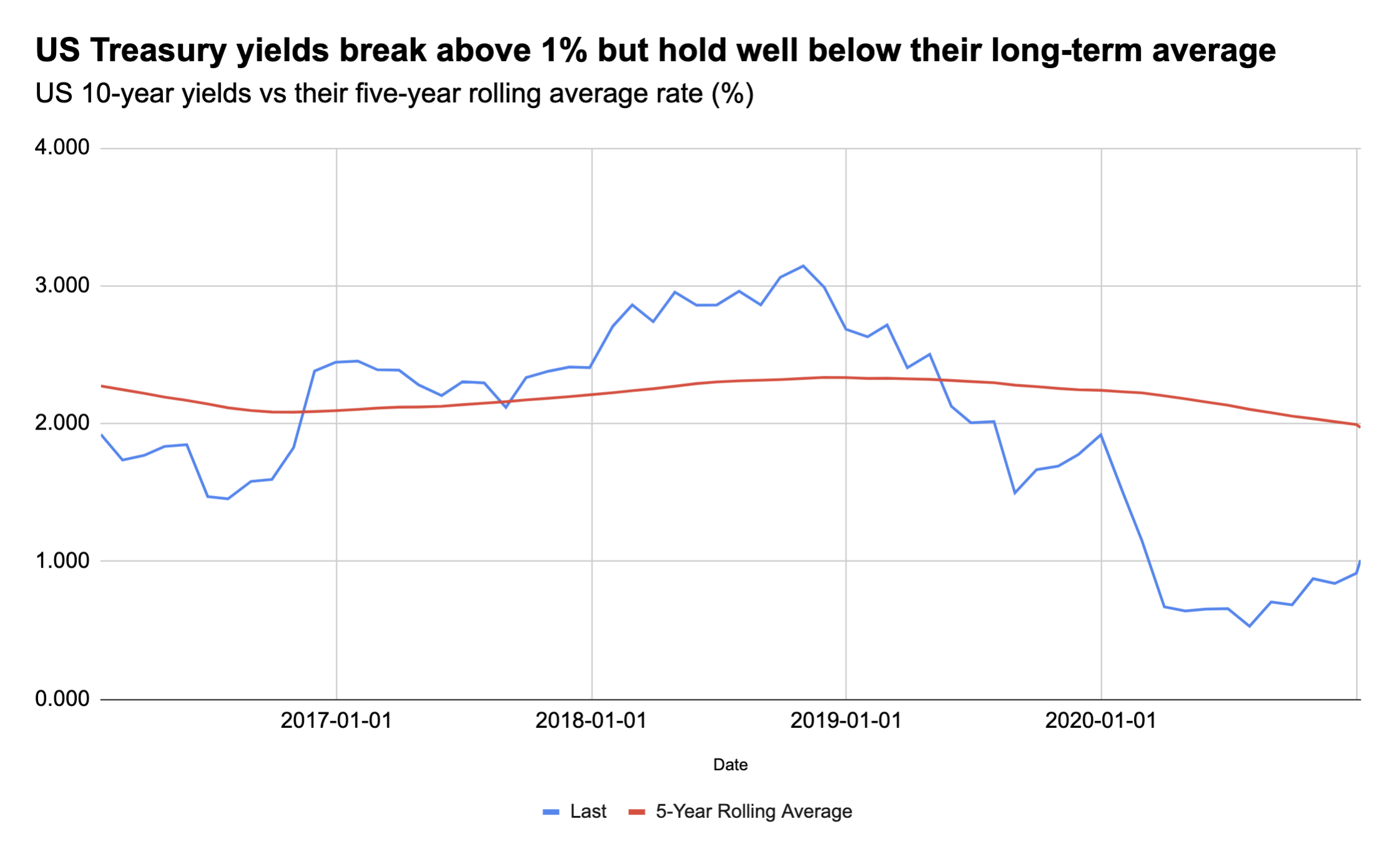

- On Wednesday, 10-year US Treasuries hit the 1% level for the first time since March 2020, as investors priced in the prospect of rising inflation.

- The 10-year has further to rise, according to a Morgan Stanley note published Monday, as it remains a market outlier.

- But, the rate increase could wipe as much as 22.5% of the average earnings ratio of the Nasdaq 100 index, the note said.

US Treasury yields have broken above the 1% barrier for the first time since last March, pointing to a hugely significant change in markets dynamics that could pose a serious threat to the bull run in some of the high-growth stocks, according to Morgan Stanley.

After the Democrats claimed the Senate, as well as Congress, with Georgia’s run-off election this week, investors are now pricing in the likelihood of rising inflation and less intervention from the Federal Reserve.

Investors piled into bonds during the pandemic, while the Fed bought Treasuries and other fixed-income assets to keep borrowing rates cheap, which sent yields to record lows.