The money management business could reach “a turning point” in 2017.

That’s according to Morgan Stanley, which just published a big report on the industry titled: On the Precipice of Change.

“Evolving customer demands, oversupply, intensifying competition, and secular re-pricing make 2017 a turning point for the industry,” it said.

The US bank has identified 10 potential surprises for the industry in the new year.

“These are events we believe have greater than a one-in-three chance of happening, but are not in our base case or priced into the stocks,” Morgan Stanley said.

Whether you're an asset manager, a day trader, or just have a 401(k), they may have a big impact on you and your money.

Read on:

1. Increased pressure on active management

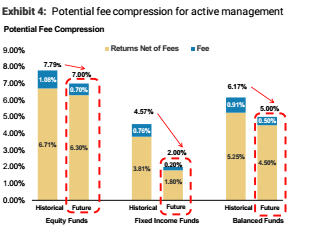

"The stars are in alignment" for active managers to lower their fees in the new year, according to Morgan Stanley.

Money has been pouring out of their accounts and into index funds at a clip over the past few years, leaving some people wondering if the active management business is dead.

Bill McNabb, CEO of the $3.9 trillion fund Vanguard, said that active managers can survive and prosper, but only if they lower their fees.

Morgan Stanley expects them to do just that. The bank estimates that fees charged by active managers could shrink by more than a third in 2017.

2. Don't buy buybacks

Traditional asset managers have reduced their share count by 7.5% on average over the past three years, according to Morgan Stanley, yet underperformed the S&P significantly.

"We see weak empirical evidence that greater reduction in shares count drives outperformance," the bank said.

With that in mind, Morgan Stanley thinks listed asset managers may be about to recalibrate their payout ratios, so as to invest in growth.

"The maturing sector still has pockets of growth," the bank said. "But achieving growth requires greater investment than in the past; in seed capital and capital to acquire new teams/capabilities and drive consolidation."

3. Consolidation in the mutual fund industry

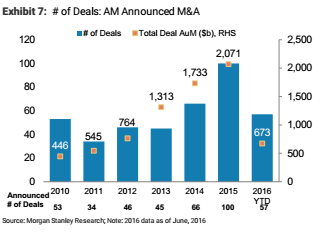

Mounting pressures in the mutual fund industry will likely lead to some consolidation in 2017.

According to Morgan Stanley, merger and acquisition activity, especially among smaller mutual fund houses, has picked up since 2015 and is likely to "accelerate" in the new year.

"We see four pain points intensifying for a highly profitable industry, which may drive more firms to weather the storm together and improve scale," the bank said.

4. Lower taxes will shake up the alternative investment space

Lower taxes are on the cards in 2017, thanks to the Republican sweep of the US Congress. And this may change the way people who managealternative investments do business.

According to Morgan Stanley, lower corporate taxes will likely tempt alternative asset managers to change their corporate structures from partnerships to C-Corps. In the latter the owner's income is double taxed, whereas in the former they are not.

"Lower tax rates would result in less tax leakage and reduce the cost of moving from single-layer taxation to double taxation structure," the bank said.

Since some investors are unable to invest in partnerships or just don't want to because of tax complexities, Morgan Stanley concludes an industry shift to C-Corp structures would "expand the universe of eligible investors in the Alts."

5. A rebirth of retail trading

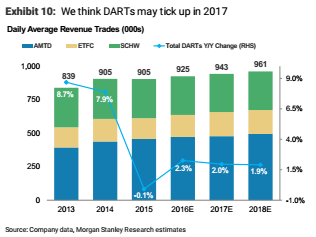

Retail traders will likely see their numbers increase in 2017, following years of subdued activity.

According to Morgan Stanley, the comeback of non-institutional investors is partially the result of major changes following the election of Donald Trump, including "tax reform, deregulation, and broader policy changes including fiscal stimulus."

Their return is great news for some players in the brokerage industry. That's because increased trading activity will boost daily average revenue trades, which means more money for brokers.

According to the bank, TD Ameritrade and E-Trade are positioned to benefit the most from the 10% increase in DARTs they project.

6. An aging population will save fixed income from higher interest rates

It's almost a certainty that the Federal Reserve will hike its benchmark interest rate in 2017.

History suggests that this might push investors to dump their fixed income assets.

"Three of the four past rate hike cycles saw meaningful outflows from fixed income strategies amounting to -8% during the first 12 months," Morgan Stanley said.

This time could be different. That's because the US population is aging, and older investors tend to favor lower risk investments, such as bonds.

"Demographic trends are a tailwind for sustained fixed income flows as an aging population is expected to represent a larger portion of the US population over the next few decades," the bank said.

7. The fiduciary rule will survive

Financial firms are excited about Donald Trump's promise to roll back many of the regulations enacted after the 2008 financial crisis. But there's one regulation that will likely go into effect unimpeded; that's the fiduciary rule.

The Department of Labor regulation will legally require financial advisers to act in their client's best interest before their own, and is set to go into effect in April.

"As a consumer-friendly rule, it could be politically challenging for an administration elected on a populist platform to walk away from," Morgan Stanley said.

"Even if the rule is scrapped, the SEC could implement a broader and more far reaching fiduciary rule that impacts all retail accounts (taxable and retirement), as opposed to the DOL's rule that focuses on retirement accounts," the bank added.

8. A golden age for stock pickers

Things may be looking up for stock pickers.

"Potentially unprecedented political actions could result in active management outperformance," Morgan Stanley said in a note.

"Unexpected consequences of Trump administration policies could lead to higher dispersion and lower correlation, potentially reaching levels not seen since the financial crisis, and ultimately creating more opportunity for stock pickers to generate [higher returns]," Morgan Stanley said.

9. Shift to risk premia strategies

Rising interest rates, weak returns, and a number of other factors will likely pressure asset owners to reconsider how they construct their portfolios. Morgan Stanley expects these conditions to spur an industry move towards so-called risk premia strategies.

"Risk-based portfolio construction provides a more structured approach to diversification," the bank said.

"We think this could provide a meaningful growth opportunity for asset managers and potentially disrupt the hedge fund industry by introducing low cost and liquid systematic hedge fund replication strategies," they concluded.

10. ETF fees drop below zero

America's hottest investment product may get even cheaper.

According to Morgan Stanley, ETFs may see their fees fall below zero in 2017 as the market continues to crowd and competition intensifies.

"Some large scale firms are flexing their muscle to differentiate on price with the ETF wars seen during 2016," the banks said.

"Ultimately, revenue models may be transformed from asset management fees to higher valuation multiple software licensing fees," they added.