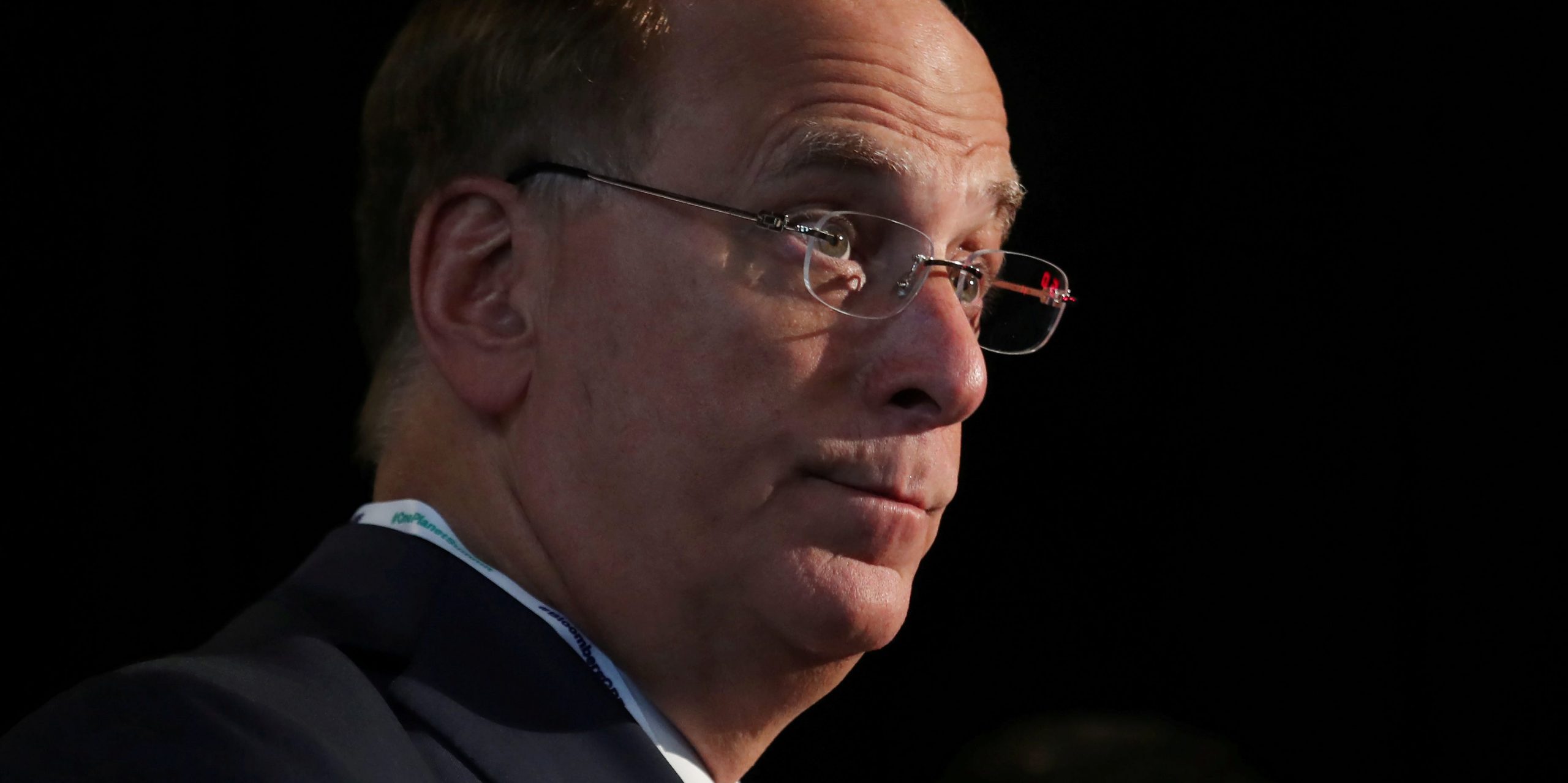

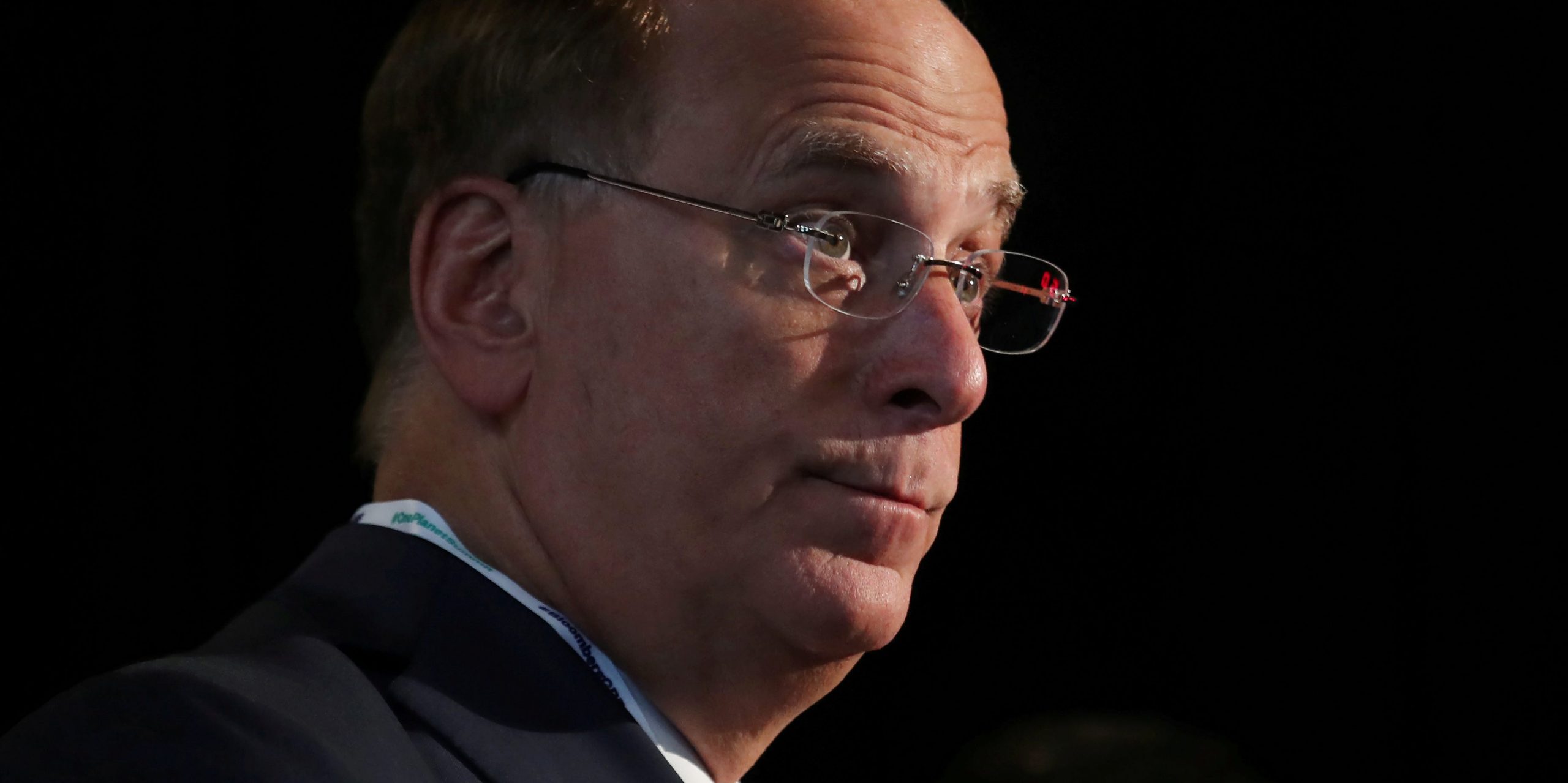

- The stock market is set up for a strong 2021 as investors remain overweighted to cash, BlackRock CEO Larry Fink told CNBC on Thursday.

- Investors around the globe continue to be under-invested, not over-invested in stocks, Fink said.

- “I think we’re going to continue to see the market be strong into 2021,” Fink told CNBC.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

The stock market is set for a strong 2021 as investors continue to hold a record amount of cash on the sidelines, BlackRock CEO Larry Fink told CNBC on Thursday.

That cash should help push stocks higher as investors put more of it to work in a low interest rate environment, according to Fink.

“We are persistently seeing investors worldwide under-invested, not over-invested, in long-term assets, and the best source of long-term assets are equities and many asset categories in the private area,” Fink said.

Helping fuel the heightened cash level and under-investment in stocks are lower interest rates, which could continue for a few more years as the Fed remains accommodative.

“I think we’re going to continue to see the market to be strong into 2021, probably not as strong as we saw in the fourth quarter or the third quarter last year,” Fink explained.

The S&P 500 finished 2020 up 16%, with most of those gains being driven during the second half of the year as equities recovered from a steep COVID-19 induced sell-off. The S&P 500 jumped 20% in the second half of 2020.

Fink expects herd immunity from COVID-19 in developed nations to be reached in June or July, which should help boost travel and business activity at restaurants, conferences, and sporting events.

An extended rally in economic activity could take hold in the second half of 2021 as herd immunity is reached, Fink said.

BlackRock is the world's largest asset manager. The firm reported assets under management of $8.68 trillion as of December 31.