- Your credit report details your entire history as a borrower, and is used by lenders to decide whether they’re comfortable extending a loan or line of credit.

- Checking your credit report periodically is the best way to stay on top of any fraudulent purchases, inaccurate information, or identity theft issues that could crop up.

- If you do find an inaccuracy, you can dispute it by first contacting the lender, then contacting the credit bureau if the lender can’t resolve it.

- Visit Business Insider’s homepage for more stories.

Your credit report is basically your lifeline to all things credit-related in your life.

If you want the best interest rates on a credit card, mortgage, or personal line of credit, you’ll want to make sure everything in your credit report checks out.

Checking your credit report periodically is also the best way to stay on top of any fraudulent purchases, inaccurate information, or identity theft issues that could crop up. If you do happen to see something erroneous in your credit report that you’d like to dispute, here’s how to go about doing that.

How to dispute your credit report

1. Pull up your credit report

Before you can object to anything in your credit report, you’ll need to gain access to it to see what’s in there. Everyone is eligible for one free credit report per year from each of the three major credit bureaus – which are Equifax, Experian and TransUnion – from annualcreditreport.com.

Setting a reminder to check in with a different agency every four months is a great way to keep an eye on your credit report throughout the year.

2. Be thorough about the information

Once you receive the report (which happens instantly), make sure you go through the report itself carefully and thoroughly. You can double check any reports of new lines of credit, missing or late payments on current credit cards or loans, as well as check out which hard inquiries have popped up.

3. Look for common inaccuracies

Besides things that are fairly obvious - like new credit card accounts or other lines of credit that you did not personally open - be sure to thoroughly check the report for information that should have been taken off (like late payments more than seven years old), remedied delinquencies that still show as unpaid, or incorrect facts like names and/or addresses.

4. Contact the source

Depending on the problem, you may be able to solve a credit report problem by directly contacting the creditor - like your bank - and resolving the issue. Have as much information on hand as you can, including the inaccurate information from your report, to hopefully resolve the issue quickly and in your favor.

5. Plan to contact the credit reporting agency directly

If you could not resolve your problem directly through the source, your next step would be to contact the credit reporting company that issued the report. According to the Federal Trade Commission, there are a few specific steps to follow to accurately file a report to correct errors, so be sure to follow them all as they are listed below.

6. Send the credit reporting agency a letter

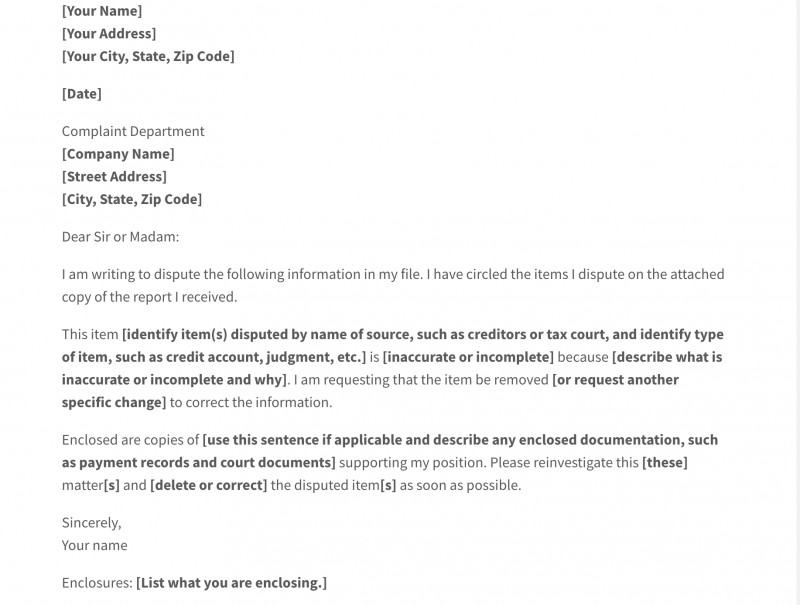

Use the FTC's sample letter to alert the credit reporting company in writing about the inaccurate information.

Send copies of documentation to support your claim and clearly provide all of the pertinent details including your name and address and each item in your report that is inaccurate.

You may also ask the credit reporting company to send correction notices to anyone else who received your report in the past six months, as well as anyone who received a copy for employment reasons during the past two years.

7. Mail the letter

Be sure to mail your form letter to the credit reporting agency by certified "return receipt requested" mail so that you can track the movements of your request. Keep copies for yourself of all the documentation.

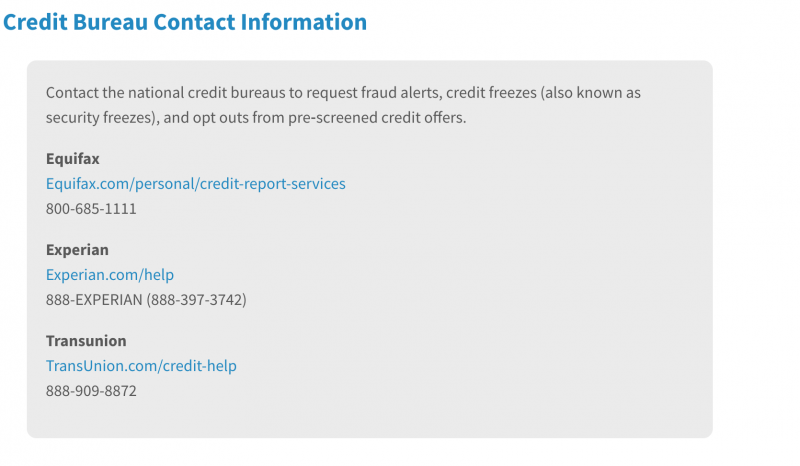

Find information for each of the three credit reporting agencies, courtesy of the FTC, here:

8. Wait the appropriate amount of time to follow up

Credit reporting companies should investigate your issue within 30 days, unless they deem your argument frivolous. When they have finished their investigation, they will contact you in writing to let you know, as well as send you a free copy of your report with the change listed.

9. Know your rights

If your request for a change to your credit report doesn't resolve in your favor, you can still ask that a statement of the dispute be included in your file and that the reporting company provide that statement to anyone who recently received a copy of your report. There is usually a fee associated with this service, so be sure to ask about that before doing this step.

10. Consider setting up fraud alerts

Besides keeping an eye on your credit report yourself throughout the year, it helps to set fraud alerts whenever possible so that you might be made aware of any issues as soon as they crop up. Some banks offer these services now, so be sure to start there, or check out Credit Karma for its free monitoring services. Experian, Equifax, and TransUnion also offer paid identity monitoring services.