- Bethany McCamish is a freelance writer and designer who lives in Vancouver, Washington, with her fiancé, an electrical engineer.

- Together, they bring home an average of $11,500 a month and their budget gives every dollar a job. They put a minimum of $1,400 a month toward student loan debt and about $4,900 into savings and investments.

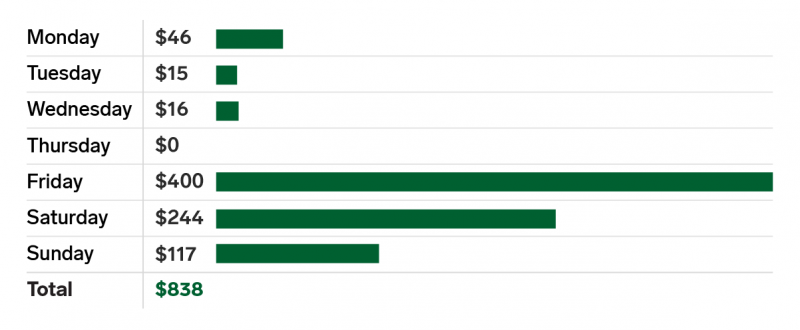

- For Business Insider’s “Real Money” series, McCamish tracked their spending for a week. Between bills, groceries and dining out, and other incidentals, they spent about $838 this week.

- Want to share a week of your spending? Email [email protected].

My partner and I have been together for seven years, but didn’t actually talk about managing money until three years ago. We met in college, so our focus was on graduating and getting into our careers.

The conversations about money were tough at first since we both operated independently from each other. Our mindsets were rigid and we held onto emotional money baggage we picked up as kids.

Our first approach to money was to split everything 50/50. I was a teacher at the time and my partner is an electrical engineer. Our salaries had a huge disparity, and this meant that I felt financial strain trying to keep up with our life when he didn’t. Not to mention I had student loans and a bad habit of spending instead of saving.

My partner found out about the Financial Independence, Retire Early (FIRE) movement, and was ready to jump on board. At first, his approach was pushy instead of understanding, but eventually, we started to manage our money together. Our goal was to become financially independent and up our investing game. We decided to use our money as a tool to get financial freedom to make whatever choices we want in life. As a way to document our path to FI, we started the blog His and Her FI.

The blog really became a catalyst for some of our toughest money conversations. It kept us talking about money and led to us creating a budget together. We own a home in Vancouver, Washington, and our nearest city is Portland, Oregon. It's a high cost of living area, which makes following a budget even more important.

Our monthly budget gives every dollar a job.

Believe it or not, even after we decided to be honest about our money, we still kept our finances separate. We had total transparency, set couple money goals together, and equalized our bills according to income.

In March of 2019, my partner proposed (I said yes!) and we decided it was time to combine our finances 100%. The process was much easier than our first money talks since we had worked to change our mindsets about money together.

Setting a budget together was even more essential for another reason - my partner and I both increased our incomes this year. I started earning about 25% more when I switched careers and his income doubled due to a role change from engineer to real time operations.

I'm now a freelance writer and designer, so my income can fluctuate. My partner brings home $8,500 a month and I average $3,000 a month.

Right now the goal is to pay off the $74,000 of student loans I have left. If I bring in more income one month, we put that towards my student loans, but we have put this on hold before when we needed to meet savings goals, such as our wedding fund. We also have a category for savings goals where a huge chunk of our money, about $3,000, goes each month. We put about $1,800 toward investments.

Our budget is on a shared Google spreadsheet and we track all of our expenses with Mint. The budget gives a job to every dollar that comes in each month. We don't have a joint checking account. Instead, our credit union allows us to link our accounts for instant transfers.

We each have our own retirement accounts - my partner has a 401(k) and I have a traditional IRA - and high-yield savings accounts. Even though these will be legally shared when we get married, it's important for me as a woman to have the same representation in investments and savings as my partner.

This week we spent about $838 on discretionary items, a couple bills, and grocery shopping.

The majority of our bills come out the first week of the month, which is helpful in distributing our cash flow. Right after those bills come out we transfer money to savings or investments in a "pay yourself first" method.

We then triple check to make sure we have the right amount of "outgoing" money in our checking accounts. This is money for gas, groceries, and items that we purchase during the month. Even though we put our purchases on rewards credit cards to gather points, they are paid off in full every month to avoid any kind of consumer debt.

We are not perfect by any means. Sometimes we totally blow our dining out budget because there are too many happy hours with friends. If we do, we always have a backup cushion of savings and get back on track together.

I think it's important to be OK with the imperfections of money management. We're humans who make mistakes and give in to pressure. We strive to find balance with our money, even if that means it will take us longer to get to financial independence.

Here's how we spent our money during a recent week in October:

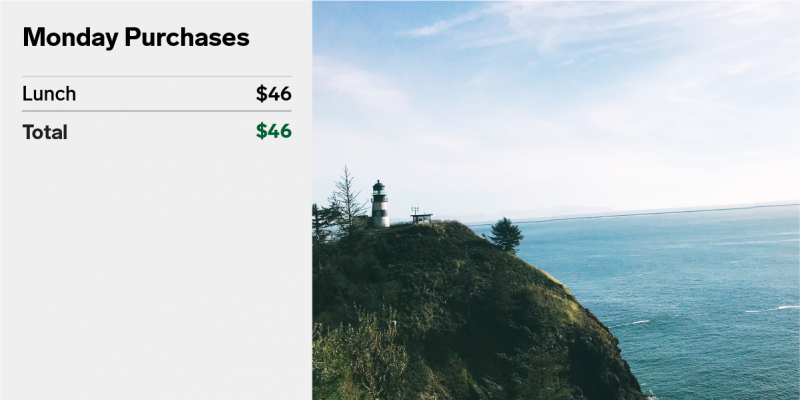

Monday fun day: A trip to the beach for a hike.

On Monday I worked from 7 a.m. until 11 a.m. editing some articles I wrote over the weekend. My partner works 12-hour shifts monitoring the electrical grid. When he is working shifts, we don't get to see each other very much. On his days off, we try to spend quality time together.

We took a drive and hiked up to Cape Disappointment lighthouse. We have an electric and hybrid car, so road trips are cheap and fun. We stopped along the way at a pub and had garden burgers and flight of beer.

A typical Tuesday: hip-hop, mountain biking, and walking the dog.

Tuesday was a full work day for me. My partner took out his mountain bike and headed to the hills. In the evening I went to hip-hop class with my soon to be sister-in-law. In between those activities we took our big dog, Henry, on a walk.

One of our budget items is health. This includes my health insurance, but also money for cycle and dance classes. It's as much a mental health fund as it is a physical health fund. Since I work from home, I need to find ways to be active and clear my mind. My partner does other things like mountain biking and snowboarding to clear his head and stay active.

Wednesday was a 12-hour work day for us that ended with a drink.

This was another full workday from 6:30 a.m. to 6 p.m. It's a self-imposed long day because in addition to full-time freelancing, which I do from home, a couple evenings a week I head to my side hustle doing marketing design for a local boutique. Since we are paying off my student debt and working on big savings goals in a high cost of living area, it helps to have multiple streams of income.

On days when I work this much, if my partner is home, he steps up and takes care of all the cooking and household chores. The same is true for when he works 12-hour shifts at work. It's a good balance where we both feel supported working 12-hour days.

Occasionally, these long days line up. When this happens, we save money by always having a meal plan. We buy our groceries weekly and we make sure to save the fast and easy meals for the days we work 12 hours.

We met up in the evening after I got off work for a drink with friends. Our dining out budget is probably what we overspend in the most. We enjoy going out with friends and most of the time it's the way we can foster those relationships.

On Thursday we didn’t spend any money.

Today I went to cycle class in the morning and my partner left for work at 5:15 a.m. to start his shift.

Nothing came out of our accounts and we didn't make any personal purchases today. We were still busy doing our normal activities, but because we plan for meals and workout classes we aren't spending. We average about two no-spend days a week.

I did spend some money on business expenses today. My business expenses are not in our personal budget. That's because before I even send myself a paycheck, I pull 35% from my business checking account into a business savings account. This is for taxes, a monthly Adobe subscription, and any kind of purchases I need to make. It stays separate from our combined finances, which is important for anyone who works for themselves.

Fridays are still the middle of our work week.

This was another workday from 6 a.m. to 6 p.m. for me with my side hustle. Since we work most weekends, we rarely get the TGIF feeling on Friday. It's typically the middle of our work week.

My partner was still on shifts, so we made an easy beefless stew. When we make dinner each night, we always make double the recipe so we can have it for lunch the next day. This keeps us from being tempted to eat out. It also ensures less waste of our food.

The expense for Friday was my usual student loan payment. The required payment each month is $400, but we typically make additional payments at the end of the month.

On Saturday, our dog went to the vet and then picked out a treat.

Today I took Henry to the vet for his annual check-up and vaccines. My partner is still on shifts, so I run the daily errands and chores like this. Our pets are family, and that means they get a line in the budget. We spend about $100 per month on pet supplies. If we don't spend all of that, it goes into our savings for their vaccine appointments.

We made the mistake years ago of not having a fully funded emergency fund that takes into account pet expenses. Our cat had a tragic accident where his foot needed to be amputated, and it happened on a weekend so the emergency vet bill was $4,000. Tack on surgery at our normal vet and the total cost was about $5,000. It wiped out our savings and we had to put some on a credit card. Lesson learned to keep a good chunk of money aside for pets and our own emergencies.

Henry was an angel at the vet, so I took him to Petco to pick out a new toy and big bone. We spent $30.16 on both of his treats. I know I can get it cheaper online, but since he doesn't destroy toys I let this happen as a reward. After we got home, I went back to work.

Sunday was grocery day and we came in under budget.

On Sunday I made our grocery list by creating a meal plan for the week, finished up the some work, and then headed to the store. We go to the grocery store weekly so that we can have fresh produce. The bill this time was actually cheap for us, because I stayed conscious of what we had in the pantry as I made the meal plan.

We are big spenders in this category and average $800 a month. This includes all alcohol and household items like laundry soap, paper towels, etc. This, combined with trying new recipes all the time, keeps us spending about $150 to $200 a week on groceries. We've decided we are totally OK with it too. We cook together and eat well at home.

Later on in the day I met up with my aunt. We went hunting for my wedding shoes but didn't find anything. In defeat, we grabbed lunch and then went back to my house to have a hard cider together. Finally, my partner came home from his last shift for three days off before he goes back to work again.

- Read more from our Real Money series:

- My family of 4 is financially independent thanks to passive income from real estate. Here's what we spend in a typical week.

- I live in rural Costa Rica and spend $1,000 a month on travel. Here's exactly where my money goes in a typical week.

- My husband and I live in Seattle and save almost half our income so we don't have to work by 40. Here's what we spend in a typical week.

- I retired as a millionaire at 36 to stay home with my kids. Here's what my family spends in a typical week in San Diego, California.