- The Federal Trade Commission approved a $5 billion fine for Facebook last week as a result of its investigation into the Cambridge Analytica scandal.

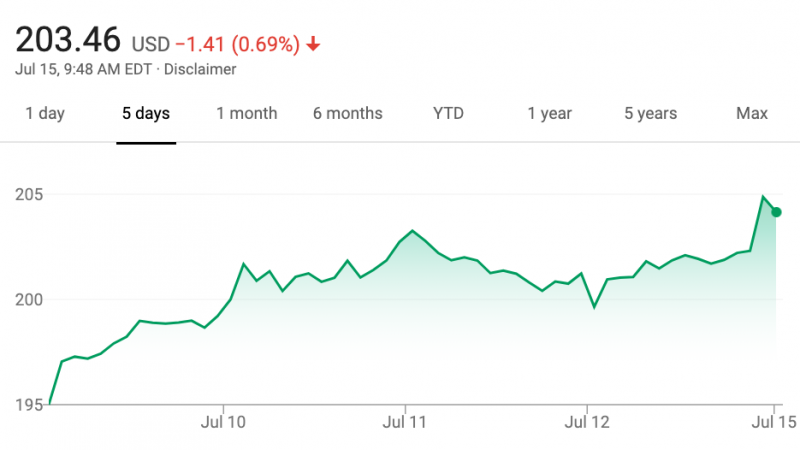

- Facebook shares actually jumped on the news, rising 1%, to the highest they’ve been in the past year.

- As Facebook’s primary stockholder, CEO Mark Zuckerberg stands to profit handsomely from the stock-price jump. The value of his Facebook stake increased by more than $1 billion in 30 minutes following the news.

- Visit Business Insider’s homepage for more stories.

Facebook is about to get slapped with a $5 billion fine by the Federal Trade Commission because of the Cambridge Analytica scandal, where data from over 50 million users was used without permission.

In a surprising twist, Facebook’s stock value actually rose by 1% following the news on Friday afternoon of the FTC’s landmark fine – and Facebook CEO Mark Zuckerberg owns a whopping 88.1% of Facebook’s shares.

Per an April financial filing, Zuckerberg owns 410,497,115 shares of Facebook stock. At its price before the news broke around 3:45 p.m. ET, $202.31, his shares would be worth $83 billion. At its price of $204.87 around 4 p.m., those shares would be worth $84.1 billion.

What that means is that the value of his shares increased by over $1 billion in just 30 minutes.

As Facebook's primary shareholder, Zuckerberg can see a huge windfall from a stock-price increase of just 1%.

The $5 billion FTC fine is intended to punish Facebook for mishandling user data and presumably not to increase the wealth of Facebook's primary shareholder. Facebook could not be immediately reached for comment.

The fine is a record for the FTC - a move seemingly intended to set a precedent for the kind of punishment that tech giants could receive for mishandling their users' data.

But many have characterized it as essentially a slap on the wrist for Zuckerberg and his social-media company.

But why is Facebook getting hit with such a huge fine in the first place?

As Business Insider's Rob Price put it last week: "For the last year, the FTC has been investigating Facebook's various privacy snafus. The agency started with a probe into whether Cambridge Analytica's misappropriation of 87 million users' data amounted to a breach of the company's 2012 consent decree with it. It later expanded the inquiry to incorporate the California tech giant's myriad other recent privacy scandals."

And on Friday, news broke that the result of that investigation would be a $5 billion fine and some additional oversight of Facebook's business practices. Soon after, the company's stock value jumped.

It may sound counterintuitive, but the logic is simple: Because Facebook expected a fine and planned its annual financials around that expectation, investors reacted positively to that plan playing out - and the fine not being bigger.