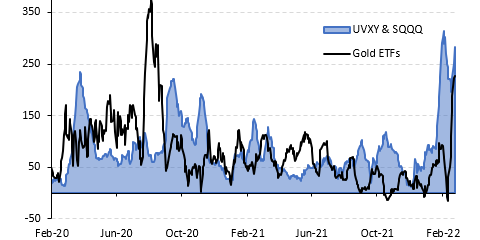

- Retail investors have rotated into gold and VIX ETFs as Russia begins its war on Ukraine.

- Vanda Research found retail traders now are focused on the geopolitical crisis over monetary policy.

- Gold hit its highest level in more than a year as Putin ordered the invasion of Ukraine.

Retail traders are seeking safe havens as the Russia-Ukraine conflict worsens with Vladimir Putin's forces launching an attack on the eastern European country overnight.

A report from Vanda Research found retail investors have rotated heavily into gold ETFs amid the worsening Russia-Ukraine crisis. The precious metal, which is viewed as a safe-haven asset in times of crisis, saw its biggest weekly inflows since the trough of the pandemic, the researchers said. On Thursday alone, gold surged to its highest level in more than a year.

Retail traders are also piling into exchange-traded funds based on the VIX — also known as the stock market's fear gauge — while ramping up bets against tech stock, Vanda said, adding that investors have shifted focus from the US Federal Reserve set to bump interest rates to the growing geopolitical crisis.

Purchases as the crisis unfolds include the ProShares Ultra VIX Short-Term Futures ETF (UVXY) and the ProShares UltraPro Short QQQ (SQQQ).

"As the Russia-Ukraine conflict takes a turn for the worse and war narratives gain momentum, retail investors are seizing the opportunity to temporarily break away from managing the potential impact of upcoming monetary policy decisions in their portfolios and instead focus on winners/losers from this geopolitical crisis," Vanda researchers Marco Iachini and Giacomo Pierantoni wrote.

The crisis has been escalating for months, reaching a boiling point this week when Putin order troops into Ukraine Tuesday, which triggered widespread sanctions from Western countries. Early Thursday, Ukraine said Russia launched a "full-scale invasion," in which dozens on both sides were killed.

The worsening conflict caused stock markets to tumble and oil to surge past $100 per barrel Thursday for the first time since 2014. Bitcoin slumped 4.6% to $35,563.80. The largest cryptocurrency by market value has frequently been dubbed "digital gold," but its price compared to the yellow metal has sunk amid the geopolitical crisis.