- After years of procrastinating on moving my savings into another account to earn interest, I finally opened a Wealthfront high-yield cash account.

- Wealthfront cash accounts come with a 2.57% APY (as of July 19), have a $1 minimum deposit, and are fee-free.

- I moved my emergency fund savings over to Wealthfront and the process couldn’t have been any easier.

- Currently, Business Insider readers who sign up for a Wealthfront investment account will receive their first $5,000 managed for free in that account in perpetuity.

As someone who writes about personal finance every day, I’m somewhat embarrassed to admit that I’ve never had a high-yield cash or savings account. That’s because I’ve been with the same monster mega bank since my teenage days.

For years, I had serious bank account inertia. I just couldn’t bring myself to put in the effort that would be required to open up a new bank account. But I’d been told that the hassle factor really wasn’t an excuse any longer and that I could open an account in minutes.

I finally decided that it was time to bite the bullet and find a cash account that would pay me more than 0.01%. And after taking a look at several great options, I decided to go with Wealthfront.

Why I chose to open a high-yield cash account with Wealthfront

If you’re looking for a high-yield cash or savings account, there are several good choices available. But here is a quick list of the reasons that I chose Wealthfront:

- FDIC insured up to $1 million

- Fee-free

- $1 minimum deposit

- 2.57% interest rate

That amazing interest rate was really the clincher for me, but the other points came into consideration as well.

It's also important to point out that I didn't need all the bells and whistles of an actual bank. I still have all my online bill pay and ACH debits set to pull from the checking account at the bank I've been with for years. I was just looking for a place to park my emergency fund money and hopefully outpace (or at least keep up with) inflation.

If you're looking to open both a checking and savings, you may be better off choosing an online bank. But for my situation, Wealthfront seemed like the right fit.

I was relieved to find that the sign-up process with Wealthfront was a breeze. It took me less than 10 minutes from start to finish. Here's how it went.

Wealthfront gives two options for creating an account. You can start from scratch using your email address or you can import your personal information from Intuit.

Since, I’ve long used TurboTax (owned by Intuit) as my tax-filing software, I decided to choose the import option. Even so, I still had to give Wealthfront some information before they could begin the import.

The Intuit import only took a few seconds to complete. I verified my key information and then Wealthfront said they wanted to verify my mobile number for security purposes.

The text from Wealthfront came through promptly. I entered the code that I was sent and just like that I was on my way.

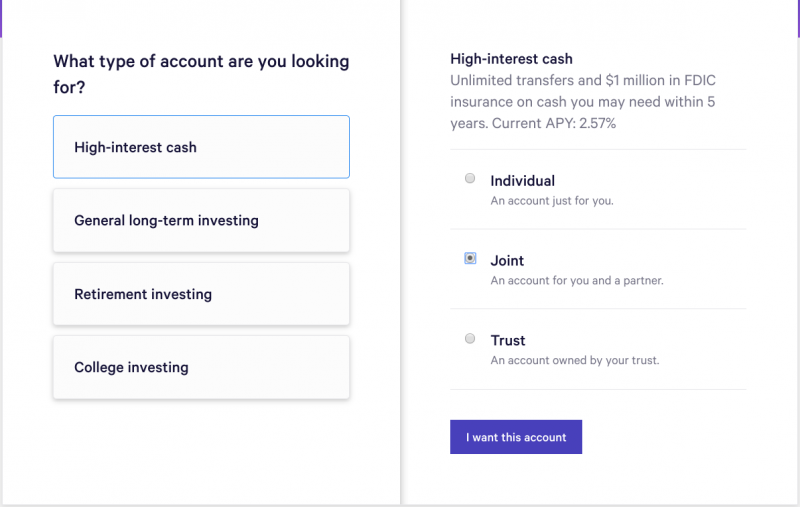

Wealthfront wanted to know my primary reason for opening an account.

After I selected "high-interest cash savings," they wanted to know if I planned to open an individual account, joint account, or a trust. Since I wanted my wife and I to both be on the account, I selected "Joint." At this point, the process had taken me a total of four minutes.

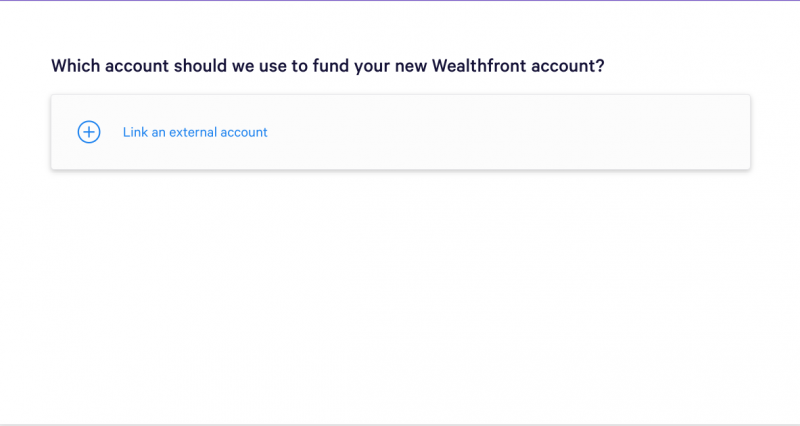

Next, Wealthfront wanted to know how I planned to fund my cash account. When I clicked on “Link an External Account” a dialog box popped up that showed several popular banks.

It also had a search box in case my bank wasn’t one of the ones listed.I selected my bank and then typed in my bank credentials.

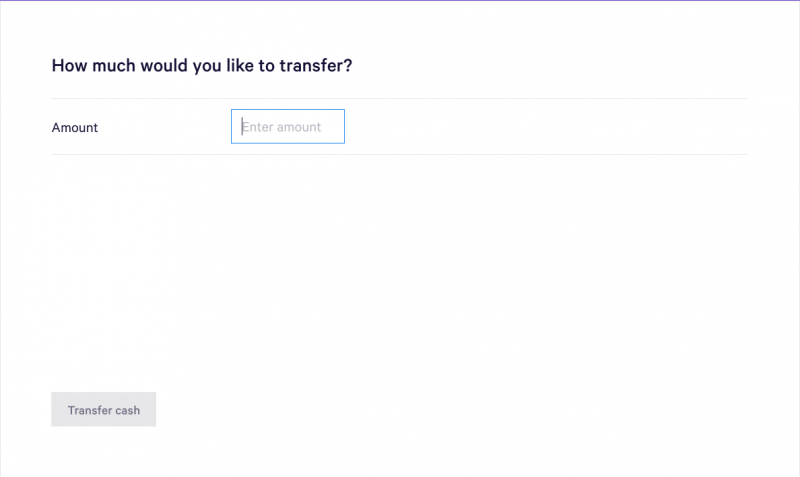

In only took Wealthfront a few seconds to connect to my bank account. I was asked whether to pull the funds from checking or savings. After selecting my savings account, I was asked to type in the amount that I wanted to transfer over.

After typing in my transfer amount, Wealthfront said I'd been sent a confirmation email. I logged into my email account and, sure enough, the email was sitting in my inbox just as they said. I clicked on the confirmation link

Then Wealthfront said that my work was done! Now I just had to wait on the transfer to go through. Most transfers go through within one business day, but I'd be notified when the transfer was complete.

Total time spent creating my account and initiating the bank transfer: eight minutes.

The only thing that I had to do now was wait for confirmation from Wealthfront that my transfer had gone through. It was a short wait. When I checked my email the next morning I had this message waiting for me.

Just like that, my emergency fund money was earning me over 25 times what it had been earning me the day before.

That feels pretty awesome ... and also makes me feel a bit ashamed that I hadn't opened a high-yield savings account sooner.