Lloyds Bank is setting aside an extra £1 billion ($1.2 billion) to compensate people who were missold payment protection insurance (PPI).

PPI was a form of insurance intended to pay out if consumers failed to make payments on their loans. Many consumers were duped into buying it, or did not know how it worked.

PPI was wrongly sold alongside loans, credit cards and mortgages and banks have been forced to pay out to customers who were wrongly sold the coverage.

The lender, which is 9% state-owned, reported pre-tax quarterly profit of £811 million, down from £958 million in the same three month period last year.

The bank said cost savings had been outweighed by lower income.

The group said "marginally lower income and increases in the impairment charge and operating lease depreciation partially offset by lower operating costs."

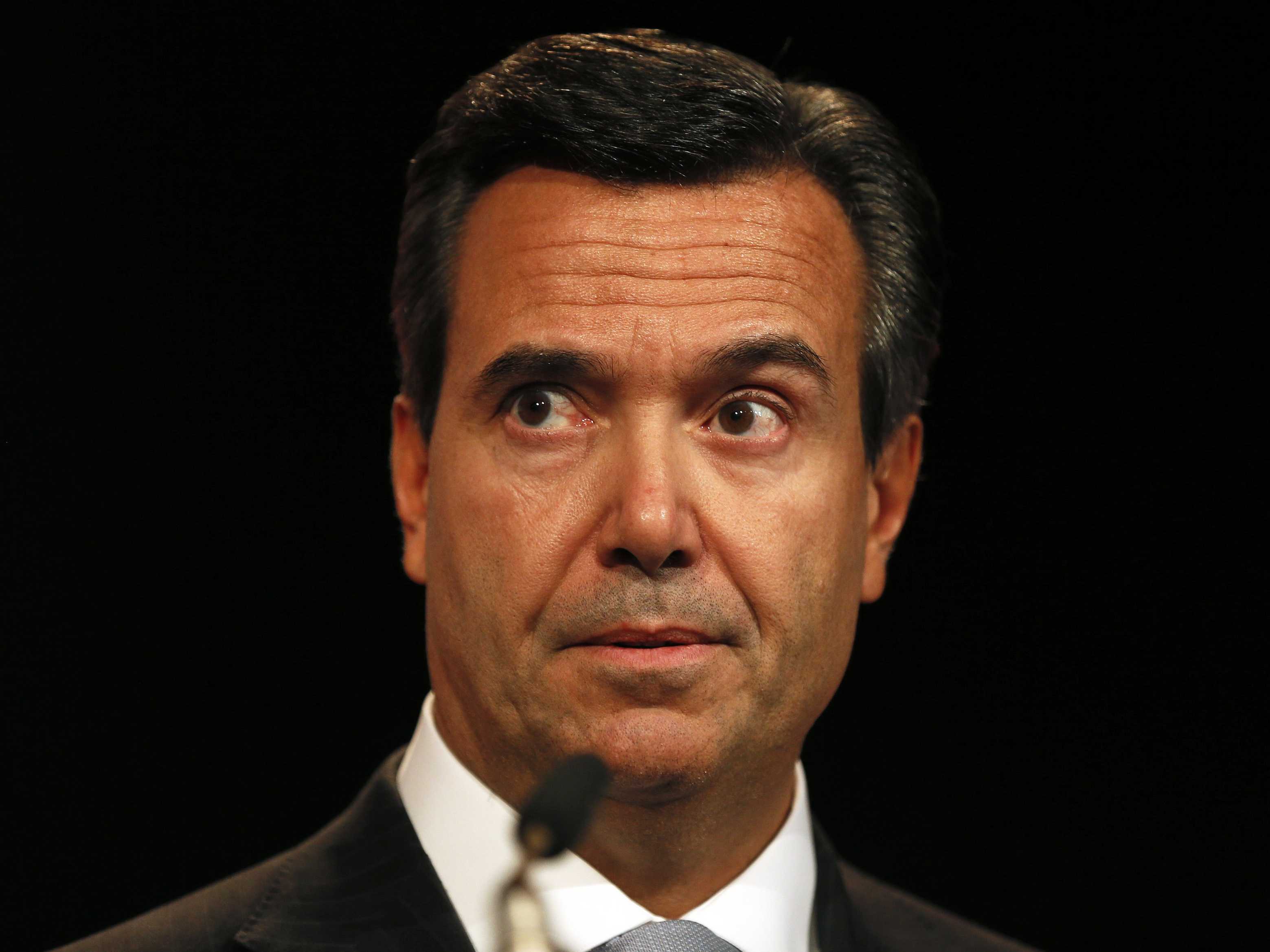

Antonio Horta-Osorio, Lloyds CEO, warned that "the outlook for the UK economy remains uncertain," in the bank's third quarter results statement.

"However the strength of the recovery in recent years means the UK is well positioned," he added.

Lloyds is part-way through a series of drastic cuts. This month the bank slashed 1,340 jobs as part of a restructuring plan that will see as many as 12,000 staff leave the bank in total.

Last quarter the bank said it would slash 3,000 jobs and closing 200 branches as part of a cost-cutting exercise in the wake of Britain's vote to leave the European Union. That cost-saving plan came on top of that announced in 2014, which will see the Lloyds workforce slashed by 9,000 roles.

Here are the key financial points for the nine months ending in September:

- Operating costs 2% lower at £6 billion. Net interest income of £8.6 billion, up 1 per cent with improved margin of 2.72% Underlying profit of £6.1 billion, down from £6.4 billion in 2015

The extra £1 billion provision for PPI claims was unexpected and investors have reacted accordingly. Shares fell off a cliff at around 3% at the market open: