REUTERS/Larry Downing

- March saw home sales accelerate further and price growth hit its fastest rate since the mid-2000s.

- The rally isn't sustainable, but a rebound in building will allow for months of healthy growth, Redfin said.

- Millennial homeownership is on the rise and should spur the construction of millions of homes per year.

- See more stories on Insider's business page.

The US housing boom wasn't built to last.

What began as a hefty uptick in home purchases evolved into an all-out buying spree in a matter of months. Americans taking advantage of low borrowing costs and looking to flee cities for suburbs snapped up homes at a rate not seen since the mid-2000s housing bubble.

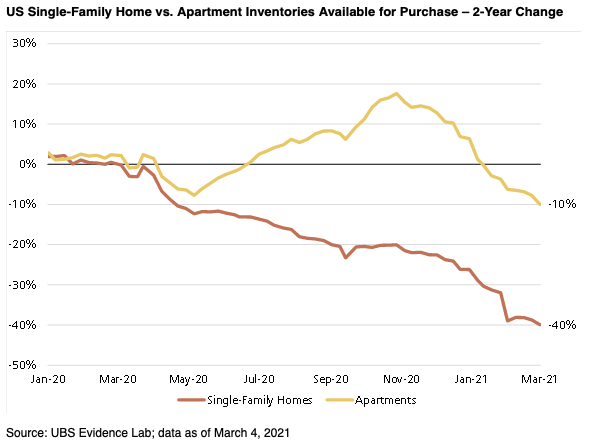

It didn't take long for strains to crop up. Homebuilders struggled to keep up with demand, and lumber shortages cut into construction. The national supply of existing homes fell to a record low in January and stayed there in February, even as the pace of sales slowed. Inventories of US single-family homes now sit 40% lower than at the start of the pandemic, while apartment inventory is down 10%, according to UBS data.

UBS Evidence Lab

The supply-demand imbalance was most evident in home prices. The national median home-sale price grew at the fastest year-over-year rate on record in March, according to Redfin data published Thursday, which called it the hottest month ever in the US housing market. This extraordinary price inflation now risks making the housing market far less accessible at a time of intense economic struggle.

Potential homebuyers need not worry, Taylor Marr, lead economist at Redfin, said. After the housing's hottest month in history, stronger homebuilding activity and attractive mortgage rates should help the market settle into a slower and more sustainable expansion, he added.

"Despite the intense competition and high prices we face, I still see more big gains to be made in home equity," Marr said in the Thursday report. "Waiting for the market to cool could take many months, and at that point we may have missed out on the opportunity to benefit from these super-low mortgage rates and price gains in the year ahead."

Solving the decade-old problems plaguing the housing market

One factor that should ease pressures on the market is a sharp uptick in homebuilding. Housing starts leaped nearly 20% last month to their highest level since 2006, according to Census Bureau data published Friday. Permits for building residential units also swung higher, albeit at a slower pace. The readings follow February declines linked to harsh winter storms.

Contractors are also growing increasingly confident in market conditions. The National Association of Home Builders and Wells Fargo sentiment index edged higher in an early April reading, boosted mainly by new traffic from prospective buyers.

Still, some lockdown measures are still in place, and lumber prices remain elevated.

"While states have mostly lifted restrictions, demand surges in residential construction and supply chain disruptions have made certain materials scarce, creating long lead times and cost overruns, putting additional pressure on contractors trying to service their clients, pay their employees and still have something left for themselves," Ben Johnston, chief operating officer of lending firm Kapitus, said.

Firms also have to make up for years of slower building activity. Home construction remained relatively weak for years after the Great Recession as damage to the market left firms desperate to prop up prices.

Those efforts have since come back to haunt contractors. The housing market is about 3.8 million units short of current demand, Sam Khater, chief economist at Freddie Mac, told The Wall Street Journal. That hole would be much smaller had building kept up with demand before the pandemic struck, he said.

"This is what you get when you underbuild for 10 years," he added.

Transitioning to a cooler, but healthier, housing market

A rebound in supply won't reverse the market's expansionary streak. Buying activity will remain robust as the Federal Reserve holds interest rates near zero and the economy rebounds from the coronavirus recession, Redfin's Marr said.

"Fundamentals like low mortgage rates and high demand for housing are fueling the record-high price gains, so I don't believe that homes are overvalued," he said.

Price growth, however, will slow. Supply should balance out with demand in roughly six months as building picks up, Jefferies analysts led by Philip Ng said in an April 8 note.

Lumber prices should also peak over that period. The futures market currently sees the commodity plunging 26% into early 2022. That should cut down on premiums paid for new homes, according to Jefferies.

Contractors also have plenty of warning for a coming wave of fresh demand. Millennials' homeownership rate shot higher during the pandemic, particularly among those aged 30 to 34. The population of people aged 25 to 34 is about 9% larger than that aged 35 to 44, according to Jefferies. That bigger group's continued foray into homeownership should drive the construction of 1.7 million to 2 million new homes per year through 2024, the analysts said.

"Underbuilding has left the inventory of new and existing homes for sale at all-time lows, making the only solution to satisfy growing demand from the Millennial cohort to be new residential construction," they added.

All signs are pointing to a surge of new building. Such a rebound is heavily reliant on lumber supply chains and, as with the broad economy, the path of the coronavirus. If growth cools as Jefferies, Redfin, and current data suggest, homeowners and prospective buyers might both come out winners.