- JPMorgan recently rolled out a mobile bank aimed at young millennials who don’t need branches.

- I tried it and I definitely like it more than my traditional Chase account.

- But there’s also some weird things about it.

Finn, a mobile bank built by Chase, recently rolled out nationwide. And I gave it a try.

In addition to offering bread-and-butter checking and savings account functionality, it also offers services many firms in the personal finance startup space have built their businesses around. These include automatic saving tools and charts to see where you are spending money.

The point of the app is to help Chase expand in regions where it doesn’t have branches by luring folks who don’t need to use branch-related services.

Personally, I think the app is a better experience than my traditional Chase mobile bank, since it more easily allows you to send checks from the app, save money in an easy and fun way, and keep track of your spending. It’s also free. And there’s no overdraft fees. But it’s not without flaws.

First, the app is pretty ugly. It also has a weird portal that allows you to rate your transactions with emojis, which I think is pointless.

In any case, here's a walk through I put together to share my experience. Enjoy.

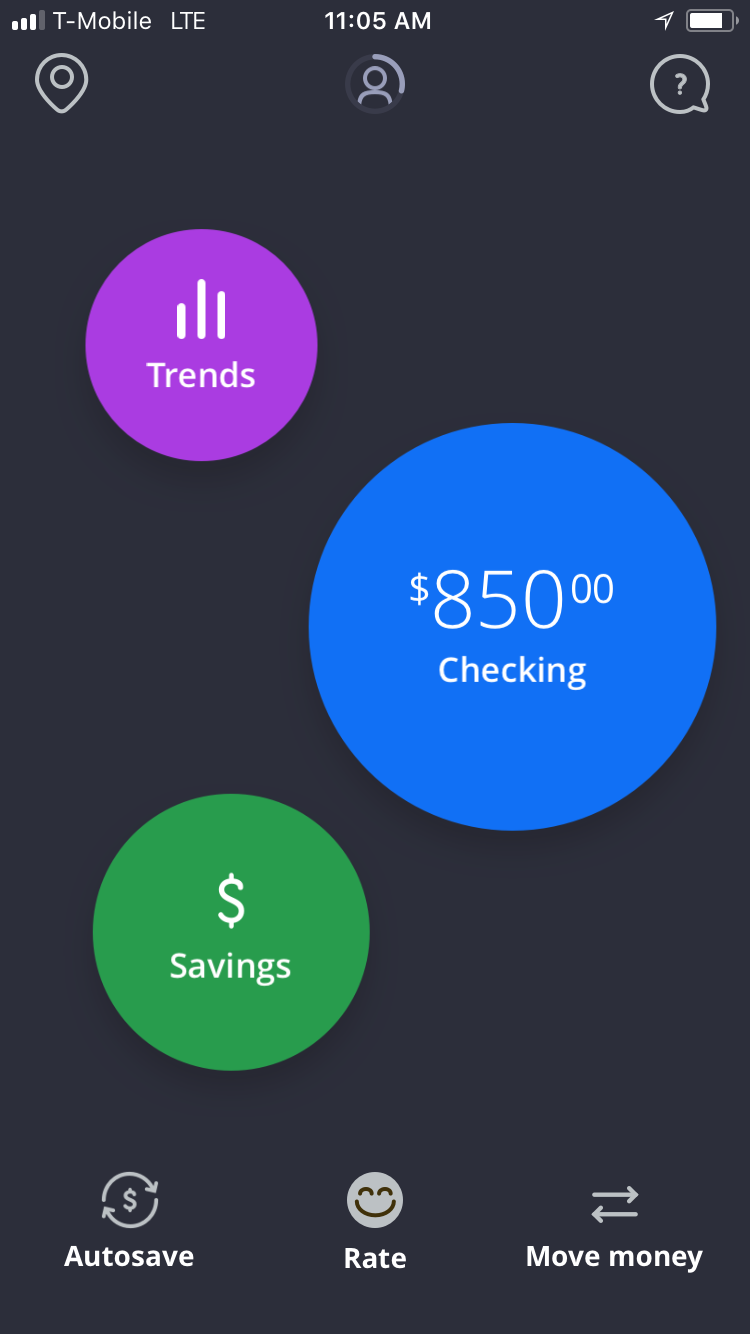

Here's what Finn looks like on the iPhone. It's not available on Android yet.

Opening up a new account took a couple minutes since I already have an account with Chase.

To be sure, you don't need to bank with Chase to open a Finn account. In fact, new customers are eligible for $100 when they open an account. The sign-up process is just as quick as other personal finance apps, requiring information like date-of-birth, address, and Social Security number.

There's nothing sexy or attractive about this app.

The interface is pretty simple with three portals: savings, checking, trends.

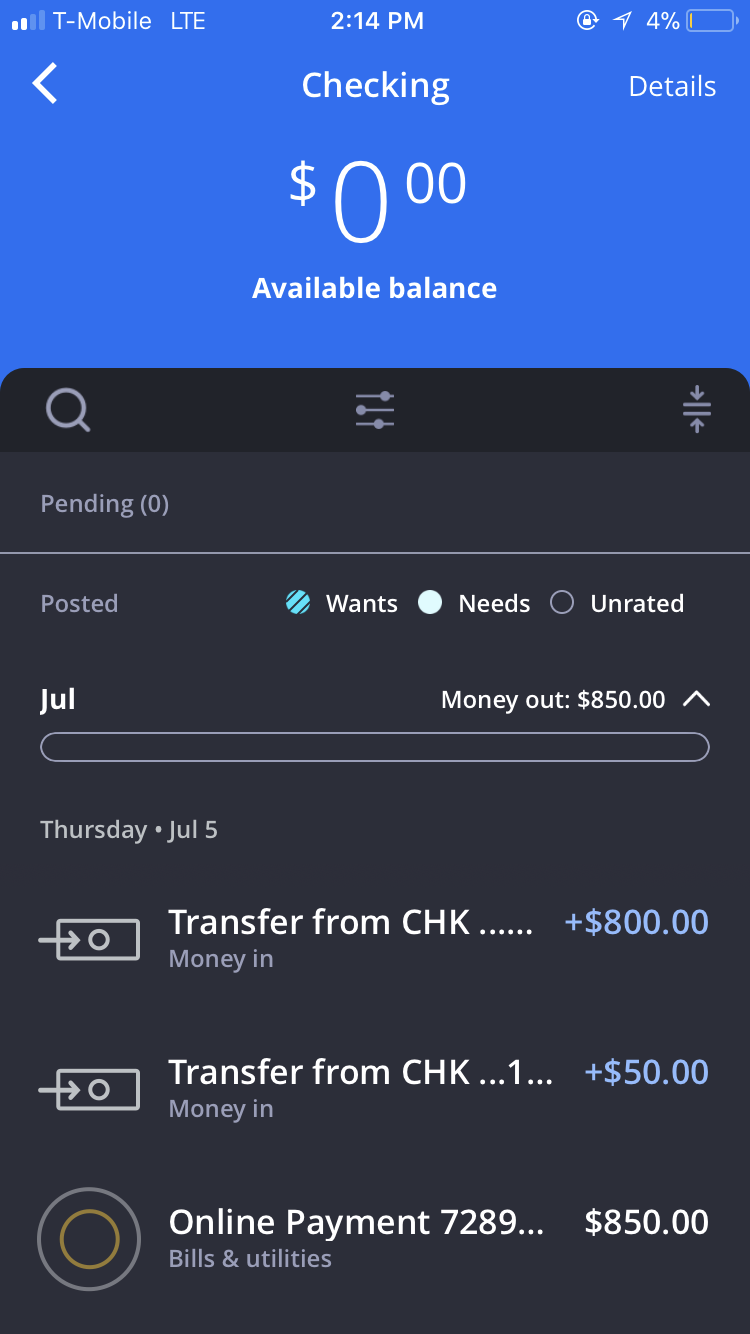

Here's what the checking account portal looks like when you click on it.

In the checking account section you can see a breakdown of your financial transactions, including money coming in and coming out. I transferred $850 from my traditional Chase account via the app in a matter of seconds. I used that money to pay for my rent (More on that later). But that transaction shows up as "bills & utilities." Through the trends portal, users can get a sense of where their money is being spent. It definitely falls short of the budgeting features of companies such as Mint and Personal Capital.

The app helps you keep track of where your money is going.

Since I only bought one thing on my account so far, I will use an example from Chase to show what the trend portal looks like after a user makes a number of purchases. You can see a breakdown for each month. There's over 10 categories including shopping, transportation, travel, and home.

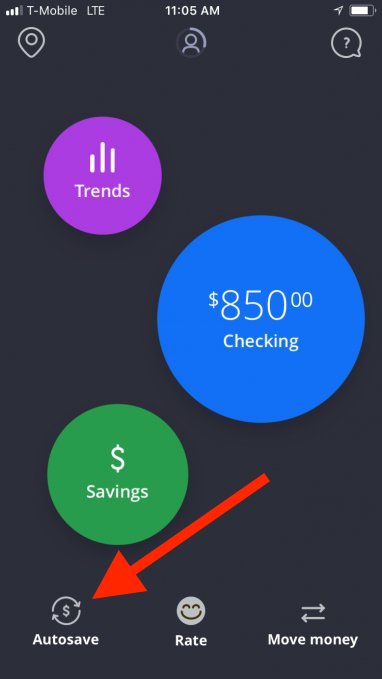

There are several ways to save money on the app.

The savings shows you how much money you are bringing in from your various autosave rules and transfers. To put money into savings you simply can move it from checking in seconds. Or set up rules that automatically transfer the cash from checking to savings based on a number of factors.

Here are some of the rules users can pick from.

The app's autosave rules expand on the functionality popularized by investment apps such as Acorns, Digit, and Stash. Acorns, which is known for pioneering so-called round-up investments, allows users to invest the spare change from checking account purchases in the markets. Finn users can do something similar. The so-called Pocket Your Pennies rule rounds up checking account purchases and transfers them over to a user's savings, not the markets.

Here's what "The Limit Does Not Exist" looks like.

This rule, which I hope is a humorous tip of the hat to "Mean Girls," allows a user to save a certain amount of money whenever a user spends a certain amount. As an example, I instituted this rule to save $2 whenever I spend $20 until I reach the limit of $250. I will use that cash for a trip to the Alamo in Texas.

It's easy to move money around.

Through the move money tab you can pay your bills, send money to friends via Zelle, deposit checks, and mail a check.

You can send checks and pay your bills on the app.

You can set bills and check payments to be reoccurring so they go out automatically without you having to do anything.

The fact that you can send checks from the app was especially appealing to me. It takes about a week for them to print it and then send to the recipient.

I don't know why anyone would ever want to rate their transactions.

For some reason the app allows you to rate your transaction. I don't know why anyone would want to do it. But Chase told me that people really like it.

If you like it, can you please email me at [email protected] and explain why.

There are no branches, but the app does map local ATMs.

Since Finn customers don't get access to bank branch services, they can only withdraw money from Chase ATMs and partner ATMs. In areas where there are no bank branches, such as on Cape Cod where I am vacationing, there's a number of partner ATMs from which you can withdraw cash at no cost.