Merck

- Merck's COVID-19 pill holds tremendous promise in fighting the pandemic.

- Industry analysts expect Merck to make billions off the not-yet-authorized drug.

- Some countries will be paying $12 per pill, while the US agreed to pay $712 per treatment course.

Merck is walking a tightrope with its COVID-19 pill, expecting to reap billions in revenue while still making the medicine affordable to the world.

The pharmaceutical giant's antiviral program became the first pill to succeed in a late-stage study. The drug, called molnupiravir, halved the risk of hospitalization and death compared to a placebo for people with mild to moderate COVID-19 who are at high risk of severe illness.

Merck now finds itself in a position to make molnupiravir one of its most profitable drugs, with industry analysts forecasting the company will make about $22 billion in revenue from the drug through 2030. At the same time, to be an effective tool in the pandemic, it'll have to work to make it accessible to the people who need it the most around the world.

Global inequity has been a hallmark of the world's COVID-19 response. Moderna, for instance, has faced criticism that it has prioritized rich countries in making supply deals for its coronavirus vaccine. More than 50 countries and territories, mainly in Africa and the Middle East, have vaccinated less than 10% of their population as of the end of September.

Merck hopes to make billions while not leaving behind the most vulnerable populations. While the US government is paying $712 per treatment course, Merck is allowing generic manufacturers to make its pill for lower-income markets, where they will likely charge a fraction of that cost.

Merck has reached agreements with eight generic drug companies, allowing each of them to sell molnupiravir in more than 100 low- and middle-income countries. These generic companies will compete on price, with one report saying they are expected to charge about $12 to $15 per treatment course.

Drug companies have enlisted generic manufacturers before with HIV and hepatitis C medicines, typically after public pressure. For its COVID-19 pill, Merck has set up these partnerships ahead of time, preemptively giving up the monopoly control of the drug that pharma companies so aggressively protect under normal circumstances.

"We've been planning to put this strategy in place from the very beginning," Paul Schaper, Merck's executive director of global pharmaceutical public policy, told Insider.

Even some drug-pricing advocates applaud Merck's strategy.

"Merck is among the better actors in the pandemic compared to other companies," said Jamie Love, head of the drug-access advocacy group Knowledge Ecology International.

The US is paying $712 per patient for Merck's drug

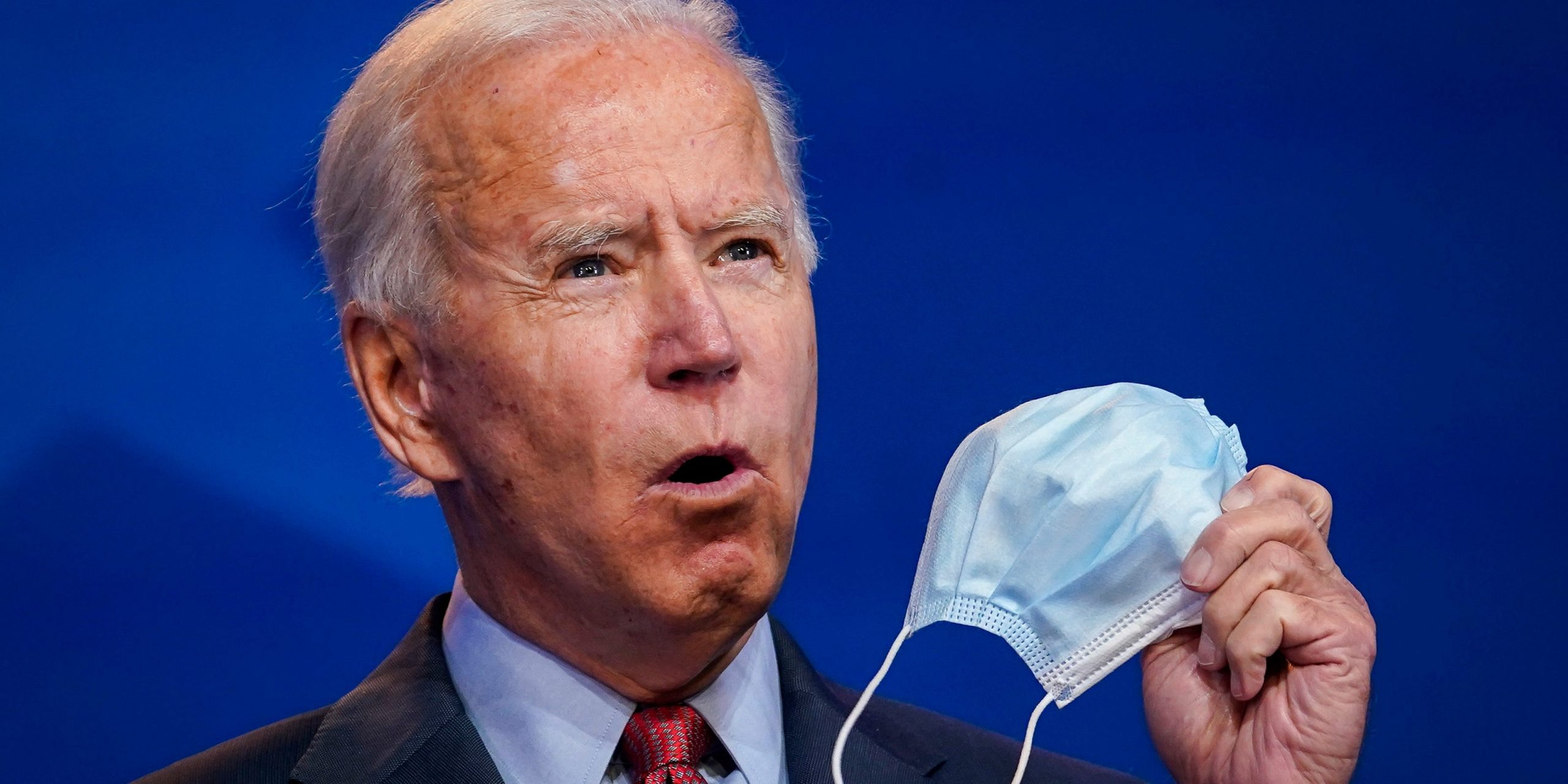

Drew Angerer/Getty Images

Merck is expected to reap billions from its new drug, fueled by supply deals with rich countries like the US.

In June, the US government agreed to pay $1.2 billion in a supply deal for molnupiravir, if the drug wins an OK from the Food and Drug Administration. Merck declined to provide details on how that price was negotiated; the Department of Health and Human Services did not respond to Insider's request for comment on the price.

Analysts expect molnupiravir to turn into a top-selling drug for Merck. The Bernstein analyst Ronny Gal projected in an October 6 research note that Merck will make $5.3 billion in 2022 sales for the drug, with about 80% of that coming from the US market. Gal forecasted $22 billion in total molnupiravir revenue for Merck through 2030.

Investors appear to see that potential as well: Merck's stock price rose as much as 10% after the company announced the positive study results on October 1.

The US is effectively paying about $712 per treatment course from the June deal. That price strikes some experts as too high, particularly given federal grant money that has been invested in the drug. The drug's early development was funded with $35 million in taxpayer grants, Axios reported.

"Unfortunately, in the US, we allow manufacturers to set whatever price they want, and as a result, we get situations like this," Dr. Aaron Kesselheim, a professor at Harvard Medical School said in an email, adding the government's negotiations factor into the public investment.

But patients won't face that bill directly. The US government negotiated a supply deal for 1.7 million treatment courses, which will then be distributed to patients for free.

Even at that price, molnupiravir is cheaper than other COVID-19 treatments. A pill is much simpler to produce than other medicines, given as IV infusions. The government is paying $2,100 per infusion of Regeneron's antibody cocktail and $3,200 for a five-day IV course of Gilead Sciences' antiviral remdesivir. The COVID-19 vaccines, on the other hand, are far cheaper, ranging from $10 to $40 per shot in the US.

Merck hasn't set a commercial price for molnupiravir yet but said it will use different prices in countries by their income level.

Even with access plan, some say Merck should do more

Merck

Advocates pointed out a few steps Merck could take that would improve access.

Dzintars Gotham, an independent researcher and a physician at King's College Hospital, said it would be useful to know how much it costs Merck to produce the pills. That information can help countries negotiate fair prices, he said.

Gotham and Melissa Barber, a doctoral candidate in population health sciences at Harvard University, released their own analysis, estimating it costs $17.74 to produce a course of molnupiravir.

Merck declined to say how much it costs to make molnupiravir. Schaper said the marginal cost isn't the right question to ask on pricing, saying that doesn't consider the societal benefit of the drug.

This lack of transparency is common in the drug industry, Gotham said.

"A lot of drug pricing relies on very dramatic pricing asymmetry between the buyer and the seller," Gotham said, "which is a fancy term for the seller knowing a lot of information about what they could or couldn't afford in terms of pricing and the buyer not knowing much in terms of what's possible."

Gotham and Love also both said they'd like to see Merck publicly release the contracts with generic suppliers. This would include information on the list of 105 included countries, how long the licenses last, and what royalties Merck receives from those sales.

"Licenses should be public," Gotham said. "I don't see a logical argument why they wouldn't be."