Robinhood is an app built around one promise: no-fee stock and cryptocurrency trading.

And it’s a model that’s working for people. A little over four years after launch, the company has a $5.6 billion valuation – four times more than its 2017 valuation of $1.3 billion.

The app first launched in December 2014 and quickly became a favorite among younger people looking to invest. It allows users the freedom to complete a transaction without paying a processing fee, and became the first finance app to win an Apple Design Award thanks to its simple-but-stylish design.

In short: It makes stock trading cheap, intuitive, and mobile, which is apparently exactly what young investors were looking for. It began as invite-only, and by the time it opened to the public in March 2015, the waitlist rose above 700,000 according to Fortune. By November of that year, TechCrunch reported that it had facilitated over $1 billion in transactions.

In 2018, it completed a Series D funding round of $363 million to bring it to its current valuation, and doubled its users from 2017 to 2018: Robinhood says it now has 4 million users. This spike could be attributed to its recent decision to expand into cryptocurrencies (bitcoin, ethereum, and litecoin), which have had a lot of market success themselves.

Here's what it's like using Robinhood, the app that wants to democratize stock trading.

This is what the Robinhood icon looks like on an iPhone.

The sign up process doesn't take long. It automatically prompts you to sign up with your email address, and then asks you a series of questions.

It used to give you the option to sign up with Touch ID, but I don't see that option on there anymore.

After you sign up with email, it asks you to create a password (at least 10 characters), and then you have to share some personal information: your legal name, email address, phone number, date of birth, residential address (U.S. law apparently requires that brokerages collect this information), citizenship, and social security number.

It also asks you how much investment experience you have. I selected None. Then a few more questions about your employer and ties to companies or brokerages, review, and submit.

The whole process took only a few minutes.

To start trading with Robinhood, you must first link your bank account.

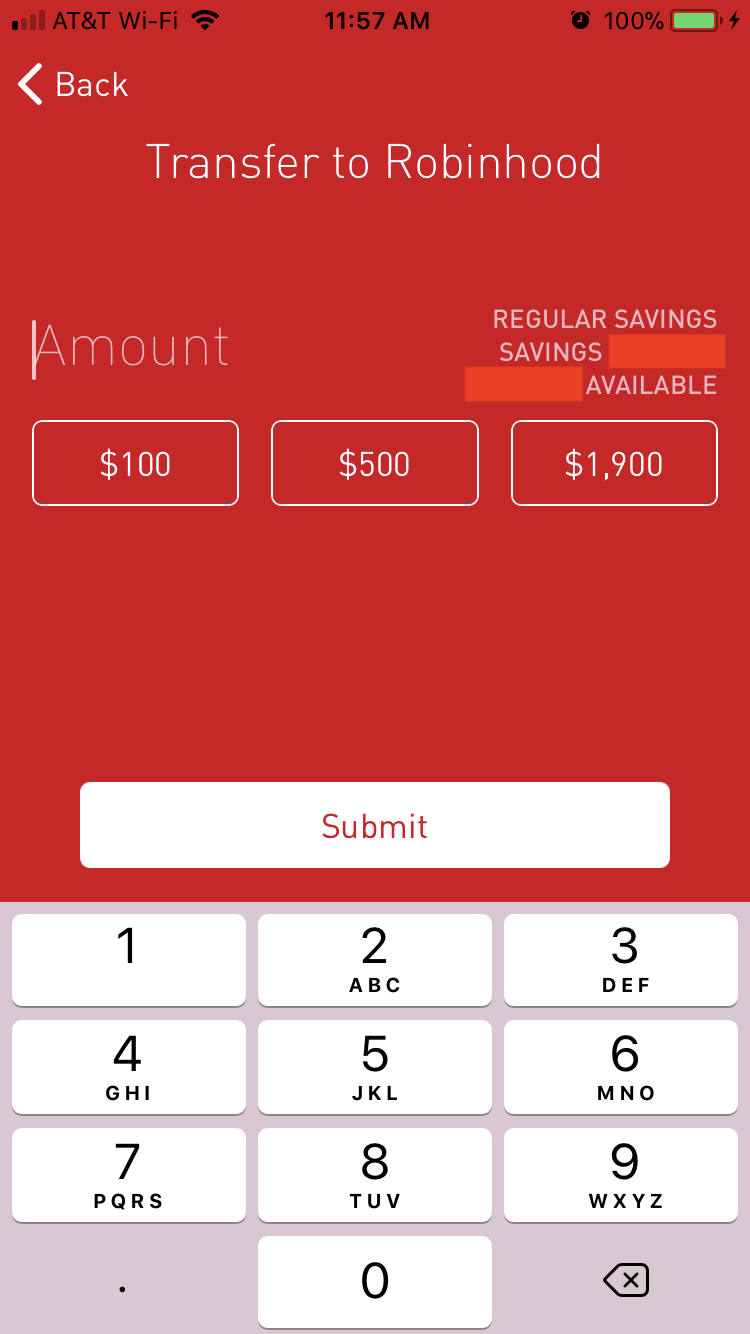

I'm all signed up at this point. Once I logged in, my Bank of America account gave me the option to set up a custom one-time transfer or choose one of the pre-determined amounts, but — even though my account was synced — it wasn't ready to make transfers yet. It takes up to a few business days to process, and the funds will remain in your Robinhood account until you transfer them back.

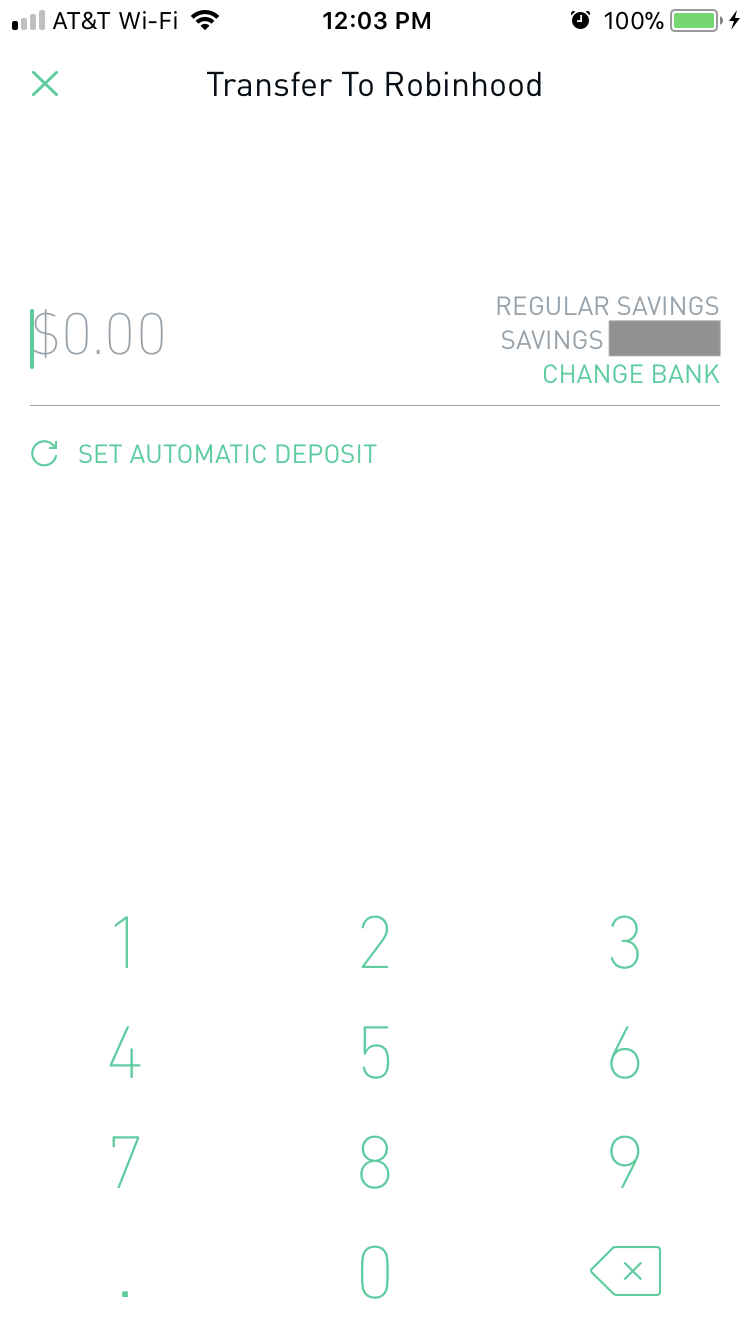

When I x-ed out and came back, the home screen had an option for me to add funds. That brought me to this screen, which is where I imagine most of my transactions will take place.

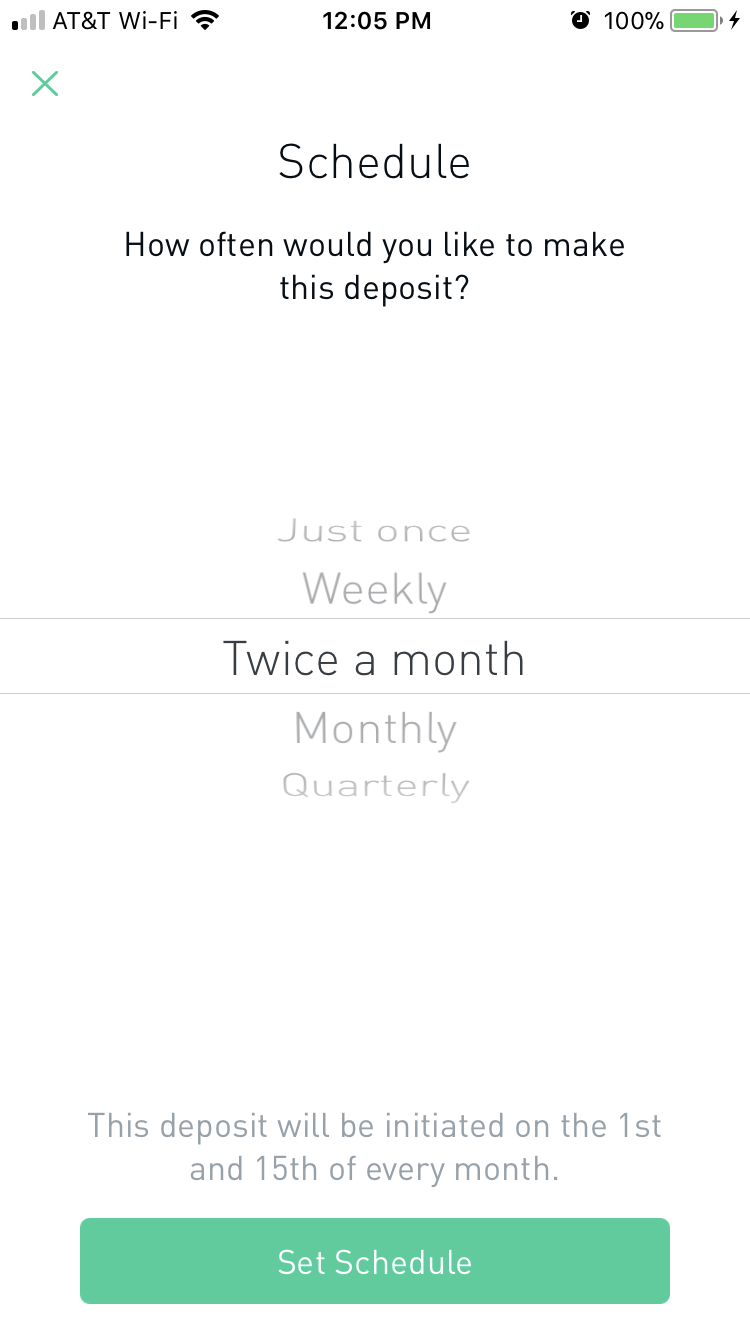

There's also the option to schedule recurring deposits.

I made a one-time deposit, which was available for trading immediately, but here are the scheduling options:

My one-time deposit was small, and I donated the final amount that I made to charity, since Business Insider journalists adhere to an ethics policy that prevents them from playing the stock market.

Once I submitted that, there was an option to view the confirmation and cancel if I needed to.

Now you're ready to go. This is what Robinhood's home screen looks like: It shows you your total money in the center (stocks and cash) and how much you've made today (below in green or red, depending). You can also select to view different time periods along the bottom.

When the market is closed, Robinhood's background appears black, like it does here. If you press and hold on any point on the graph, it tells you what your total was at that point in time.

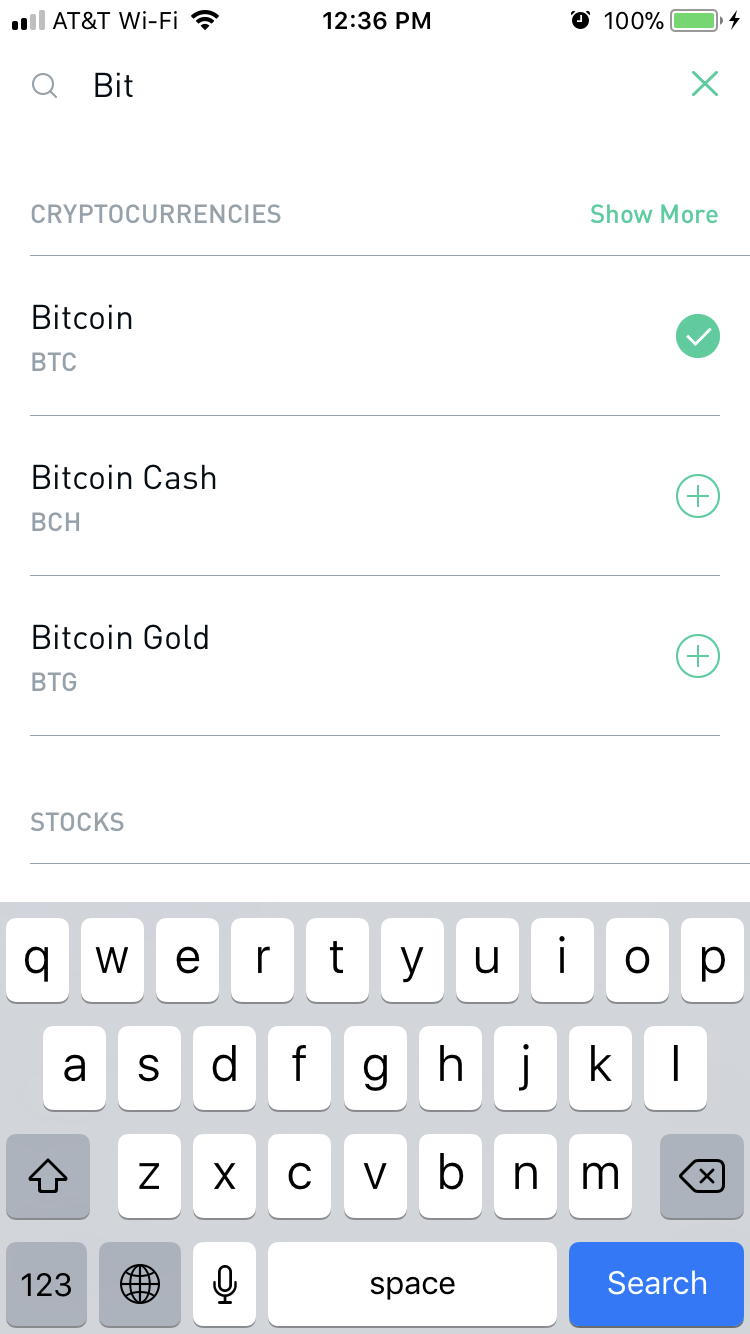

To trade a specific stock, you can search for it by clicking on the magnifying glass. If you want to add it to your "watch list," you click the check mark on the right. The example we're going to use is Groupon (GRPN).

There's a separate section for cryptocurrencies and stocks.

When you click on "Show More" next to the cryptocurrencies header, you can see a complete list of the ones available to trade.

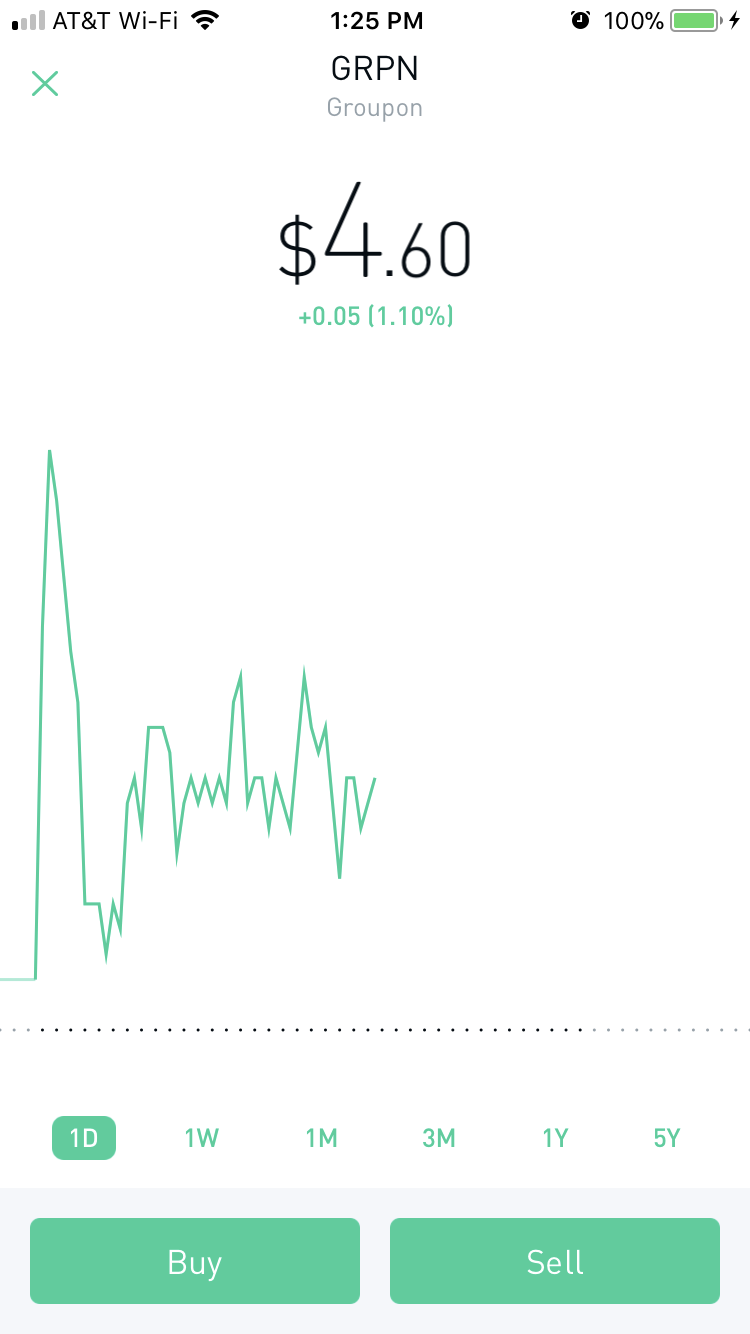

When you click on a stock, this screen comes up. It shows you that Groupon is trading at $4.60 per share. To buy shares in Groupon, you just click the "Buy" button on the bottom.

When you click on a cryptocurrency, the color scheme looks completely different but it works almost the same way: You can see here that Bitcoin (BTC) is trading at $8,555.12.

A notable difference is that cryptocurrencies give you the option of a Live view - just select it on the grid at the bottom.

When I hit Get Started, it added me to a waitlist, which is currently in place as Robinhood continues to roll out its cryptocurrency functionality to more people and cities.

I can move up the list of "over 1,000,000" by clicking on Invite Friend (and get us both a free stock). That took me to a screen to connect to my address book. You can also move up the list by sharing Robinhood via social media or other messaging platforms.

That weird coloring on the stock price is because the numbers update every now and then to take into account the changing value of the cryptocurrency.

If you scroll down on that page, you can also read relevant news about the stock that Robinhood has pulled from the web.

Underneath that, there are statistics, a measure of how volatile the stock is, a chart that shows the earnings per share of the last four quarters, and an About section.

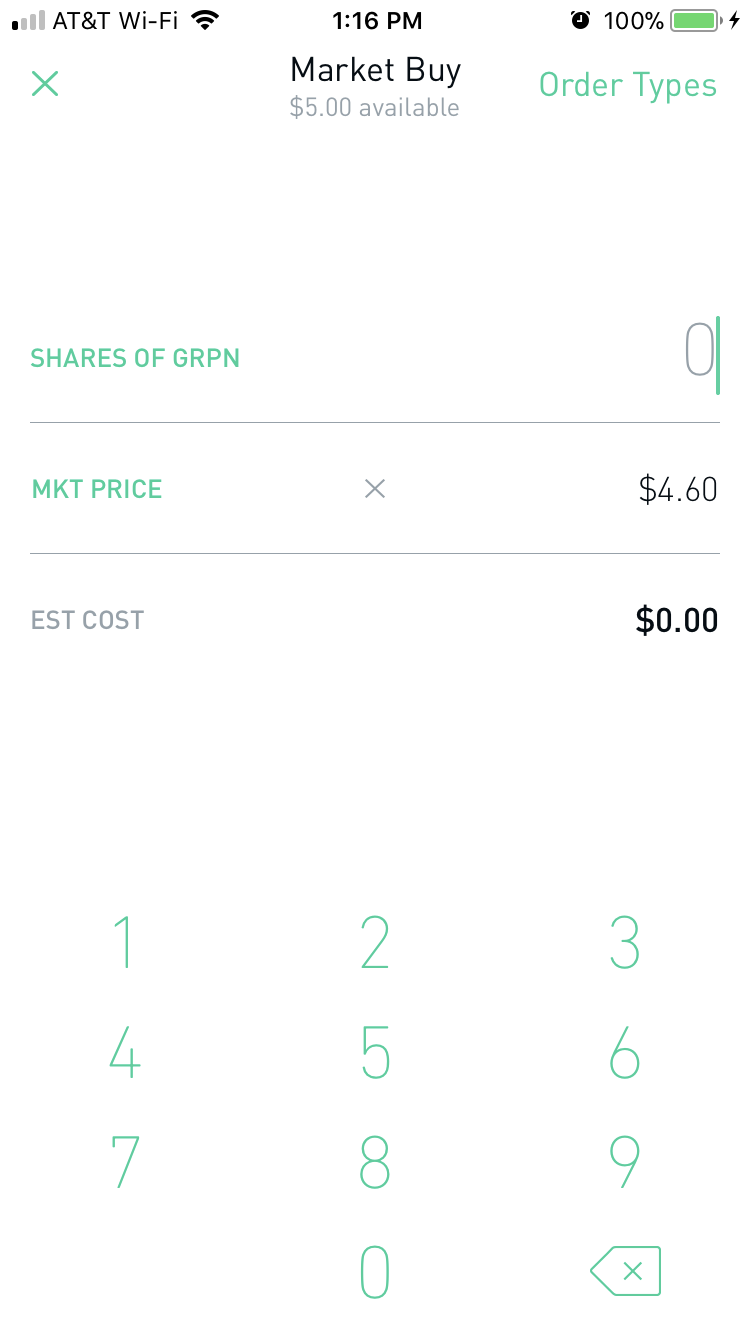

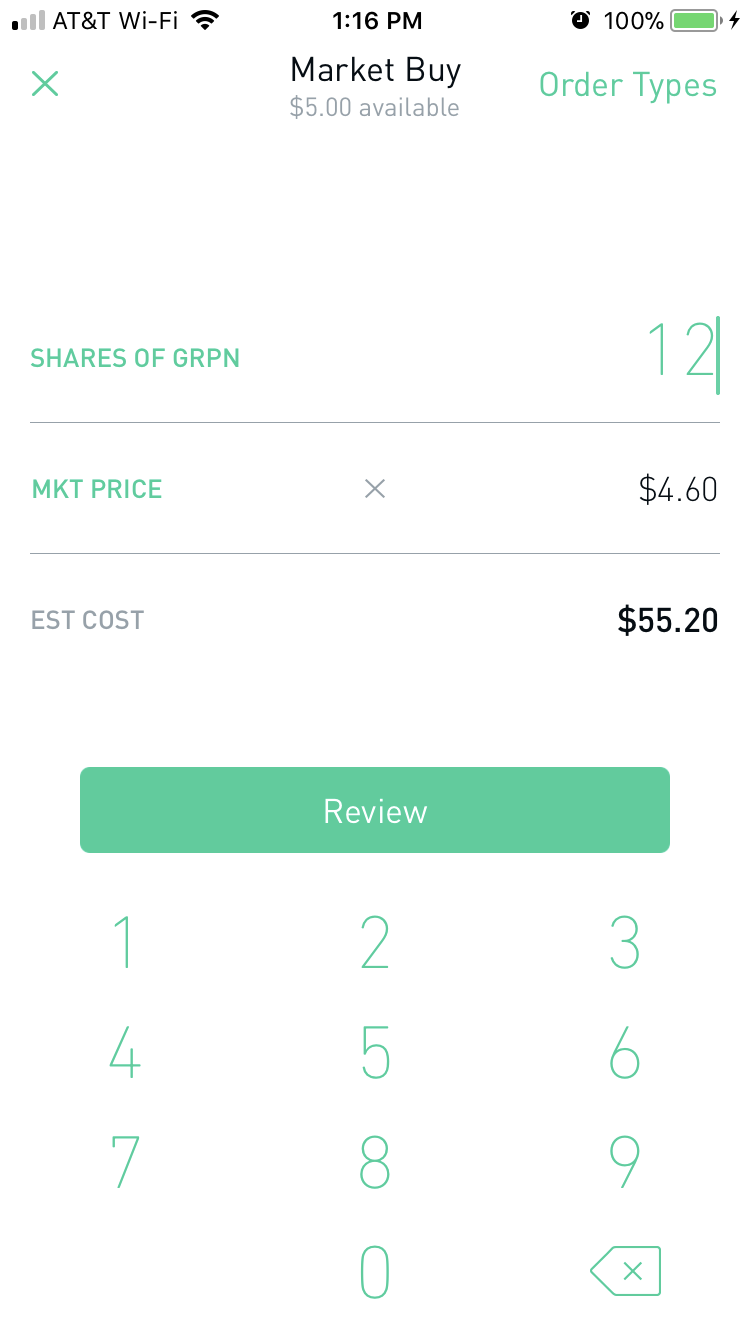

Once you've clicked the buy button, you are taken to the Market Buy page. The amount in your portfolio is shown at the top.

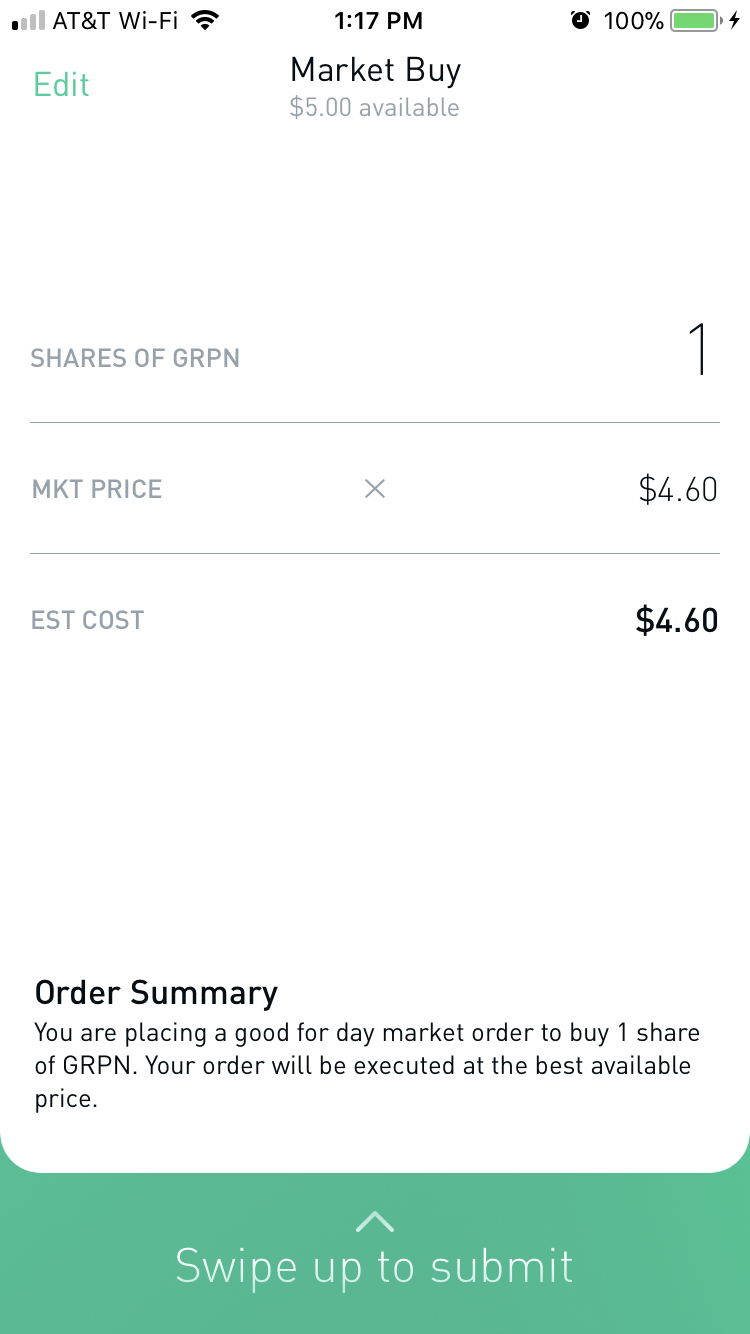

Type in the number of shares of Netflix you want to buy (now at $4.60 per share), and it does the estimated cost math for you. I typed in 12 for the purpose of this example, but I only bought one. Then I hit Review.

That took me to this page. Swipe up to submit your trade, and it'll happen immediately. Or, if it's before market hours, Robinhood will complete it when the market opens.

When your purchase goes through, you'll see a confirmation screen that looks like this — complete with confetti.

Robinhood Gold gives you up to 2x buying power (money that Robinhood lends to you to buy stocks with no interest, according to the app), access to pre- and after-market trading, and instant access to big deposits.

If you want to get rid of your stock, you can go back to the stock's main page. If you own stock, a sell button will appear next to the buy button.

The selling interface is similar to the buying one. You choose how many shares you want to sell (at $4.60), tap Review, and swipe up to submit.

Once you've sold your stock, you get a notification like this. No confetti this time.

If you want to see an overview of your money, you can go to the account page by hitting the person icon in the top left and selecting "Account." You can see here that you have a lot of other menu options, too.

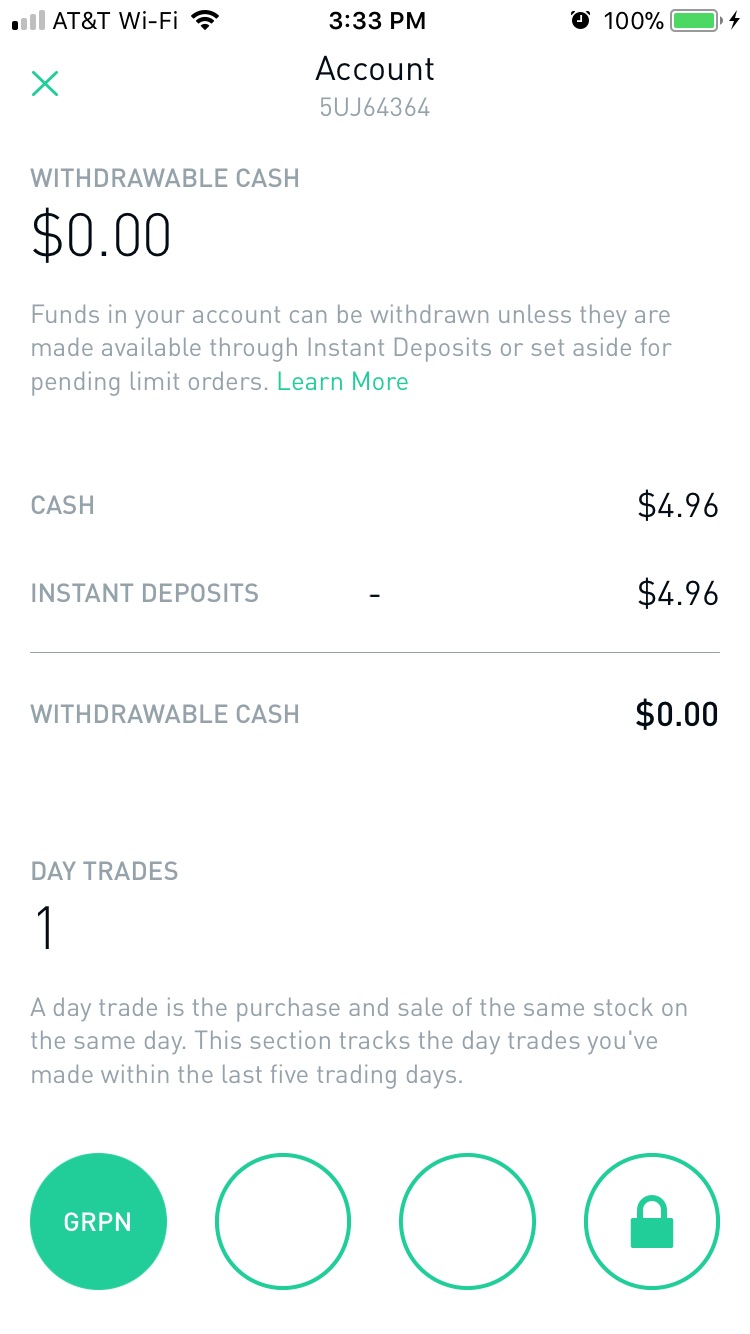

Your account page shows you how much cash and stocks you have, as well as how much buying power you have. Buying power means how much money you can spend on stocks this second (withdrawable cash + instant deposits).

One of the drawbacks of Robinhood is that you have to wait for the money you've made selling stock to be "settled" before you can reinvest it and buy a different stock. The settling period is two days in addition to the trade date, so the $4.96 will be reflected in my Withdrawable Cash and Buying Power on the third day. Switching to Gold will remove this little speedbump.

When you scroll down, you can see a breakdown of your withdrawable cash (cash + instant deposits), the number of day trades (buying and selling the same stock on the same day) you've made in the last five trading days, and what stocks those are.

If you want to cash out of Robinhood, you can easily transfer the funds back to your linked account by going clicking Transfer To Your Bank from this page. This also takes up to three business days to complete, which is standard for apps that hold money, like Venmo. Additional reporting by Nathan McAlone.