- The wealthiest people in America would be substantially less rich if the United States had a wealth tax, a study published by the Brookings Papers on Economic Activity shows.

- If a moderate wealth tax had been introduced in 1982, Jeff Bezos‘ fortune would be half what it was in 2018. Bill Gates would be $61 billion less rich.

- A wealth tax like the one proposed by presidential candidate Sen. Elizabeth Warren would make ultra-wealthy Americans pay the federal government a small percentage of their net worth each year.

- Warren’s wealth tax proposal is less aggressive than the one proposed by fellow candidate Bernie Sanders. Joe Biden, the current Democratic frontrunner, has said that he does not support a wealth tax.

- Visit Business Insider’s homepage for more stories.

If the United States had implemented a moderate wealth tax in 1982, Jeff Bezos’ fortune would be half what it was in 2018 and Bill Gates would be $61 billion less rich, a study published in the Brookings Papers on Economic Activity found.

America’s inequality problem has become central to the Democratic primary; frontrunner Bernie Sanders lampooned former candidate Pete Buttigieg for accepting donations from billionaires and Mike Bloomberg for being one. Buttigieg suspended his campaign on Sunday, and Bloomberg did the same Wednesday after a disappointing showing on Super Tuesday. Joe Biden, another frontrunner, has said that he does not support a wealth tax.

The idea of taxing the net worths of Americans has gained traction in recent years, but proposals have been hampered by questions over the effectiveness and the constitutionality of such a tax, Business Insider previously reported. Elizabeth Warren was the first Democratic contender to propose a formal wealth tax, and Sanders soon followed with an even more aggressive plan.

The Brookings Study, “Progressive Wealth Taxation” by The University of California at Berkeley’s Emmanuel Saez and Gabriel Zucman, concludes that “the wealth tax has great revenue and wealth equalizing potential in the US context.”

How a wealth tax would work

A wealth tax would require that ultra-wealthy Americans pay the federal government a small percentage of their net worth each year.

One of the most frequently cited proposals, Elizabeth Warren's "Ultra-Millionaire Tax," calls for a 2% annual tax on households with a net worth between $50 million and $1 billion and a 3% annual tax on households with a net worth over $1 billion. Warren has since proposed increasing the tax on households with net worths over $1 billion to 6%, but has yet to modify the proposal on her campaign website.

The idea has support from ultra-wealthy and ordinary Americans alike: An Insider poll shows that more than half of Americans support Warren's wealth tax proposal.

Keep reading to see how rich America's richest billionaires would be if the country had a moderate wealth tax.

Methodology: The study published in Brookings Papers on Economic Activity examines American billionaires' net worths if a moderate wealth tax had been implemented in 1982.

The date was chosen as the study's starting point because the earliest Forbes 400 data on American billionaires dates back to 1982.

The study examined how billionaires' fortunes would have been affected both by moderate and extreme wealth taxes. For the purposes of this article, Business Insider looked at the moderate wealth tax only, which would tax fortunes over $1 billion at 3%.

As the study's authors noted, "The wealth tax has a much larger cumulative effect on inherited and mature wealth than on new wealth," which helps explain the differences in how extremely some of the billionaires would be affected.

However, the study's model fails to account for the fact that ultra-wealthy Americans will likely reengineer their finances to try to evade the tax. That's a real possibility, former Department of Justice tax attorney James Mann, who is now a tax partner at law firm Greenspoon Marder, told Business Insider in August.

Warren's estimates also don't consider tax evasion, Mann said. The authors write that technological advances, the United States citizenship-based tax system, and a high exemption threshold make tax evasion less of a concern.

All data on billionaires' 2018 net worth is sourced from the Brookings study, which relied on Forbes data.

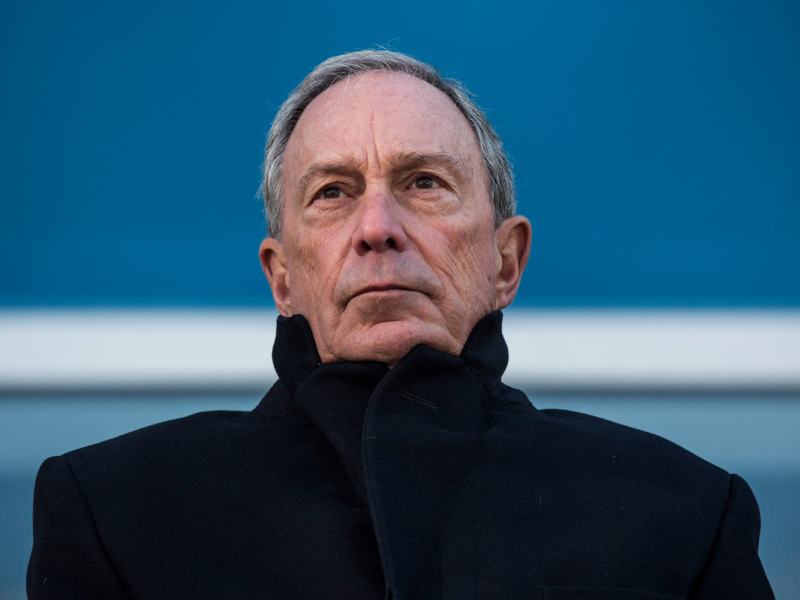

10. If the US had implemented a moderate wealth tax in 1982, Mike Bloomberg's 2018 net worth would have been reduced by more than half.

Actual 2018 net worth: $51.8 billion

2018 net worth with a moderate wealth tax: $24.2 billion

The former Mayor of New York City and former presidential contender, Bloomberg built his fortune running Bloomberg LP, his financial data and media company, Business Insider previously reported.

9. The net worth of Google founder Sergey Brin would have dropped by over a third.

Actual 2018 net worth: $52.4 billion

2018 net worth with a moderate wealth tax: $34.4 billion

Brin, 46, founded the search engine in a garage in California in 1998, Business Insider previously reported.

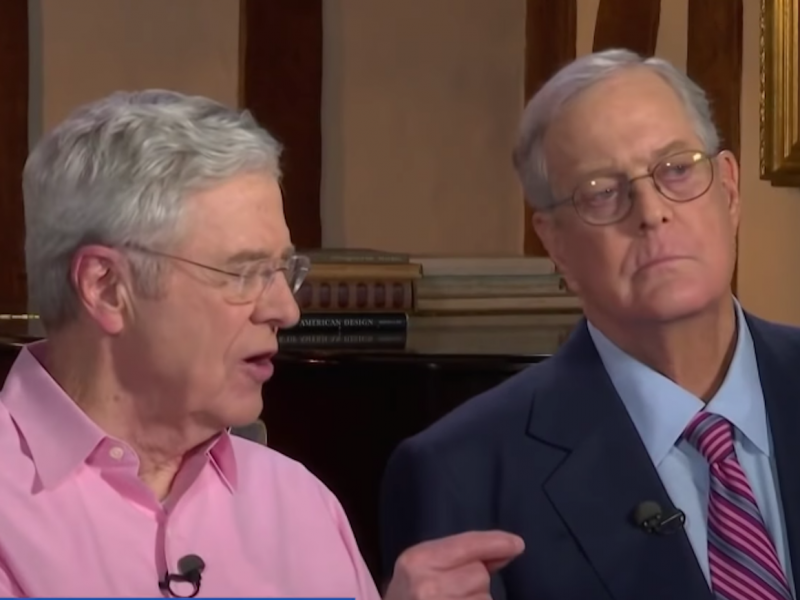

T8. Billionaire brothers Charles and David Koch would each have net worths nearly $35 billion lower than they were in 2018.

Actual 2018 net worth: $53.5 billion each

2018 net worth with a moderate wealth tax: $18.9 billion each

The brothers controlled industrial giant Koch Industries and are known for their donations to conservative causes. David Koch died in August after a battle with prostate-cancer, Business Insider reported.

6. The net worth of Google cofounder Larry Page would be down $18.5 billion.

Actual 2018 net worth: $53.8 billion

2018 net worth with a moderate wealth tax: $35.3 billion

Page, 46, is the CEO of Google parent company Alphabet, Business Insider previously reported.

5. Oracle founder Larry Ellison would be 40% less rich if the United States had a moderate wealth tax.

Actual 2018 net worth: $58.4 billion

2018 net worth with a moderate wealth tax: $23.5 billion

Ellison, 74, is also known for having a playboy reputation, Business Insider previously reported.

4. If a moderate wealth tax had been implemented, Facebook's Mark Zuckerberg would have been worth approximately only 72% of what he actually was in 2018.

Actual 2018 net worth: $61 billion

2018 net worth with a moderate wealth tax: $44.2 billion

Zuckerberg became a billionaire at age 23 after founding the social networking site, Business Insider reported. At the time, he was the world's youngest self-made billionaire. That title has since been taken by Kylie Jenner, whose cosmetics line made her a billionaire at age 21.

3. Warren Buffett's fortune would be one-third the size it is.

Actual 2018 net worth: $88.3 billion

2018 net worth with a moderate wealth tax: $29.6 billion

The "Oracle of Omaha" founded and serves as the CEO of conglomerate Berkshire Hathaway, Business Insider reported.

2. A moderate wealth tax would have made Bill Gates $61 billion less rich.

Actual 2018 net worth: $97 billion

2018 net worth with a moderate wealth tax: $36.4 billion

The Microsoft founder and full-time philanthropist recently faced criticism for his connections to deceased sex offender Jeffrey Epstein, Business Insider reported.

1. A moderate wealth tax would have cut Jeff Bezos' fortune in half.

Actual 2018 net worth: $160 billion

2018 net worth with a moderate wealth tax: $86.8 billion

Amazon founder and CEO Jeff Bezos is currently the richest person alive. However, if the United States had a wealth tax, LVMH CEO Bernard Arnault would be richer. Arnault has a net worth of $108 billion, Business Insider reported.