LONDON – House prices in central London had their weakest month since the 2008 financial crisis, according to the Royal Institute of Chartered Surveyors (RICS).

The rest of the country fared better, with a positive balance of +6 of survey respondents reporting higher prices last month for the country overall.

That’s up from a four-year low of +1 in July, but the survey said the results were evidence of an “increasingly divergent picture” across the UK.

House prices have slumped since last year’s Brexit referendum, with current growth rates of about 5%, compared to 8% before the vote.

Prices in London have been particularly hard hit, and have been effected by a number of factors including political uncertainty, stagnant wage growth and a volatile pound.

For the third month in a row estate agents in the South East were more likely to report a fall than a rise in prices, and the survey said prices in the capital were expected to remain low.

While East Anglia and the North of England also reported price falls, the rest of the UK reported growth, with Northern Ireland, the North West, Scotland and the South West reporting the biggest increases.

According to the survey, the number of people buying properties overall has been modestly deteriorating over the past nine months, although Northern Ireland, the South West and Scotland witnessed stronger sales over the August. As a result, the number of properties listed for sale on estate agents' books across the UK are near an all time low - although London estate agents have seen a rise in number.

Agents also reported that they expect rental growth to outpace that of house prices over the next year.

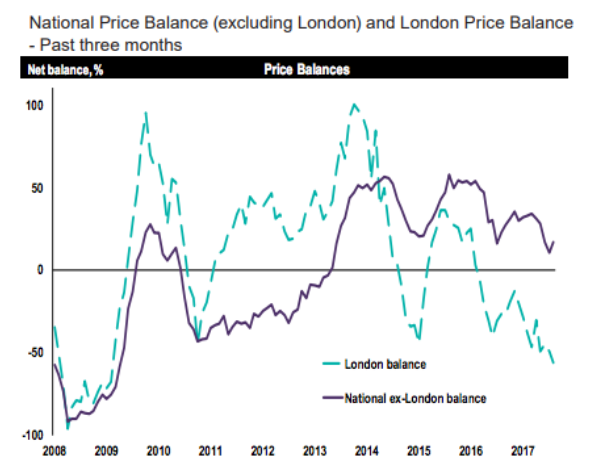

This chart shows the decline in London:

As does this one: