- Even after a rough week, bitcoin is trading at around $14,400.

- A recent research note from Morgan Stanley points out how hard it is to justify that valuation.

- The scarcity of people willing to accept it as a means of payment indicates that its actual value might be nothing.

Morgan Stanley analyst James Faucette and his team sent a research note to clients a few days ago suggesting that the real value of bitcoin might be … $0.

That’s zero dollars. (Bitcoin stood at around $14,400 at the time of writing.)

The paper (titled “Bitcoin decrypted”) did not give a price target for bitcoin.

But in a section titled “Attempts to Value Bitcoin,” Faucette described why it is so hard to ascribe value to the cryptocurrency. It’s not like a currency, it’s not like gold, and it has had difficulty scaling. He concluded:

• Very difficult question to answer, but some points to consider

• Can Bitcoin be valued like a currency? No. There is no interest rate associated with Bitcoin.

• Like digital gold? Maybe. Does not have any intrinsic use like gold has in electronics or jewelry. But investors appear to be ascribing some value to it.

• Is it a payment network? Yes but it is tough to scale and does not charge a transaction fee.*

• Bitcoin average daily trading volume of $3bn (last 30 days) vs $5.4 trillion in the FX market.

• Est. <$300mn in daily purchase volume vs. $17bn for Visa.

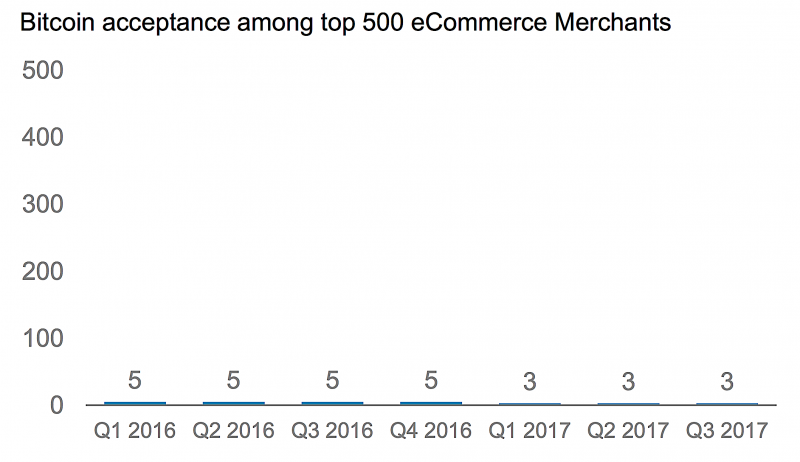

Faucette backed his argument with this chart of online retailers who accept bitcoin, titled "Virtually no acceptance, and shrinking":

"If nobody accepts the technology for payment then the value would be 0," Faucette suggested.

Of course, even if bitcoin can't be used to buy goods it is still largely exchangeable for fiat currency.

*Clarification: It's not clear why Faucette wrote this, as most miners do charge transaction fees.