- A series of implosions this year has led to massive deleveraging in the cryptocurrency market.

- The collapse of stablecoins like TerraUSD and crypto hedge funds like Three Arrows Capital have led to forced selling in the sector.

- But these are the two signs that the deleveraging in crypto is nearing its end, according to JPMorgan.

Investor confidence in the cryptocurrency market has been shaken to its core this year, as the implosion of TerraUSD jump-started a wave of deleveraging in the sector.

The deleveraging has come from retail investors scaling back their margin accounts as well as miners who have to sell bitcoin after using it as leverage to expand their operations.

More recently, the default of crypto hedge fund Three Arrows Capital, which had $3 billion of cryptocurrencies under management as of April, "suggest that the tremors from this year's crypto market fall continue to reverberate," JPMorgan's Nikolaos Panigirtzoglou said in a Wednesday note.

Three Arrows Capital is just one example of many that shows companies that employed higher leverage are now the most vulnerable to not making it through the ongoing crypto winter.

One of the most high-profile cases of a leveraged company taking on too much exposure to crypto is likely MicroStrategy, which has an unrealized loss of more than $1 billion in bitcoin. The company raised billions of dollars in debt to add bitcoin to its balance sheet.

But the deleveraging that has overtaken the crypto sector in recent months could be nearing its end, Panigirtzoglou said. "Indicators like our Net Leverage metric suggest that deleveraging is already well advanced."

"The fact that crypto entities with the stronger balance sheets are currently stepping in to help contain contagion" is one reason, according to the bank, likely referencing FTX's Sam Bankman-Fried lending out to troubled crypto firms like BlockFi.

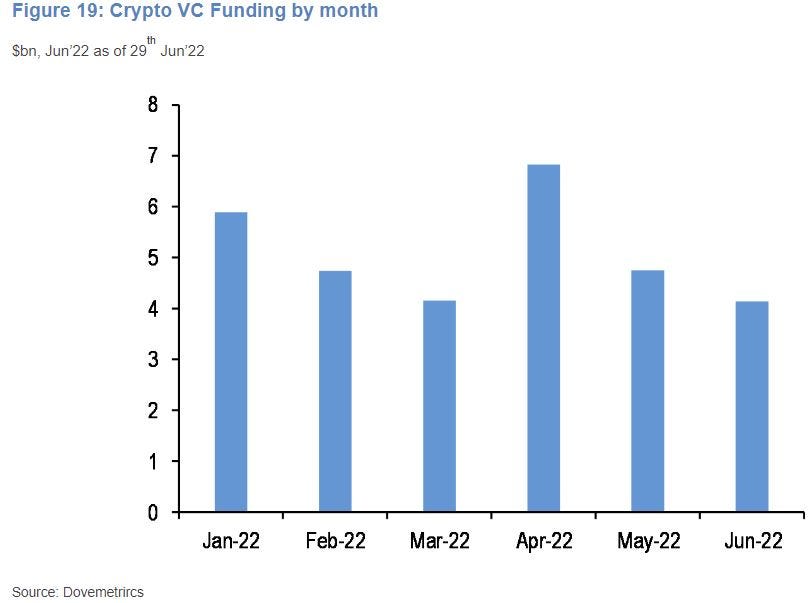

The second reason is that venture capital funding, which is an important source of capital for the sector, has continued at a healthy pace of about $5 billion in both May and June, according to the bank.

But just because deleveraging may be nearing its end in the cryptocurrency market doesn't mean investors should expect a quick rebound in crypto prices, according to technical analyst Katie Stockton of Fairlead Strategies. She expects long-term momentum trends to remain in negative territory for months before a sustainable rebound can materialize.