Britain’s emerging online property investment industry is looking increasingly at risk from a wider property slowdown, with new figures showing lending at one leading platform collapsed by 95% in just three months.

Figures from the P2PFA, the industry association for Britain’s online lending industry, show that Landbay saw a huge drop in the amount lent over its platform between the second and third quarter.

Landbay lent just £283,000 in the third quarter, compared to £5.3 million in the second quarter. The £5.3 million figure was itself a sharp decline from the £16.7 million lent in the first quarter of 2016.

Landbay, founded in 2013, lets people fund mortgages for buy-to-let landlords. Investors get a monthly income stream based on the mortgage repayments. Landbay’s third quarter lending total is the lowest ever recorded since P2PFA began publishing lending figures for its members in the third quarter of 2014.

The figures come shortly after Landbay stopped accepting new investor money for one of its products. Landbay has suspended its three-year fixed product, saying on its website: “No loan parts currently available. New loans coming soon.”

Gray Stern, cofounder and CCO of Landbay, told BI: "With our proof of concept phase complete we took advantage of the usual summer lending slowdown to work on our next phase of growth. Landbay's first two years' of lending has performed remarkably well, with zero defaults or late payments across our 243 mortgages. This has positioned us well to open discussions with institutional lenders and further build out operational capability, which includes hiring and training more underwriters.

"Over this time we successfully launched our strategic partnership with Zoopla, which together with the recent base rate cut, has led to record investor inflows. Combine this with the launch of our updated technology platform last week and we're in a strong position to rapidly scale our lending through 2017," he said.

Landbay, a major sponsor of the recent LendIt Europe conference, recently signed a deal to market its product through Zoopla. It has also been revamping its platform behind the scenes and is gearing up to focus more on lending in the new year.

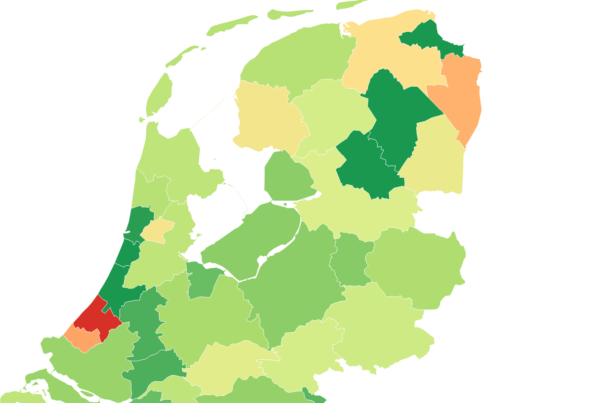

But the startup may also be suffering from a slowdown in both the buy-to-let market and the London property market. Half of Landbay's loans to date have been in London, according to its website, and London estate agent Foxtons' third quarter results out on Wednesday show sales in the capital have collapsed by a third over the last three months.

Buy-to-let activity is also slowing following a hike in stamp duty designed to curb the market in April of this year. Landlords rushing to beat the hike likely contributed to Landbay's strong first quarter. Recent mortgage approval figures from the British Bankers Association (BBA) show a 20% and 19-month low in August. The slump has been attributed to a mixture of Brexit hangover and buy-to-let slowdown.

'PropTech' jitters

While Landbay's lending slump is the most marked, it comes amid wider jitters for Britain's emerging "PropTech" - property technology - companies that let people invest in or finance property online.

Analysis by BI Intelligence shows that property loans from marketplace lenders fell by 30% in the second quarter.

LendInvest, which lets people finance short-term mortgages online for buyers looking to do up properties and resell them, registered a 13% fall in lending volumes in the third quarter, according to P2PFA figures. LendInvest's second quarter total, £87.5 million, was itself a 23.9% fall on the amount lent in the first three months of the year.

Contacted by Business Insider, a spokesperson for LendInvest pointed to the fact that lending in the third quarter was 29% higher than the same quarter a year earlier and investors deposited 50% more money on the platform than they had a year earlier.

The 29% figure contrasts with a 7% rise according to P2PFA's figures, which only counts money received by the borrower.

LendInvest says the difference is because it counts facilities agreed by its development finance team with borrowers that have yet to be drawn down on. Development money is usually drawn down gradually rather than all at once.

But the disparate growth rates between loans and deposits, as well as the decline in lending across the sector, points to a problem for peer-to-peer mortgage providers - demand seems to be outstripping supply due to a slowdown in the property market.

LendInvest CEO Christian Faes admitted there was a slowdown in borrowers but played down the problem, telling Business Insider earlier this month: "For online platform investors, we generally have always enough deal flow to feed to them."

Meanwhile, Property Partner, another "PropTech" startup, laid off 13 staff in July, saying it was "a proactive move to improve efficiency and streamline the company's cost base." Property Partner lets people invest in the UK rental market by crowdfunding investment and buying rental properties directly.

The lending figures and lay offs all point to tough trading conditions for the emerging "PropTech" sector, seen as one of the most promising new areas of tech and fintech at the start of the year.

Marketplace lending treading water

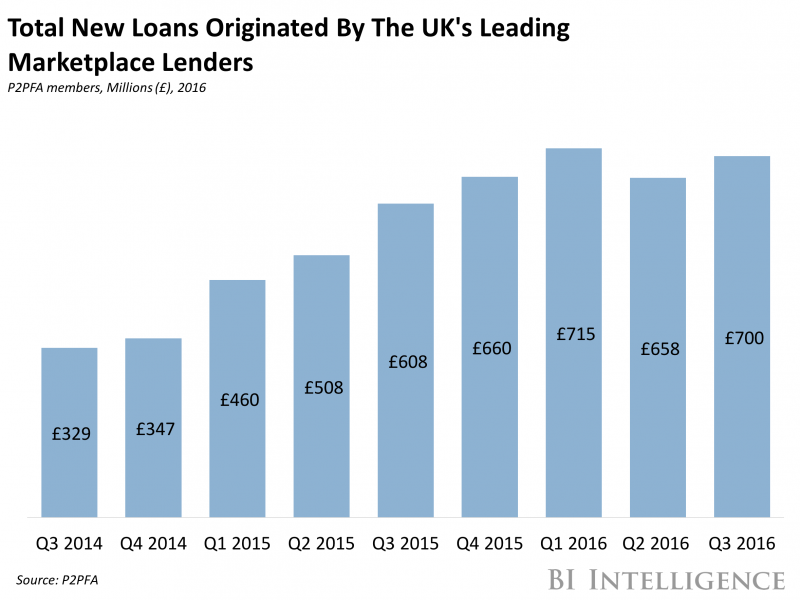

The P2PFA's overall figures show the UK's marketplace lenders are more or less treading water. Total new loans made over the platform in the third quarter totaled £700 million - an improvement on the second quarter's £657.9 million, but still below the first quarter's £715.2 million total.

Small business lending marketplace Funding Circle was the best performing platform in the third quarter, with a 20% rise in new loans. Zopa, which offers marketplace-funded consumer loans, was not far behind, with 14% growth. RateSetter, another consumer platform, grew volumes by 8%. All other P2PFA members saw falls in loan volumes.

P2PFA chair Christine Farnish says in an emailed statement: "Data from the third quarter of 2016 highlight the strength of peer-to-peer lending in the United Kingdom, and underscore the value that this form of alternative finance is providing to the economy for borrowers - both business and consumer - as well as lenders."