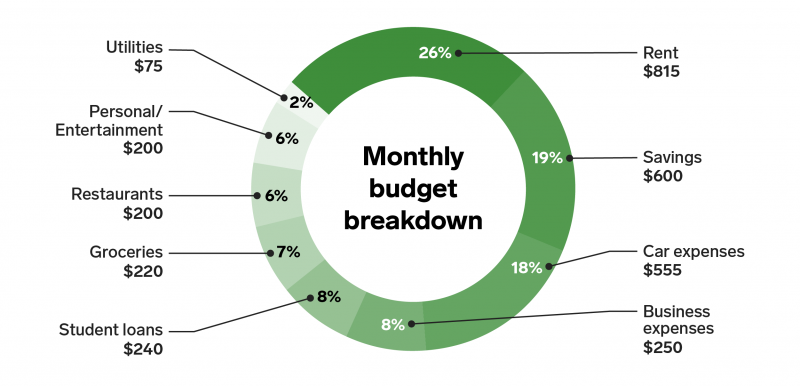

- Aaron, 27, makes about $60,000 a year as a marketer for a software company. He also spends about 10-15 hours a week on his side hustle blogging at Personal Finance for Beginners.

- He’s working to make his side hustle his full-time job, but it’s taking time – he’s saving 20% of his income every month in an “opportunity fund” and also paying back $25,000 in student loans.

- For Business Insider’s “Real Money” series, Aaron shares how spent and saved his money during a week in July.

- Want to share a week of your spending? Email [email protected].

I’ve always been an entrepreneur.

When I was in elementary school, my best friend and I would knock on our neighbors’ doors selling our homemade products: bookmarks (made from dried Elmer glue), magnets (laminated stickers with magnetic tape on the back), and books (short stories we wrote and stapled together).

I remember we drew up plans for the office building that would one day be home to “A&T, Incorporated” (based on our initials). While those floor plans haven’t come to fruition (yet), those years as a child entrepreneur have stuck with me.

Since then, some of my entrepreneurial pursuits have included creating (and eventually selling) a professional basketball blog as a teenager, consulting small businesses on marketing, and helping to lead a student organization that helps provide funding for student entrepreneurs.

Entrepreneurs are dreamers and creators. It takes vision, that's for sure, but ideas aren't enough on their own. Entrepreneurs find a way to bring their ideas to life… Often with limited resources.

If you consider yourself an entrepreneur, you can most likely relate. Perhaps you feel like you have:

- plenty of time but no money

- plenty of money but no time

- plenty of ideas but neither time nor money

Personally, I've decided to keep my expenses low and dedicate my time toward my work.

I think I've found my "idea" for now: building a brand that teaches young adults the basics about money - how to get a higher credit score, what to do when you get a raise, how to find the right auto insurance, etc. I also work a full-time job doing marketing for a software company and earn about $60,000 a year.

Now my challenge is bringing my side hustle to life. Since I want to avoid business debt and keep my monthly business expenses, I get to practice what I preach: spending less than I earn, and being resourceful with what I have.

Here's a look at my typical monthly spending living in downtown Salt Lake City, Utah. I spend about $2,600 per month while saving an additional $600 per month toward an "opportunity fund."

For the most part, I've managed to keep my monthly expenses close to the commonly recommended benchmarks for spending: around 30% on housing and 10-15% on either food or transportation.

There's one particular expense which might stand out to you: my car payment. I count it as one of my greatest financial mistakes, and I'll share a more detailed explanation later.

I pay at least $240 a month toward my student loans. I graduated with about $25,000 in student loan debt. This could have easily been closer to $50,000 or $60,000 at the school I attended, but I was able to earn scholarships through qualifying for merit-based awards and volunteering to help lead a student-run organization for entrepreneurs.

My strategy for paying back my student loans is moderate: I have set up automatic payments to cover 5-10% above the minimum payment each month.

When I find myself with a little extra money at the end of the month, I'll make another $50 or $100 payment to help reduce the loan principal and shorten the life of the loan. However, since the interest rate on my loans is only around 4%, I've decided to focus on increasing my retirement contributions and building my savings instead.

I'm not completely sure how I'll use the "opportunity fund" yet: possibly relocating to a new city, putting a down payment on a house, or scaling my blog somehow.

This aggressive monthly savings of $600 is only made possible after I got a raise earlier this year. I basically took all of the new income from the promotion and set it up to be automatically deposited in a secondary bank account.

Here's a look at my spending during a week this past July.

During this particular week, I had a couple major expenses related to my blog: one was planned (a new laptop) and the other was impromptu (changing where I host my blog).

Otherwise, this is a pretty typical week for my expenses. I used to go out to eat daily, sometimes twice.

I've tried to cut this down - and skip the bar scene altogether - so I can save money for when business-related expenses come up.

While I've certainly made some trade-offs socially, I want to be able to invest my money into something I'm passionate about without worrying about paying my rent or car payment later.

Here's a look at my week.

On Monday, I start the week with a typical day at the office. My only spending for the day is my car payment.

Although I'd love to become a completely self-employed entrepreneur at some point, it's not financially feasible at this point.

So the start of my week probably looks a lot like yours: I make a 25-minute commute into the office. My day is spent responding to emails, attending meetings, and working on my projects - nothing too unusual.

If I do ever decide to make "side hustling" my full-time gig, I'll miss out on more than just a stable salary. My employer offers employees extra perks like a stocked kitchen that helps keep my food budget under control.

So today I don't spend any money as far as food or entertainment is concerned, but today just happens to be when my car payment hits my checking account.

As I mentioned before, my car payment might very well be my worst financial decision to date.

I purchased my car when I was still working part-time as a student. Somehow, the dealership was able to get me financing for a loan that was almost equal to my annual income the year prior. Not only that, but they got locked me into a six-year loan that meant I was upside down on the car as soon as I drove it off the lot.

While I can afford to make the payment each month, my financial values have changed since I made the decision to buy the car as a college student. These days, I'm more interested in building up my savings account than keeping up with the Joneses.

If you're about to start working full-time for the first time, learn from my mistake: you don't need to spend every dollar you're earning. Just because you can afford something doesn't mean you should buy it.

Next time I need to buy a vehicle, I hope to follow something called the 20/4/10 rule: put at least 20% down, agree to a term length of four years or less, and keep total auto expenses (payment, insurance, and gasoline) to under 10% of your income.

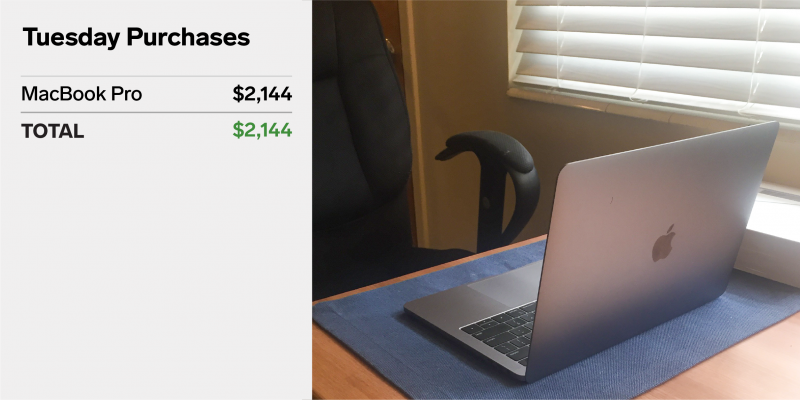

On Tuesday, I order a new MacBook Pro.

You might want to say "This doesn't seem like a normal week of spending!"

And you're totally right. I've been waiting for Apple to announce their latest model of laptops for several months.

My current laptop is a 2013 MacBook Air. The battery is due for a replacement in the next few months, and recently, the laptop has began struggling with some of the websites and image editing software I'm using for my projects.

I'm not sure if my current laptop could last another 12 months. I also want to buy a new laptop while I definitely have a steady source of income and some savings in the bank.

I decide to pay an additional $200 (for a total of $2,144.48) for an upgraded model of the new 13-inch MacBook Pro. Hopefully the upgraded technical specs will extend the life of the laptop by another year or two versus the base model.

I've been focused on saving a large part of my paycheck every month, so I'm not super thrilled with forking over this much cash for the laptop, but having a reliable personal laptop is critical for internet marketing and I'd like something that will last.

I curse at myself for being an Apple "fanboy," remind myself that I'm paying about $40-$50 a month for the laptop over the course of its life, and click "buy."

On Wednesday, it's another normal day in the office. I pay for my music streaming subscription, buy some groceries, and refuel my car.

Today is a pretty standard workday. I go the gym during lunch, and eat a meal from home that I've packed the night before and supplement with snacks from the office kitchen.

I do have a few expenses today, one of which is my monthly Spotify subscription. I pay for a Spotify for Premium Family account that I share with a sibling.

This is one of my only monthly subscriptions. I don't pay for other entertainment streaming services (and I try to steer very clear of video games!) because I realize just how much time can be consumed by the sites.

On my way home from work, I stop by the local grocery store to pick up some food: yogurt, chicken drumsticks, spinach, mixed nuts, blueberries, avocados, butter, and a few other miscellaneous items. (Including candy, you caught me!)

This is a little higher than my normal grocery bills, especially since I'll often buy groceries twice a week. However, I rarely feel guilty about a big trip to the grocery store as it typically translates into spending less food at restaurants throughout the week.

On Thursday, I decide to migrate my website to a new hosting company.

Right now, my personal finance blog is my primary "side hustle." Over the past few weeks, my site's had an incredibly slow load time.

Nobody wants to click a link and wait 7-10 seconds before the article shows up, right?

I try lots of things to troubleshoot why my website is so slow - compressing images, changing cache settings, and disabling plugins - before someone suggests that I should consider changing website host providers. I decide to lock in three years of hosting for just over $200.

Dropping over $200 for website hosting isn't an expense that's built into most people's budgets, but that's exactly why I've started aggressively saving money each month - so I can invest in my entrepreneurial projects without simultaneously worrying about paying the bills.

You choose to spend $200 a month on concert tickets, bar tabs, and expensive gym memberships. I choose to spend it on blog hosting, social media tools, and mastermind groups. Neither set of spending habits is inherently better than the other, it's just a matter of personal goals!

Fortunately, moving my blog over to the new hosting provider is all it takes to improve my site load time. This whole process happened first thing in the morning, and that's my only expense for the day aside from going out to eat for lunch with coworkers at a nearby deli.

On Friday, I meet up with a friend for lunch.

A few weeks ago, I ran into a friend who I hadn't seen in several years. We made plans to eat lunch at In-N-Out this afternoon.

I go with my favorite secret menu creation: an "animal-style," "protein-style" double-double with chilis! Basically a lettuce-wrapped cheeseburger with grilled onions and peppers for the un-initiated.

After a few more hours at work, I head home and spend some time working on my blog.

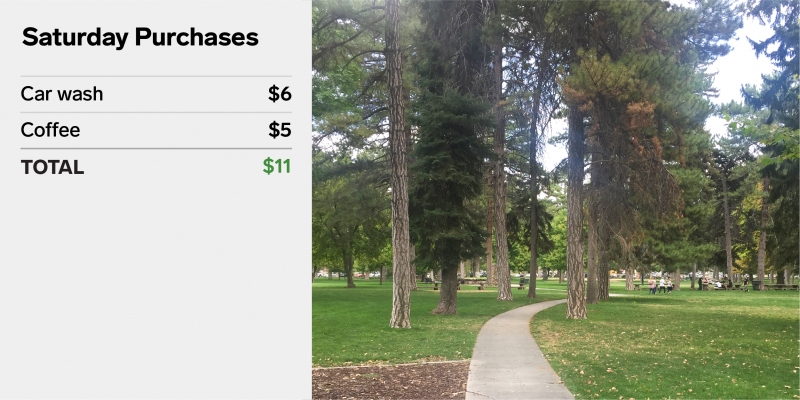

On Saturday, I start the day with a walk in the park. Then it's time to get to work.

It's easy to start bleeding money on the weekends if you're not prepared with some cheap things to do when you're bored.

I like to start my Saturday mornings by spending 45-60 minutes listening to a podcast episode and walking around a local park.

While most of my peers seem to prefer podcasts on crime, relationships, or politics, I typically opt for something marketing or blog-related, although today I decide to listen to a health-themed podcast instead.

Saturdays are also my primary day for working on my entrepreneurial projects.

Some days, like today, I prefer to go work from a coffee shop for several hours rather than sitting inside my apartment all day. I pack my own snacks but make sure to purchase something while I'm there.

My only other expense for the day is a trip to the car wash. I feel like I've already spent enough on my car this week, but I might as well keep it clean.

On Sunday, I take a break to play a casual game of poker with some friends and prepare some food for the upcoming week.

A couple times per month, I'll drop in and play a relaxed game of poker with some friends.

The buy-in is $5. It's a small enough amount that it can be easily dismissed as "entertainment money." After all, we typically play for 4-5 hours and it would cost twice that amount to go see a movie.

Even though the stakes are nearly zero, we've found that players make better decisions if there's at least a little money on the line!

On this particular Sunday, I lose my poker chips early enough in the afternoon that I end up buying in to the game twice. I end up finishing in second place and heading home with $15. Money isn't the motive for our fun weekly game, but hey, with my $5 profit I "earned" about a dollar per hour!

On my way home, I stop by Trader Joe's to purchase some chicken breast and cheese to eat as part of my dinner that night and for the next couple days.

At this point, I just have a couple hours left to prepare some food for the upcoming week and pack up my gym bag. After all, it won't be long until my 6:00 a.m. alarm goes off and it's time to work on my blog before heading back into the office.