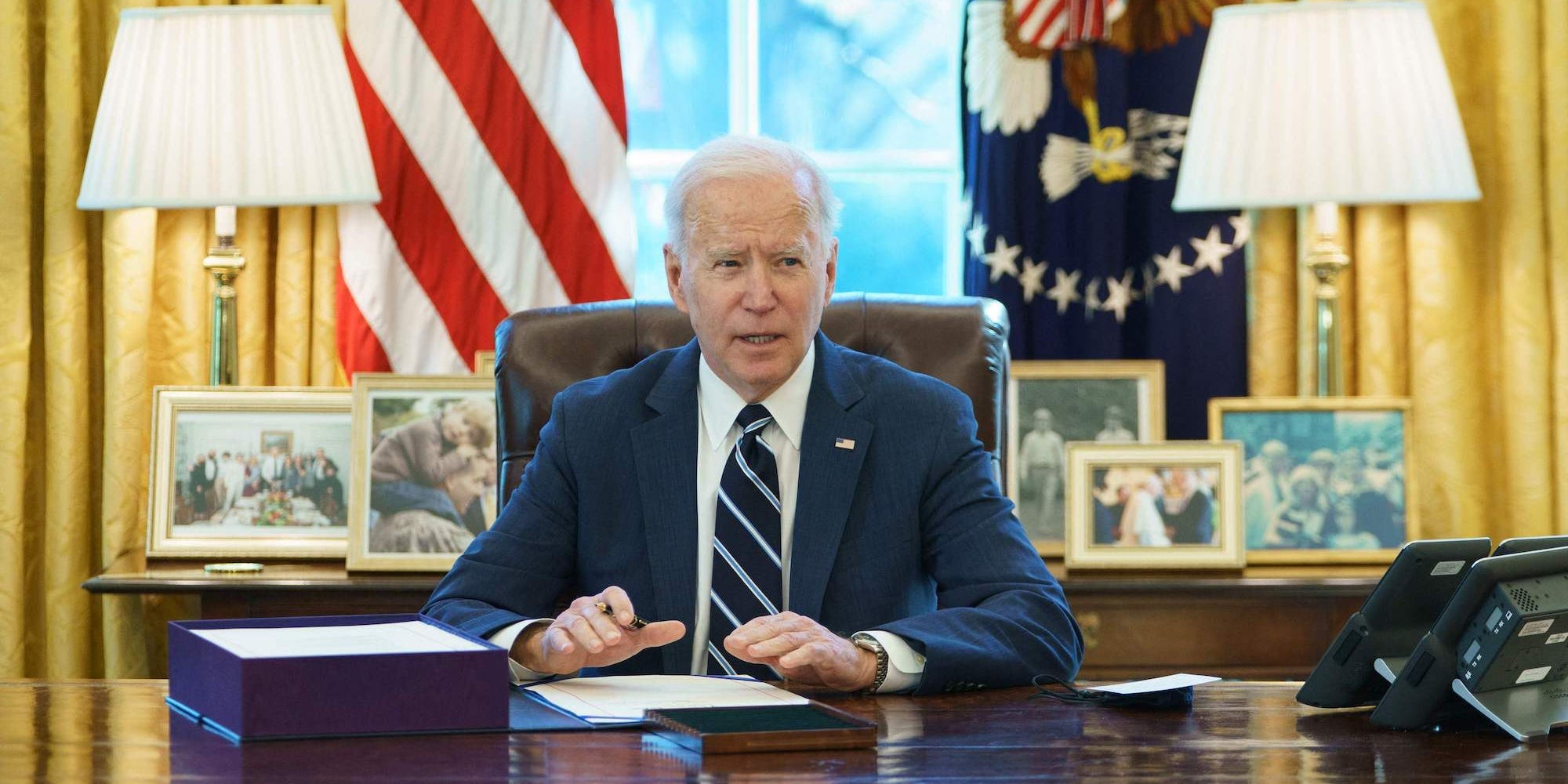

- President Biden is set to unveil the second part of his infrastructure-spending package, dubbed the American Families Plan.

- UBS Wealth Management says greentech, semiconductors, financials, and industrials will benefit from the new bill.

- The UBS team also believes Biden's planned tax increases will only mildly affect earnings per share.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

In a new client note, UBS Global Wealth Management laid out four sectors set to benefit from President Biden's second infrastructure spending bill, dubbed the American Families Plan.

Mark Haefele, the firm's chief investment officer, said that unlike many market commentators, he doesn't believe Biden's infrastructure spending has been fully priced in.

According to Haefele, President Biden's American Families Plan – together with the American Jobs Plan – could amount to a $4 trillion investment in US infrastructure, and much of it has yet to be accounted for.

Haefele's UBS team said they believe four sectors will see gains from the historic infrastructure spend: greentech, semiconductors, industrials, and financials.

(1) Green tech

With "a meaningful portion" of President Biden's infrastructure spending plan dedicated to decarbonization initiatives, UBS expects Greentech companies to be the biggest beneficiary of the incoming record spend.

Companies that operate in electric vehicles, renewable power, clean energy, energy efficiency, and water and electric grid upgrades should perform well, according to UBS.

The suppliers for Greentech firms are also set to outperform during 2021. UBS said it has been "tactically adding exposure" in Greentech firms and their suppliers over the last few months amid a pullback for high-flying tech names.

(2) Semiconductors

President Biden has allocated $50 billion to subsidize domestic semiconductor manufacturing and research in a move to combat China's growing dominance in the field.

UBS expects this will help US-based manufacturers expand their footprint in 2021 and beyond, making the sector a top pick for investors.

Intel already announced plans to add $20 billion worth of foundry capacity in March.

(3) Industrials

The obvious pick to benefit from infrastructure spending is industrials, and UBS agrees. The wealth management office said steel and aggregate (cement) companies stand to benefit from Biden's spending.

However, the UBS team also said it cut exposure to steel companies recently due to outperformance in the sector caused by supply imbalances.

The wealth management group said as supply constraints improve over the next year they expect steel companies to "come under pressure." US Steel is already up nearly 250% over the past year alone.

(4) Financials

Finally, UBS believes the financial sector will benefit from infrastructure spending due to higher interest rates.

The wealth management office said a move toward higher interest rates as the economy reopens will "more than offset" modest drags from tightening regulations.

The team also said they see President Biden's combined infrastructure plans boosting GDP by 0.5 percentage points and that earnings per share will grow 12% next year thanks to above-trend GDP growth.

Higher taxes, which are expected to pay for at least part of the infrastructure spending, will also only trim S&P 500 profits by about 4% in 2022, based on UBS' research.