Massimo Pinca/Reuters

- Nikola plummeted on Thursday after a short-seller report from Hindenburg Research alleged that the company and its CEO, Trevor Milton, had made false statements overhyping its technological capabilities.

- The Hindenburg report came two days after General Motors announced a $2 billion partnership with the electric-vehicle manufacturer, sending shares of Nikola up nearly 50%.

- Hindenburg was short shares of Nikola when the report was published.

- Milton tweeted in response to the report: “I guess everything is fair game in war, even a hit job. I know who funded it now. Give me a few hours to put together responses to their lies. This is all you got?”

- Visit Business Insider’s homepage for more stories.

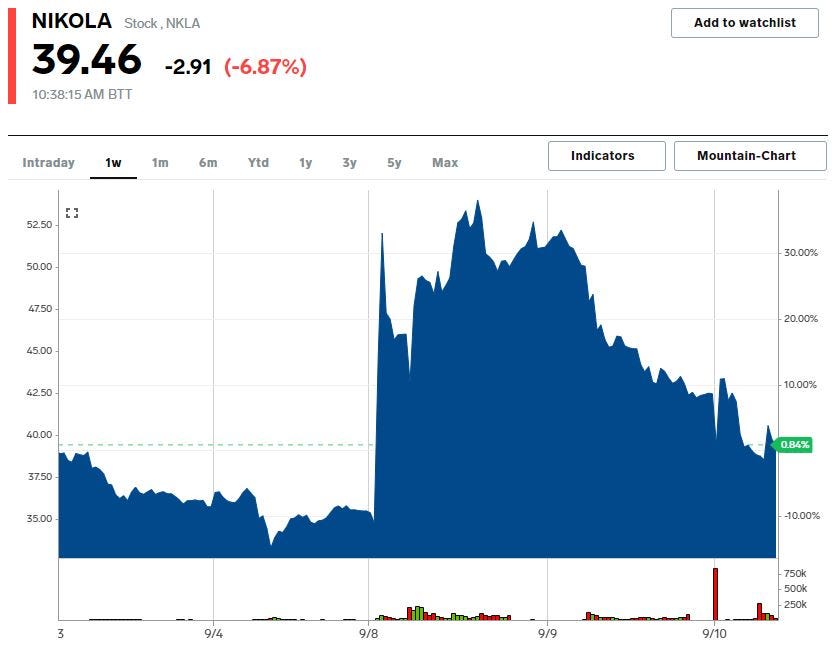

The 53% surge that Nikola experienced on Tuesday in response to its $2 billion partnership with General Motors appears to have been short-lived, as a short-seller report sent shares plummeting as much as 13% on Thursday.

In the report, Hindenburg Research, which is short shares of the electric-vehicle manufacturer, said it found “extensive evidence” — including recorded phone calls, text messages, and private emails — that CEO Trevor Milton had made “dozens of false statements” over the years.

Hindenburg alleged that Nikola engaged in several deceptive practices, from overhyping the capabilities of its electric semitruck to filling its multibillion-dollar order book “with fluff,” that led the short-seller to believe that its partners “did not do their homework.”

Hindenburg was likely referring to General Motors and its partnership with Nikola. General Motors said on Tuesday that it would provide engineering and manufacturing services to build Nikola’s Badger electric pickup truck while receiving an 11% stake in Nikola worth $2 billion.

Hindenburg said it suspected that Tesla's relentless rally "pressured" General Motors to make a deal with Nikola to increase its exposure to the electric-vehicle space.

And as Nikola stock has remained elevated since it went public earlier this year via a reverse merger with a special-purpose acquisition company, its "key partners and backers have been cashing out aggressively," the report said.

"Worthington, Bosch and ValueAct have all sold shares. Worthington sold $237 million shares over a 2-day span in July and another $250 million in August," Hindenburg said.

In response to the short-seller report, Milton tweeted on Thursday: "It makes sense. Tens of millions of shares shorted the last day or two to slam our stock and hit job by hindenburg. I guess everything is fair game in war, even a hit job. I know who funded it now. Give me a few hours to put together responses to their lies. This is all you got?"

Shares of Nikola fell as much as 13%, to $37.05, while shares of General Motors fell as much as 2%. Nikola has still traded more than 5% higher since it announced the partnership with General Motors on Tuesday.