DoubleLine Funds founder Jeff Gundlach said Donald Trump won the presidential election because many Americans felt the economy left them behind.

He was one of the few market strategists who correctly predicted – before the primaries – that Trump would win.

During a webcast with clients on Tuesday, he said Hillary Clinton was a “uniquely bad candidate” because of her inability to beat President Barack Obama in 2008.

The scandal related to her use of a private email server while she was secretary of state also hurt her chances, Gundlach said.

“I’m struck by how many investors and investment-bank econ departments were putting out notes one week before the election [saying] that if Trump wins, the markets will absolutely crash … amazingly, many of these exact same investors and economists now say Trump is great for stocks,” Gundlach said.

"Markets remain completely confused as to what is going to be the real trend election from this election."

Here are Gundlach's charts that explain why Trump won:

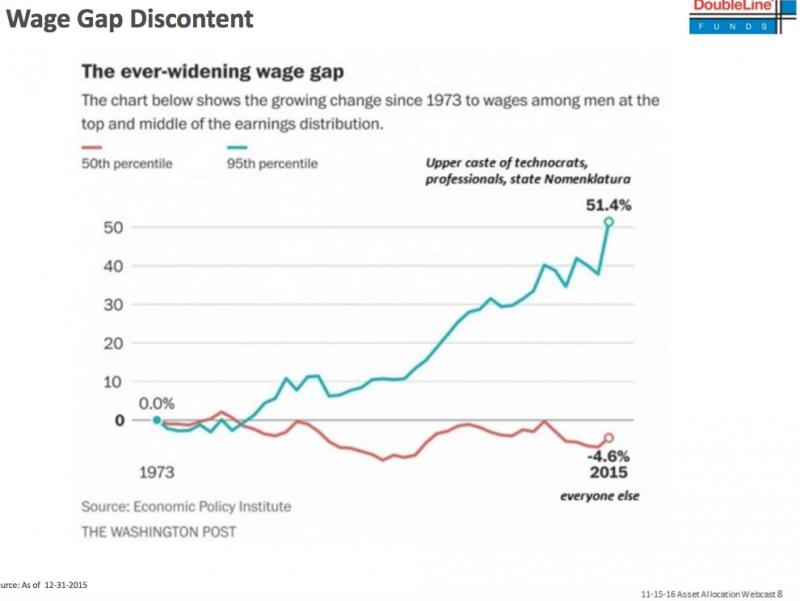

Wage growth has not been great for people who aren't among the 1%.

Trump's win will not be economically positive for consumer spending because people that voted for Trump are already economically challenged, Gundlach said.

And, those who voted for Hillary Clinton are already economically depressed, judging by the chart above. "Maybe liquor sales will go up," he said.

This chart shows a disparity in wealth distribution.

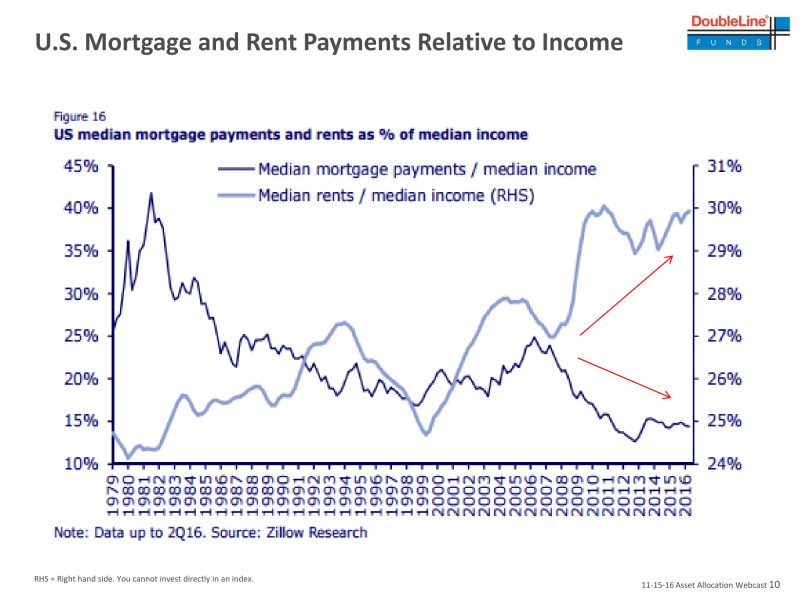

News of higher Obamacare premiums angered many voters.

The Obama administration said October 24 that health-insurance premiums will go up by an average of 25% in 2017. Gundlach said he wondered why the government did not sit on this news until after the election.

Trump promised to repeal and replace the Affordable Care Act, although he said in a post-election interview that he would keep some aspects he wouldn't have been able to repeal in the first place.

Median mortgage payments and incomes have been dropping, but median rents have been "skyrocketing."

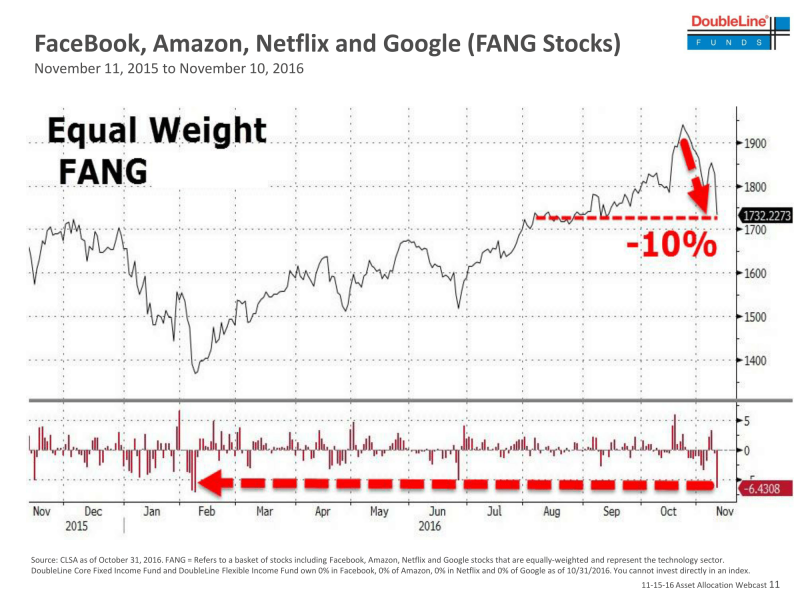

The FANGs saw it coming.

The s0-called FANGs are Facebook, Amazon, Netflix and Google-parent Alphabet. These mega-cap tech stocks fell shortly before the election and tanked harder afterwards amid concern that there would be greater regulation under Trump's administration.

"By the action of the FANGs, the market was predicting a Trump win," Gundlach said. "I strongly advise investors to stay away from these things in a big way." He told CNBC on Friday that investors should buy financials instead.

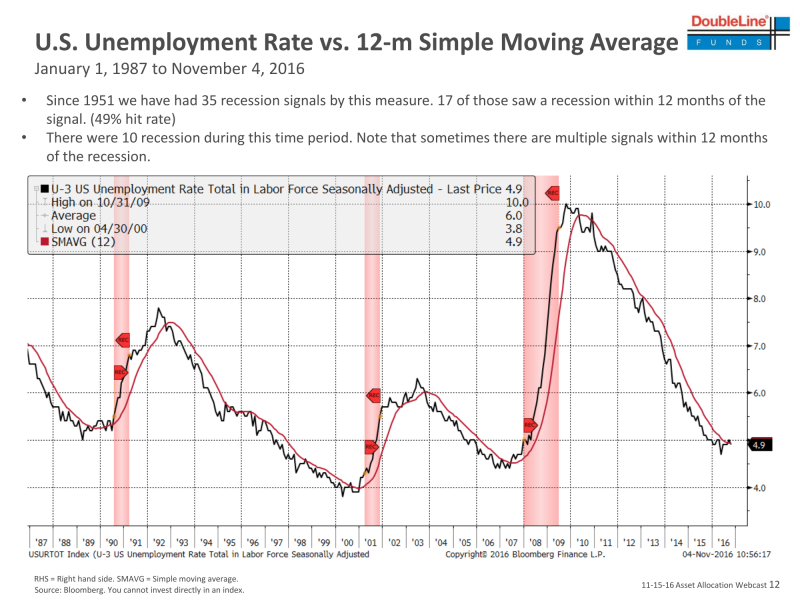

And finally, Gundlach's recession watch is in.

The unemployment rate has crossed over its 12-month moving average, indicating a change in the trend to the upside. This happened before the past three recessions.

Gundlach said, however, that gross domestic product was not pointing to a recession.

DON'T MISS:

The 24 best US stocks you can buy right now, according to Bank of America »