Hello, and welcome to Power Line, a weekly clean-energy newsletter from Business Insider.

Here’s what you need to know:

- Want to get Power Line in your inbox every Friday? Sign up here, if you haven’t already.

- Most of our coverage is available exclusively to BI Prime subscribers. If you’re looking for a discount on a subscription to BI Prime, click here.

- Do you have any story tips or feedback? Shoot me an email at [email protected].

It was a big week for science. Buckle up because we’ve got fusion. We’ve got batteries. We’ve got hydrogen!

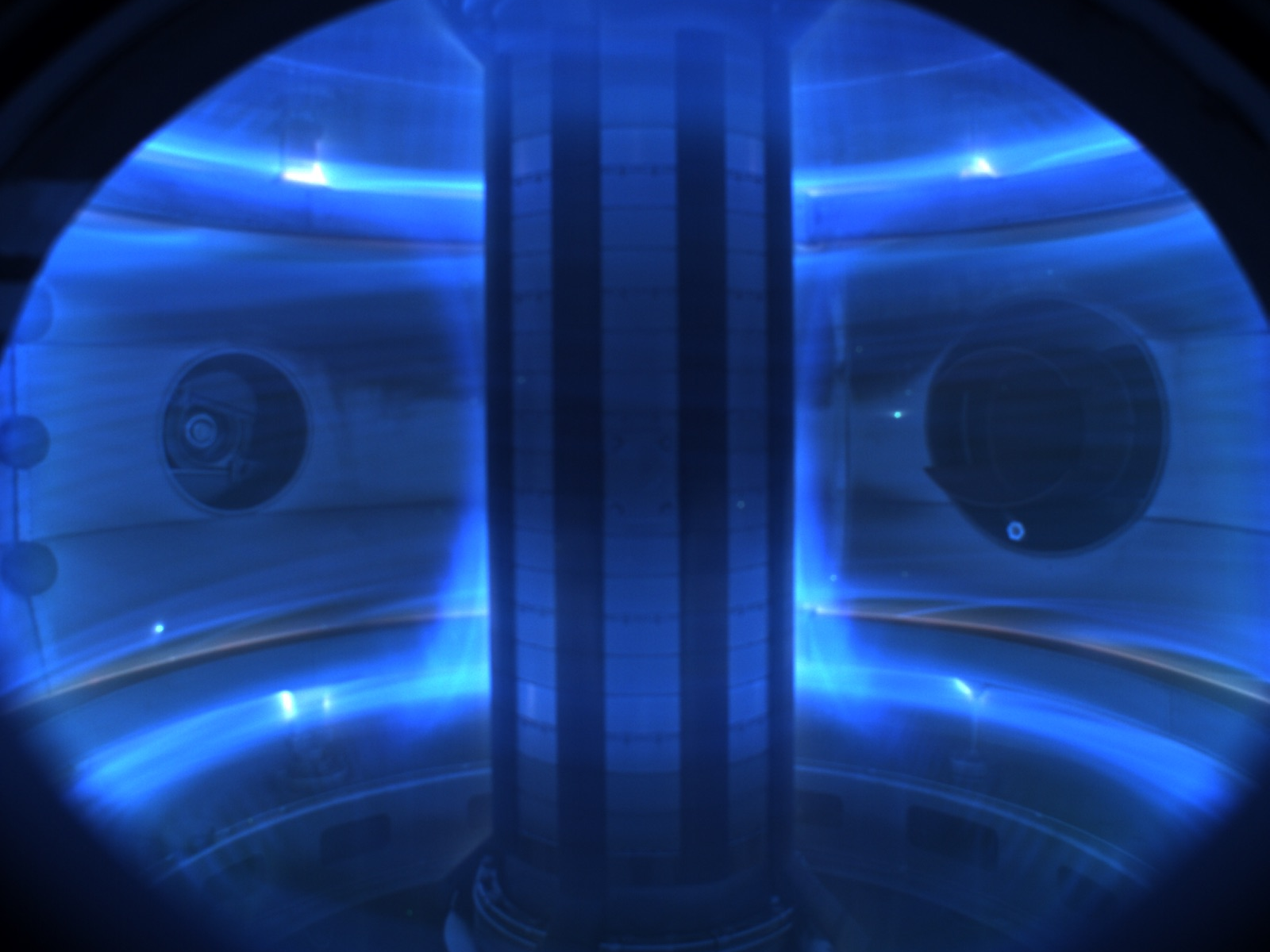

What can you do with $87 million? Get things hotter than the center of the sun, apparently.

Earlier this week, a fusion startup raised $87 million from investors including billionaire flavor mogul Hans-Peter Wild, heir to the Capri Sun fortune.

The company is using the cash to heat hydrogen plasma to 100 million degrees Celsius, which is more than six times hotter than the center of the sun.

I've got questions.

Why so hot? One way to spur fusion is to heat up a special kind of hydrogen gas called plasma. A lot. Fusion reactions peak at hundreds of millions of degrees.

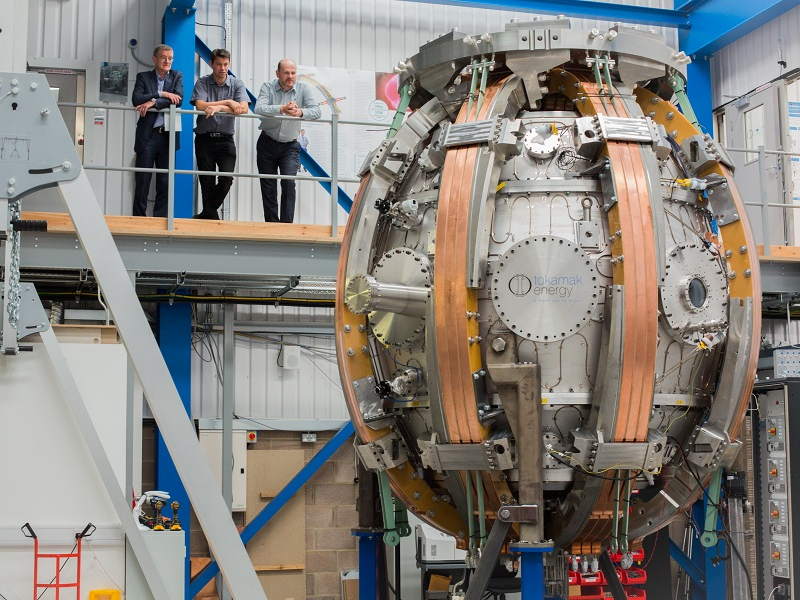

What's the company? Tokamak Energy. The British startup is named after the nuclear reactor typically used to generate fusion, called a tokamak. It's a Russian word that means "toroidal chamber with an axial magnetic field," (which I have committed, forever, to memory.)

What does Capri Sun have to do with fusion? I'm not sure.

When will fusion energy hit the grid? The company says it's aiming for 2030. Here's what experts think.

- 2030 is "very optimistic," according to Louis Brasington, an analyst at Cleantech Group. He says even if you get the tech working there will be years worth of regulatory speed bumps. Late 2030s or 2040s would be a safer bet.

- It's not impossible, but "a lot of things have to go right," Jon Menard, the deputy director for research at the Princeton Plasma Physics Laboratory (PPPL) told me.

When lithium-ion batteries don't cut it

If you don't know her, you should. I'm talking about lithium-ion, the most popular battery.

- As I wrote today, they're in nearly every portable electronic and electric vehicle, and will continue to dominate the battery market for the foreseeable future, experts say.

- And for good reason: Lithium-ion has a high energy density, it doesn't degrade easily, and it's relatively lightweight.

But: Even the best batteries have shortcomings. And for Li-ion, it's long-duration storage. I'm talking about discharging energy for hundreds of hours or more.

- That's because Li-ion batteries don't scale well - meaning, their cost grows roughly in step with their duration, according to the head of energy storage at Wood Mackenzie, Dan Finn-Foley.

- Long-duration storage with Li-ion is thus really expensive.

… and why do we care? Thank you for asking.

- You can't have a high proportion of renewable energy in the grid unless you have long-lasting batteries that are able to discharge a ton of power.

- Without them, you have to run carbon-emitting power plants in times when there's no wind or sun, and there's a big movement to get rid of those.

Good thing there are startups working on cheap, long-duration storage. Better yet, some of them have that Bill Gates money.

He built Tesla's energy storage business. Now he's got his own battery company backed by Bill Gates.

Today I profiled Form Energy, a long-duration battery startup that everyone is talking about. Here's why:

- At its helm is Mateo Jaramillo, a former VP at Tesla who built its energy storage company. He's just one of the startup's cofounders who are all battery-famous.

- Form has big backers: Bill Gates' Breakthrough Energy Ventures, the energy giant Eni, and Saudi Aramco, to name a few.

- So far, the startup has declined to reveal specifics, for fear of overhyping its product. It hasn't said much about what it has in the works.

- But at least one of its products is likely a sulfur flow battery. Unlike lithium-ion, flow batteries become cheaper as you scale them because the electrical charge comes from external tanks of liquid.

Hydrogen: A teaser

I have had not one but TWO dreams about hydrogen gas this week. Perhaps, spending a day and a half on a deep-dive into the industry has something to do with it. That story will be out next week.

Here are two surprising things I learned about hydrogen:

- We use it to make industrial products like ammonia (used, in turn, to make fertilizer) and to refine oil.

- Though it's all around us in one form or another, nearly all hydrogen is produced using fossil fuels. Experts see a big opportunity to green the industry.

Are there other energy-related industries you want explained? Let me know.

Foto: Starbucks is one of the latest corporate giants to announce a carbon-cutting pledgesourceReuters

Foto: Starbucks is one of the latest corporate giants to announce a carbon-cutting pledgesourceReuters

#climatechangegoals

The wave of companies setting carbon-reduction targets is continuing to build in 2020. Here are some of the latest and largest:

- Microsoft: Late last week, we reported on Microsoft's pledge to be "carbon negative" by 2030. I compiled a list of the top startups that are working on carbon capture and utilization tech that could help them get there.

- Arizona Public Service: Arizona's largest utility announced that 100% of its power will come from carbon-free sources by 2050.

- "The commitment is an about-face for an electric utility that poured $37.9 million into a campaign to defeat a ballot initiative that would have required it to generate 50 percent of its power from renewable sources by 2030," the Washington Post writes.

- Starbucks: Carbon negative? How about "resource positive." That's what Starbucks announced it was aiming for on Tuesday. The coffee giant set a preliminary target of halving emissions from "its operations and direct supply chain" by 2030.

3 big stories I didn't cover

- VC investment in battery storage companies doubled between 2018 and 2019, with lithium-ion technologies attracting a lion's share of the capital, according to Mercom Capital Group.

- Oil and gas giants spend 1% of their total capex outside oil and gas. The International Energy Agency plans to conduct annual reviews to "assess how they're doing on climate change and clean energy issues." (Axios)

- At Davos, loads of companies said they "they would aim to lower their emissions of planet-warming gases to net-zero by 2050 or earlier." (New York Times)

Finally, here are this week's top deals

It was a slow week.

- Tokamak Energy raised $87 million.

- ConnectDER, a smart-grid startup based in Virginia, raised $7.3 million from investors including Clean Energy Ventures and Skyview Ventures.

- GridBeyond, another smart-grid company, raised $12 million from Total and a handful of other investors, according to the research platform i3.

That's it! I'm off to Miami for the weekend, where it's 76 degrees … and iguana are hopefully not still falling out of trees.

- Benji