- Robinhood stock soared 22% on Monday following a Bloomberg report that said FTX is considering acquiring the brokerage.

- Sam Bankman-Fried disclosed a 7.6% stake in Robinhood last month and called the company's current valuation "cheap."

- "We are excited about Robinhood's business prospects and potential ways we could partner with them," Bankman-Fried told Bloomberg.

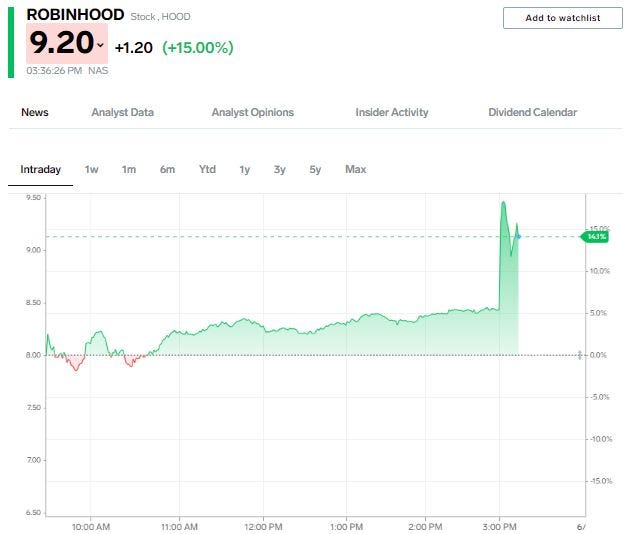

Robinhood stock popped as much as 22% on Thursday following a Bloomberg report that Sam Bankman-Fried's FTX was exploring a buyout of the brokerage firm.

The merger would be of little surprise given that Bankman-Fried personally disclosed a 7.6% stake in Robinhood last month, calling its current valuation "cheap."

A potential merger between the two would bolster FTX's stock trading aspirations and give the company more scale, as Robinhood has nearly 23 million accounts. A merger would also be a shot in the arm for Robinhood's crypto trading operations, which recently launched a long-awaited wallet feature.

Citing people with knowledge of the matter, Bloomberg reported that FTX is deliberating internally on how to buy Robinhood. No formal offer has been made, and there are no official talks currently underway between Robinhood and FTX.

"We are excited about Robinhood's business prospects and potential ways we could partner with them. That being said, there are no active M&A conversations with Robinhood," Bankman-Fried told Bloomberg. A spokesman for Robinhood declined to comment on the report.

A deal between FTX and Robinhood would require approval from Robinhood co-founders Vlad Tenev and Baiju Bhatt, who control more than 50% of the company's voting power, according to filings made with the SEC.

Depending on the price, a deal could be a quick exit for Tenev and Bhatt, who have experienced a bumpy ride as a public company. After going public in July, Robinhood stock briefly soared 156% before losing more than 90% in value. The stock is down 76% from its IPO price of $38 per share.

Robinhood's valuation of $32 billion at its IPO now stands at a paltry $7 billion thanks to an ongoing decline in the stock market, cryptocurrencies, and waning retail trading activity.