TGIF, readers. Phil Rosen here, and I'm happy to share today we're wrapping up the week on a bullish note for a change. A top Wall Streeter dished out a rare bit of optimism amid a sea of gloomy takes.

Yesterday was the final day of the NFT.NYC conference, and I have one last dispatch from the scene. It's a story of an impressive 18-year-old I met — who has notched $700,000 in revenue selling physical Bored Ape toys.

And now let's scope out the markets.

If this was forwarded to you, sign up here. Download Insider's app here.

1. JPMorgan says stocks are primed to bounce back. And it could happen as soon as this year, as analysts say markets will have a strong outing for the second half of 2022.

Analysts said in a note this week that they expect the annualized inflation rate to get cut in half over the next few months, which would lead to central banks pivoting to avoid a recession.

Despite other firms on Wall Street calling strong odds for a recession, JPMorgan thinks a downturn won't materialize anytime soon. Instead, it actually forecasts a reacceleration in global economic growth.

"While the probability of recession increased meaningfully, we do not see it as a base case over the next 12 months. In fact, we see global growth accelerating from 1.3% in the first half of this year to 3.1% in the second half," JPMorgan said.

Meanwhile, Deutsche Bank said this week it sees a 50% of a recession. And Citi, too, put the chances at about 40%.

Still, JPMorgan says otherwise, and without a recession, stocks will have plenty of upside.

"So it is not that we think that the world and economies are in great shape, but just that an average investor expects an economic disaster, and if that does not materialize risky asset classes could recover most of their losses from the first half," the analysts maintained.

In other news:

2. US stock futures gained upward momentum and the dollar eased early Friday. This came after Federal Reserve Chair Jerome Powell calmed some investor angst by pledging to fight inflation. Get your full morning wrap here.

3. On deck today: CarMax, Carnival Corporation, and Cheetah Mobile, all reporting.

4. The chief client officer of a $15 billion wealth manager shares high-quality stocks to protect portfolios through a bear market. Aspiriant's Sandi Bragar is focused on shielding from volatility, while also taking risk where there's a strong upside. These are 10 cheap names she thinks will bring big gains in a turnaround.

5. Oil is headed for its first monthly loss of 2022. Recession fears have knocked nearly 8% off the price — and traders are starting to bet that it's still got further to fall.

6. Russia still earns about 100 million euros a day in gas exports to Europe. And that's despite a 75% cut to supply. One estimate puts Russian gas revenue at about 35 billion euros since the war in Ukraine began.

7. Russian commodities traders are scrambling to set up shop in Dubai after fleeing Switzerland. One expert said Middle Eastern jurisdictions will gain in importance for those in the commodity business with Switzerland clamping down on trade rules as the Ukraine war rages on. Get the full details here.

8. Within two years, a 28-year-old scaled to nine online income streams. He raked in up to $30,000 a month. He shared how he scaled, which platforms he used — and where the bulk of his earnings came from.

9. A 31-year-old who saved over $200,00 in just over two years explained how she invested her money. "The idea of investing terrified me," said Chloe Daniels. Here's how she went from in debt and afraid to a six-figure net worth.

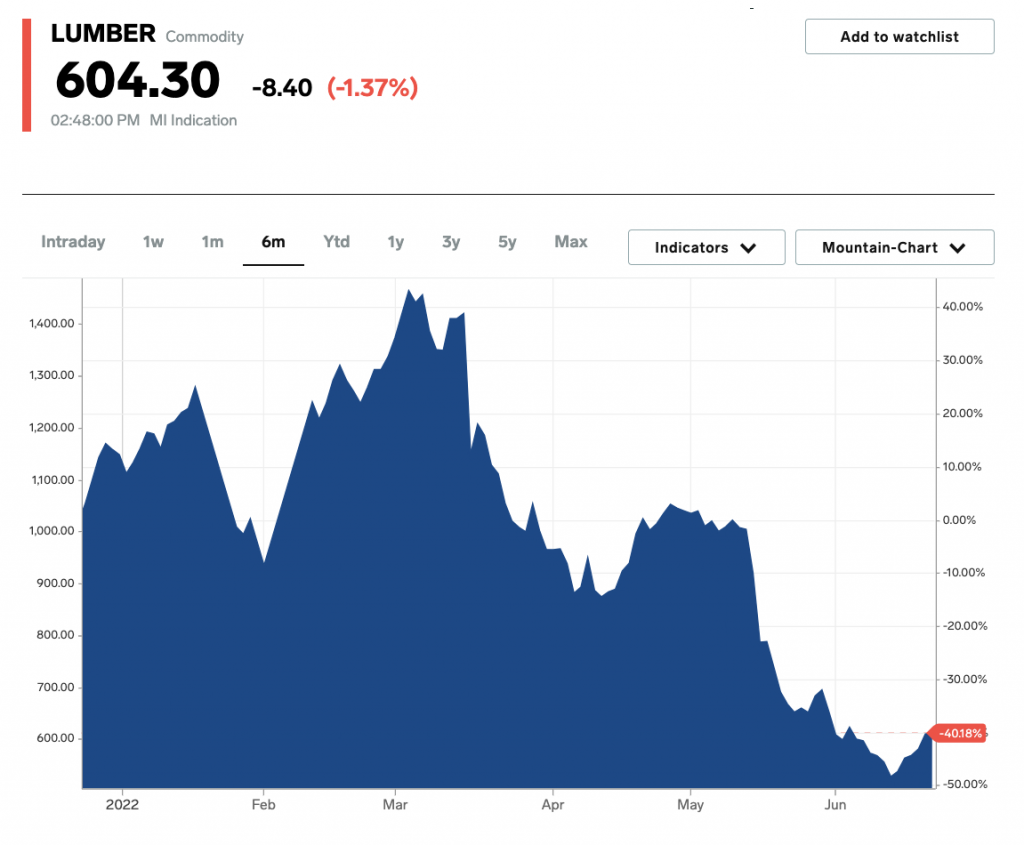

10. Lumber prices have fallen as mortgage rates hit a fresh 13-year high. "Fixed mortgage rates have increased by more than two full percentage points since the beginning of the year," a top economist said. Dig into the numbers.

Keep up with the latest markets news throughout your day by checking out The Refresh from Insider, a dynamic audio news brief from the Insider newsroom. Listen here.

Curated by Phil Rosen in New York. (Feedback or tips? Email [email protected] or tweet @philrosenn.)

Edited by Max Adams (@maxradams) and Lisa Ryan (@lisarya) in New York.