- Jeremy Grantham pointed to meme stocks, crypto, and SPACs as signs of an asset bubble.

- The GMO cofounder and market historian predicted stubborn inflation and a commodity shortage.

- Grantham underscored the climate-change threat, and touted the potential returns from green bets.

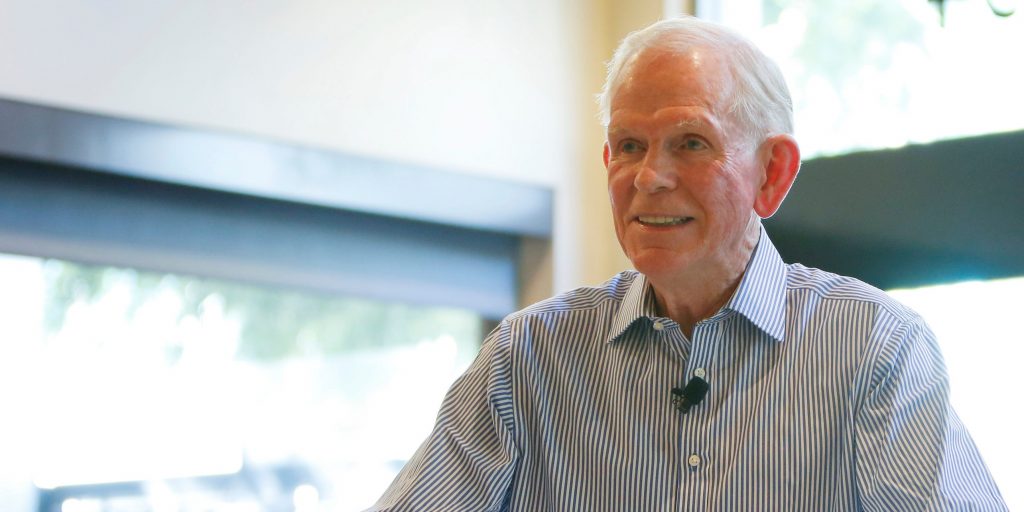

Jeremy Grantham compared the current stock market to the dot-com bubble, predicted stubborn inflation and a commodity shortage, and recommended investing in clean-energy startups during a recent episode of the "Straight Talk with Hank Paulson" podcast.

The GMO cofounder and market historian told the former Treasury secretary and Goldman Sachs CEO that speculation on meme stocks, cryptocurrencies, and special-purpose acquisition companies (SPACs) pointed to a historic bubble in asset prices.

Grantham also told Paulson that climate change threatens global stability, and the world needs to urgently transition from fossil fuels to renewable-energy sources.

Here are Grantham's 8 best quotes, lightly edited for length and clarity:

1. "The forming and breaking of the great bubbles is the only thing that really matters in equity management. If you can bring yourself to sidestep some of the pain, it can make a lot of difference."

2. "We have checked off all of the indicators that are unique to these handful of events. Crazy behavior? Check. The bitcoins and the cryptocurrencies, the meme stocks of the AMC and GameStop variety — I could even add my QuantumScape." (Grantham pointed to the Nasdaq index's stellar return last year, and blue-chip stocks outperforming more speculative ones as fund managers cut their exposure, as two more indicators of a major bubble.)

3. "This market has been proceeding eerily like 2000. You have a tech bubble — horribly overpriced, much too much enthusiasm, huge buy-in by individuals, fueled by a massive program of cash distribution associated with COVID bailouts." (Grantham said he was deeply worried about inflation and interest rates becoming constant concerns for investors as they were in the 1970s, and warned the world is running short of basic commodities, which in real terms have tripled in price since 2002.)

4. "You have a shortage of labor, which feels inflationary. You have a shortage of cheap, plentiful resources such as metals and food, which feels inflationary. As we try and transition from fossil fuels to green, we will be lucky if that is not inflationary. All in all, we face some very intractable inflationary problems."

5. "The stability of the entire global system is at risk." (Grantham was discussing climate change, and warned droughts, famines, and floods could render parts of the world uninhabitable, sparking mass migration.)

6. "We're going to run out of fossil fuels, or they will destroy the world, or both. The only way out of that is a complete greening of the energy system and the entire industrial system."

7. "If you have to depend on good common sense, doing the right thing, we're toast. If you have to depend on creativity and moneymaking talents, the US might make it."

8. "We are not putting all our money behind hope or altruism. We're putting all the money we can beg, borrow, and steal behind green technology. I consider it the only 'have your cake and eat it' of my life. Carefully selected green VC — those businesses are candidates for moving the cause as fast as any dollar could, and secondly, for making more money than anyone else."