- Crude oil prices plunged as much as 7% on Wednesday as fears of an economic recession surge.

- Deutsche Bank is the latest Wall Street bank to estimate imminent recession odds at 50%.

- The decline in oil comes as President Joe Biden announces a gas tax holiday during the summer months.

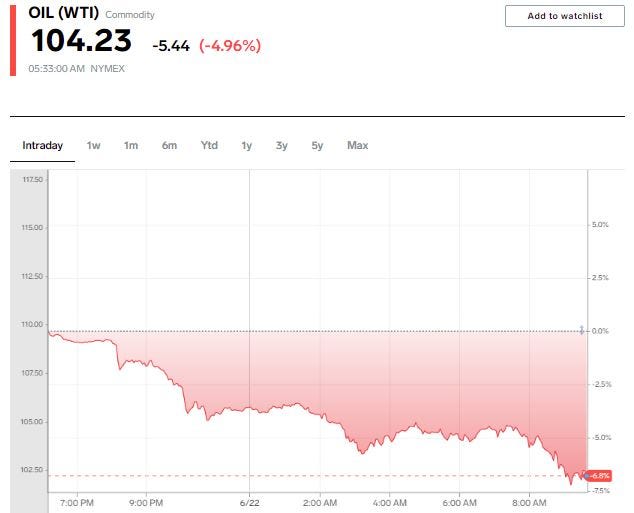

Crude oil prices plunged on Wednesday as investor fears of a coming recession continue to rise and as President Joe Biden's administration called on Congress to implement a summer gas tax holiday.

WTI Crude prices fell as much as 7% in Wednesday trades, falling to a low of $101.53 per barrel and hitting its lowest level since early May. WTI Crude's price decline from its March high of more than $130 per barrel now tops 22%.

Deutsche Bank's Christian Sewing is the latest Wall Street bank CEO to estimate that an economic recession is likely, telling Bloomberg on Wednesday that chances of a global recession currently stand at 50%. Meanwhile, Citi's Kristin Bitterly said there's a 40% chance of an economic recession going into 2023.

"We wouldn't see that until next year just because the tightening that we're seeing around the Fed generally takes around 12 to 18 months to really show up in economic conditions," Bitterly said.

A recession would lower consumer demand for oil as travel activity falls, which would likely lead to lower oil prices as supply is able to play catch-up after a year filled with shortages.

Rising oil prices have been the main driver behind a 40-year high in inflation, which prompted the Federal Reserve to raise interest rates by 75 basis points last week. And the high gas prices, which crossed an average of $5.00 per gallon earlier this month, have been top of mind for the Biden administration.

President Biden told Congress to implement a three-month long gas tax holiday on Wednesday, which would temporarily suspend the federal tax of $0.18 per gallon and save consumers about 3.5% at the gas pump. Biden also implored individual states to temporarily suspend their state-level gas tax as the summer travel season begins to ramp up.

While a gas tax holiday would give immediate relief to traveling consumers, it could also boost demand for the commodity and inadvertently push prices higher, some economists and corporate executives warn.

"It's only going to fuel the demand... It's doing nothing to increase supply, so that's a temporary, almost a mini stimulus," Target CEO Brian Cornell told the Economic Club of New York on Tuesday.