- Actively managed funds have some ill-advised bets heading into 2022, in Bank of America’s view.

- Savita Subramanian, the firm’s top equity strategist, shared why pro investors may go wrong.

- Inflation and the Omicron variant are complicating the investing landscape, but opportunity remains.

As the stock selloff intensifies, Bank of America’s top equity strategist has a suggestion for investors: Don’t follow the pros.

Major US stock market averages have sold off by as much as 5% since Thanksgiving, and active fund managers appear to be ill-positioned for the rapidly shifting environment, wrote Savita Subramanian, BofA’s head of equity and quantitative strategy, in a December 1 note.

There are three key reasons why mimicking the so-called “smart money” may be a dumb move right now: Fund managers are unprepared for inflation, overweight large stocks, and highly concentrated in growth names instead of their value counterparts.

A recent uptick in inflation, fueled by a surplus of government stimulus and supply-chain issues, is looking more persistent by the day, as even the chairman of the Federal Reserve now admits. Professional investors who took the US central bank at its word may be caught offsides.

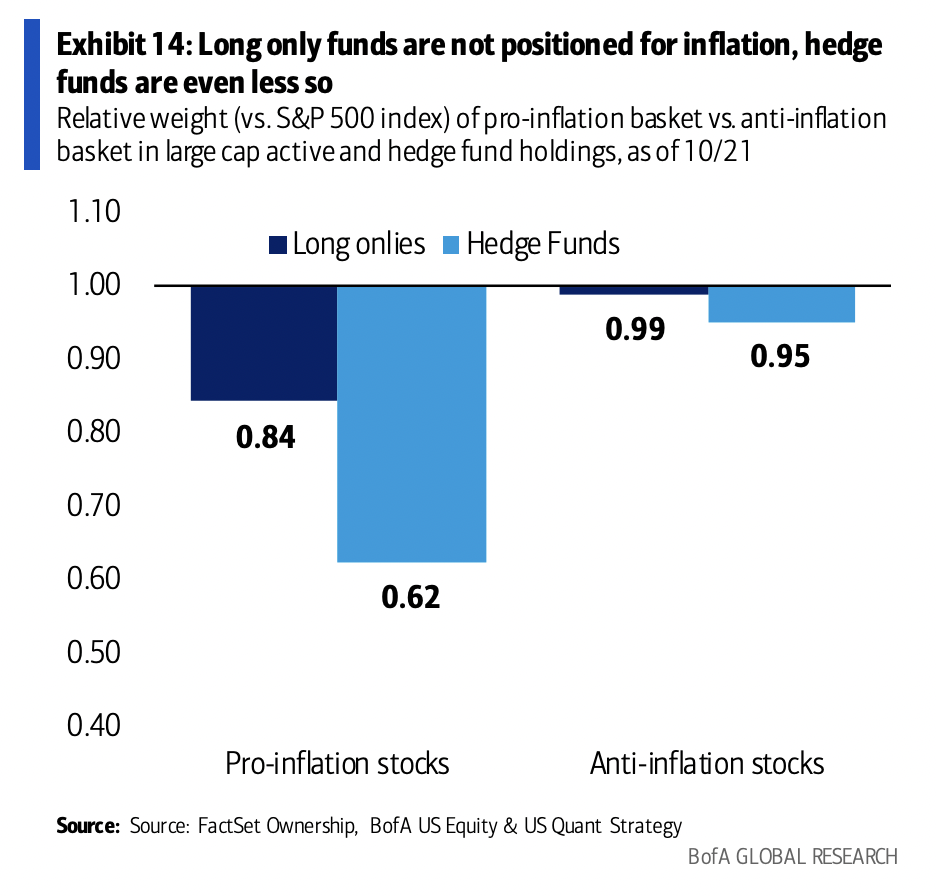

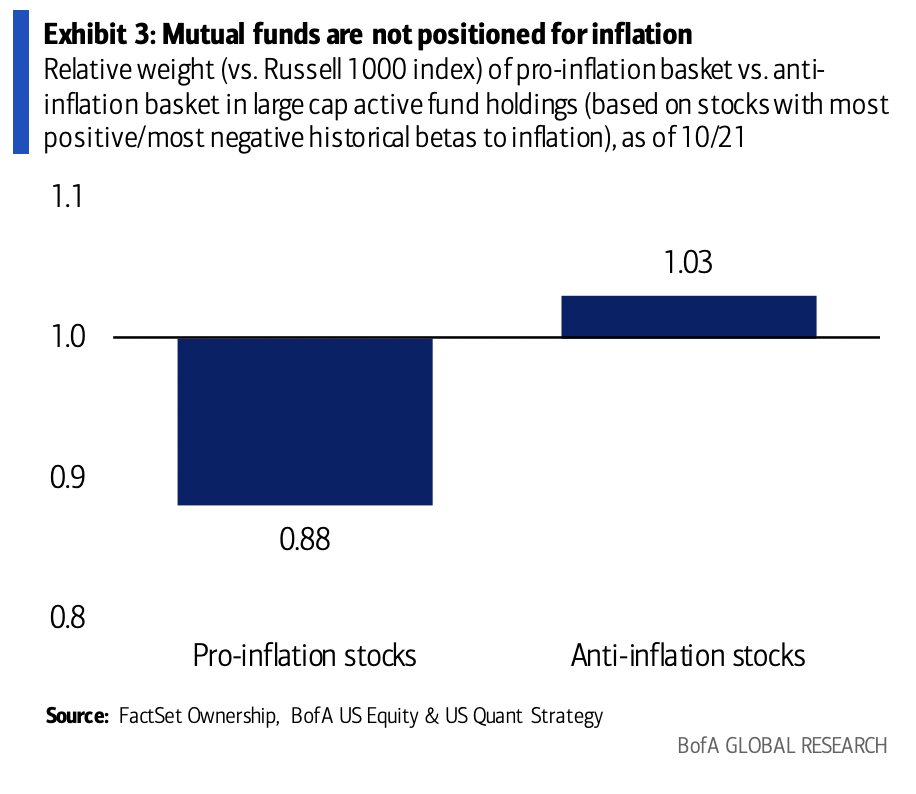

“As inflation appears to be bound to remain higher for longer and the Fed pivots away from the ’transitory’ view of inflation, active managers remain unprepared for this outcome,” Subramanian wrote. “Mutual funds remain deeply underweight (12%) ‘pro-inflation’ stocks, while being overweight (+3%) ‘anti-inflation’ companies and might be open to a prolonged period of weak performance if elevated inflation persists.”

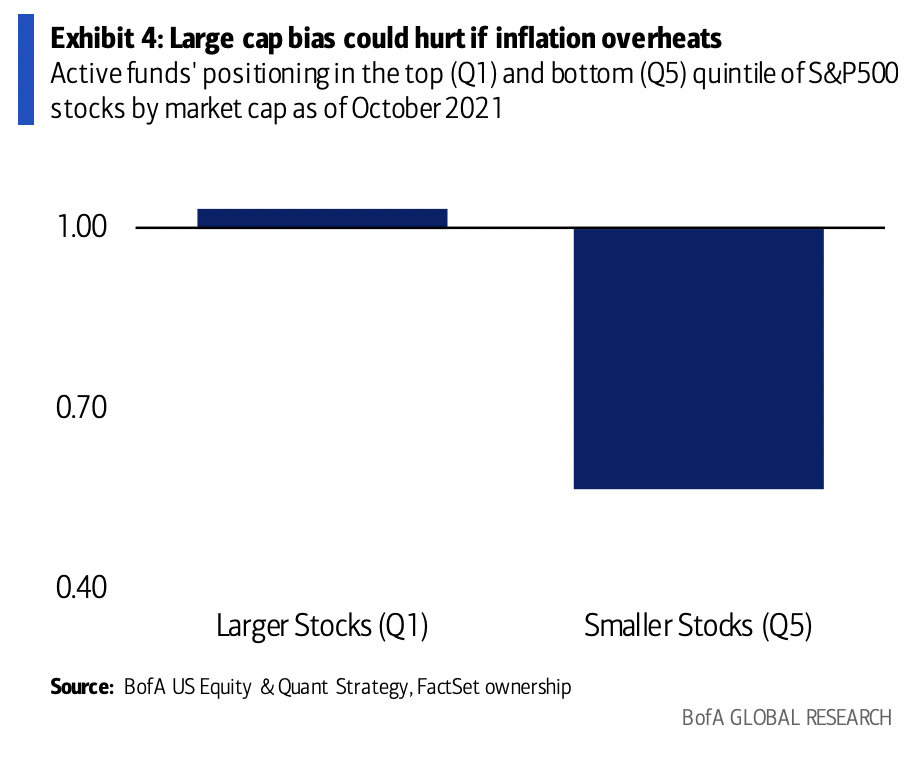

Fund managers' "persistent positioning bias" for large- and mega-cap stocks may also come back to bite them, Subramanian wrote. Bank of America expects smaller stocks to top their larger peers in 2022 as the global economy continues to heal from the pandemic, so long as the Omicron variant doesn't disrupt it too much.

Actively managed funds hold modest overweight positions of 3% in the largest quintile of stocks but are severely underweight smaller stocks by 43%, Bank of America data show.

"Small caps are much less extended on valuation, are domestically oriented, and stand to benefit more from the services spending and capex recoveries," Subramanian wrote. "Small caps also outperformed during the historical analog of the late '60's inflationary period, and could serve as a hedge against stagflation (have outperformed large caps during historical stagflationary backdrops)."

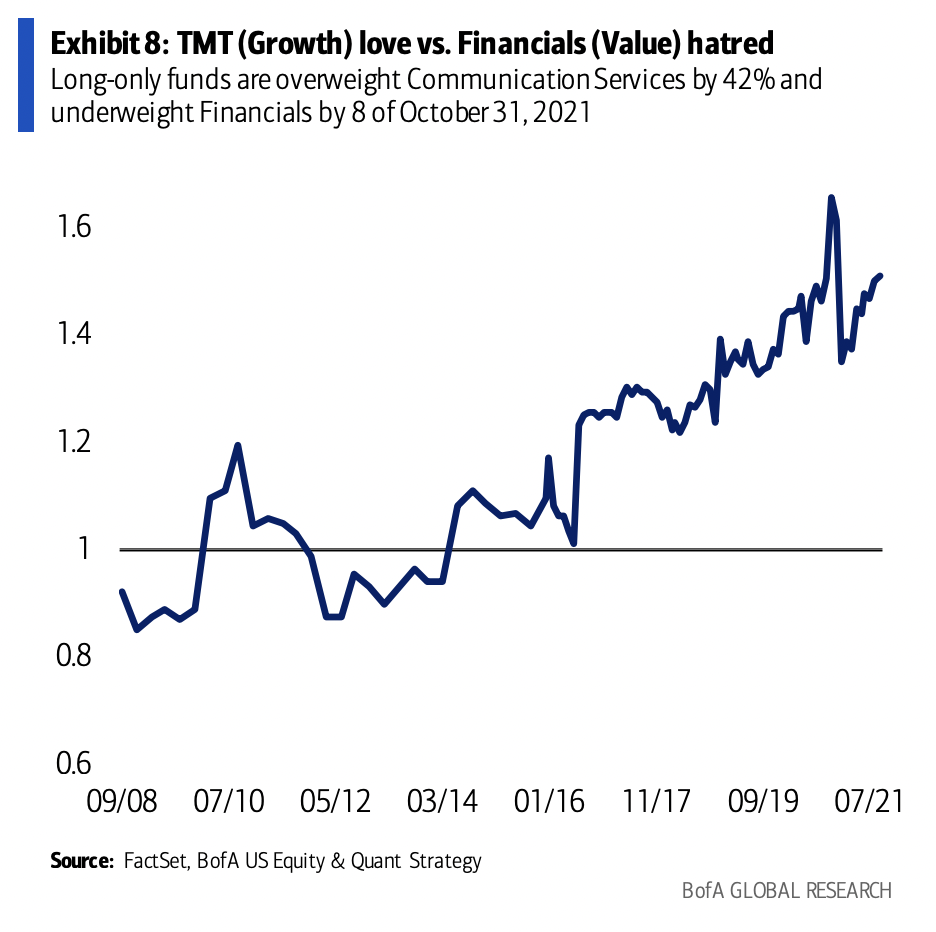

The final reason for why fund managers may lag the market in 2022 is because they don't share Bank of America's affinity for value stocks. There are several compelling catalysts for economically sensitive stocks in the coming year, in Subramanian's view, including comparatively attractive valuations and, hopefully, the containment of the pandemic.

But managers of hedge funds and long-only funds didn't get that memo. Large-cap funds are underweight by 35% in the value-to-growth trade and are placing heavy bets on growth-focused sectors, Subramanian wrote.

A prime example is many funds' positioning in the Communication Services sector, sometimes referred to as Technology, Media, and Telecom (TMT), instead of value-oriented sectors like Financials. The latter is one of Bank of America's three favorite sectors for 2022.

Stay away from stay-at-home stocks?

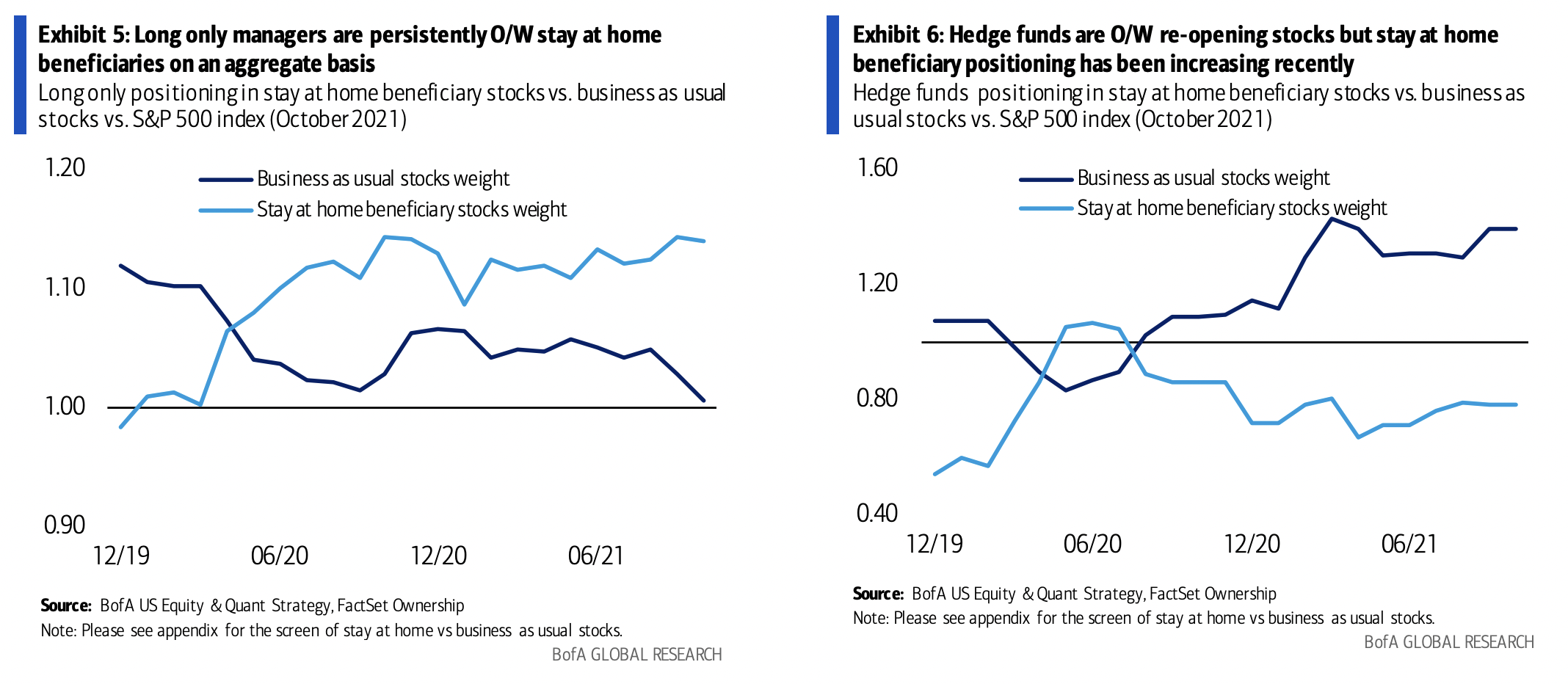

While hedge funds and long-only funds are aligned on their penchant for growth over value, they're sharply divided over another conundrum confounding investors: stay-at-home stocks versus reopening stocks. The former, like Zoom Video and Peloton, benefit from rising COVID-19 cases and are set to suffer when the world gets back to normal. The inverse is true for reopening stocks, which includes airlines, cruise lines, and hotel chains.

Hedge funds are betting heavily on the reopening trend to continue (overweight by 39%), Subramanian noted, while long-only funds are sticking with stay-at-home stocks (overweight by 14%). Predictably, hedge funds are then underweight stay-at-home names (-14%), while their long-only counterparts are ever-so-slightly overweight reopening stocks.

Bank of America's head of equity strategy didn't take a side in the debate, writing that it was "too early to forecast reliably implications" of the Omicron variant. But she is sure that whichever side is proven correct will have a rosier start to 2022.

"With the emergence of the latest COVID variant Omicron, the question regarding the direction of the ongoing recovery looms large," Subramanian wrote.