- It’s never fun to have a trip delayed, especially overnight when getting a hotel can be expensive.

- Many Chase credit cards offer insurance as an included benefit, as long as you charge your airfare to your card.

- If your flight is delayed 12 hours or overnight (or 6 hours with select cards), you may be eligible for up to $500 per passenger in trip delay coverage if you submit a claim.

Many Chase credit cards offer Trip Delay Reimbursement, which can help cover your expenses in the case of a lengthy delay when you book your ticket with an eligible Chase card or use Chase Ultimate Rewards points.

You’ll find this coverage on the following Chase cards:

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Marriott Bonvoy Boundless Credit Card

- United Club Card

- The World of Hyatt Credit Card

- United Explorer Card (personal and United Explorer Business Card)

- The Ritz-Carlton Card (This card is unavailable for new applicants)

- United MileagePlus Presidential Plus (This card is unavailable for new applicants)

- Chase Ink Business Plus (This card is unavailable for new applicants)

- Chase Sapphire (This card is unavailable for new applicants)

Chase Sapphire Reserve and The Ritz-Carlton Credit Card holders, your coverage will kick in after a six-hour delay instead of 12 hours.

It does not cover reimbursement of prepaid expenses – so, for example, if you paid in advance for a hotel room and you aren’t able to use it because you got delayed overnight, you won’t get reimbursed for the hotel reservation at your destination.

Here's the description of this benefit from the Chase Sapphire Preferred guide to benefits:

How to file a claim

Chase outsources claims management to a third-party company called Card Benefit Services. Start a claim by going to its website.

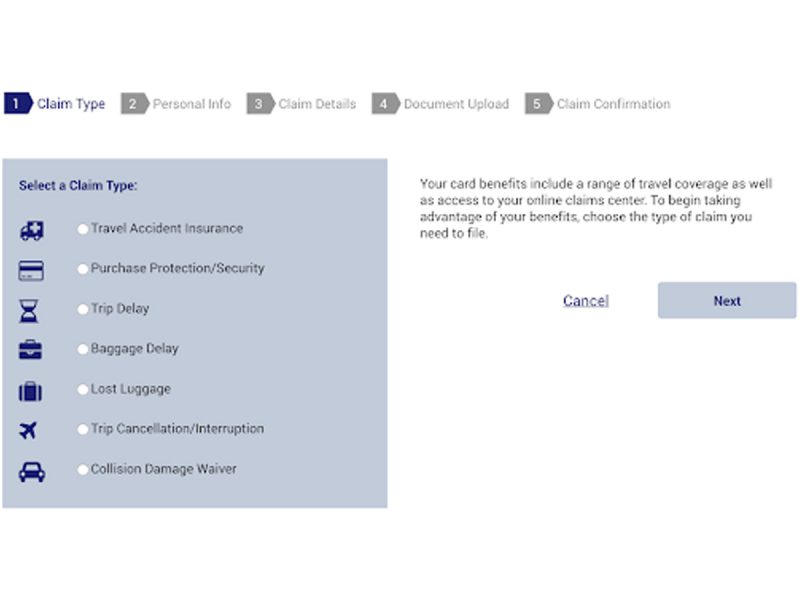

As an example, this is the list that appears for Chase Sapphire Reserve cardholders. Select "Trip Delay" and click Next.

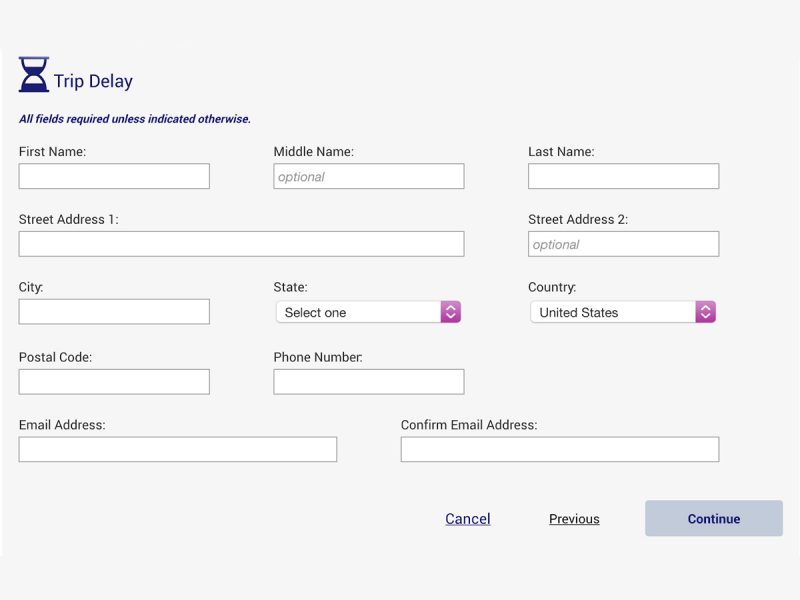

The claim form begins by asking for your name and contact information.

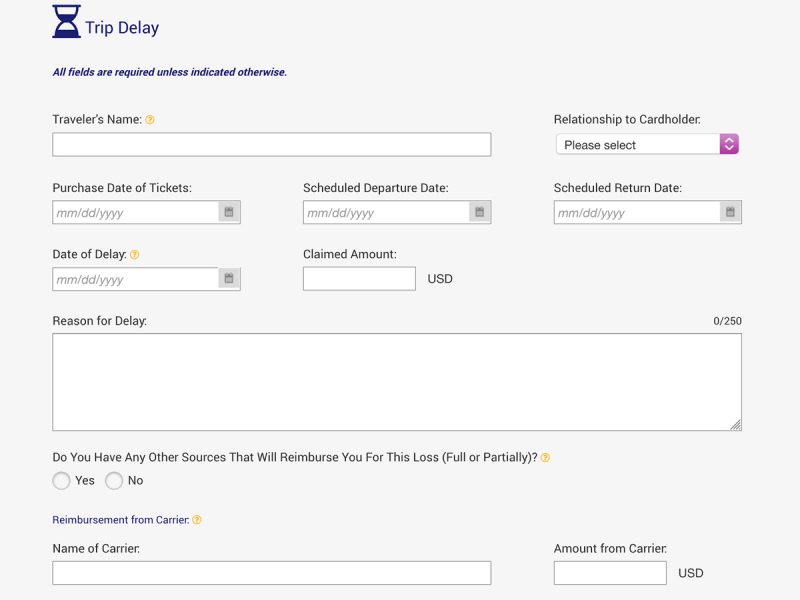

Once you've provided that information, you'll need to provide information about your flight and the reason for the delay.

Once you've provided these details, then you'll be taken to a screen with a whole bunch of upload buttons to provide documentation. Not all of these will apply to every trip delay, and you may also be asked for additional documents not listed here.

- Your itinerary

- A statement from the airline (or other common carrier) saying why your flight was delayed or canceled. The easiest way to do this is to ask for a "Military Excuse" at the gate. Otherwise, you may need to send a note to your airline's customer service department asking for a statement.

- A charge receipt

- Receipts for your expenses. Anything you're seeking reimbursement for will require a receipt. You'll want itemized receipts rather than just credit card charge slips (though they will accept charge slips for meals under $50 per person)

If you get to this final step and don't have all those documents available, don't despair - you can submit your claim without attaching documents, and come back to add them later or submit documents by email to [email protected].

In the next week or two, (it says five business days, but it's usually a bit longer) a claims examiner will review the documents you've submitted, and then you'll receive a letter (likely via email and US mail) outlining what additional documents you need, if any. Once they've received everything to their satisfaction, you'll get a message saying your claim has been approved and asking whether you want to receive your reimbursement via paper check or direct deposit. You should receive your funds within a few days of submitting that information.

If they need more documentation, you'll have to take the time to gather those documents or make what you've already submitted more clear. I've had multiple back-and-forths with Card Benefit Services before my claim was approved, but it's always happened eventually. Sometimes, persistence is key!