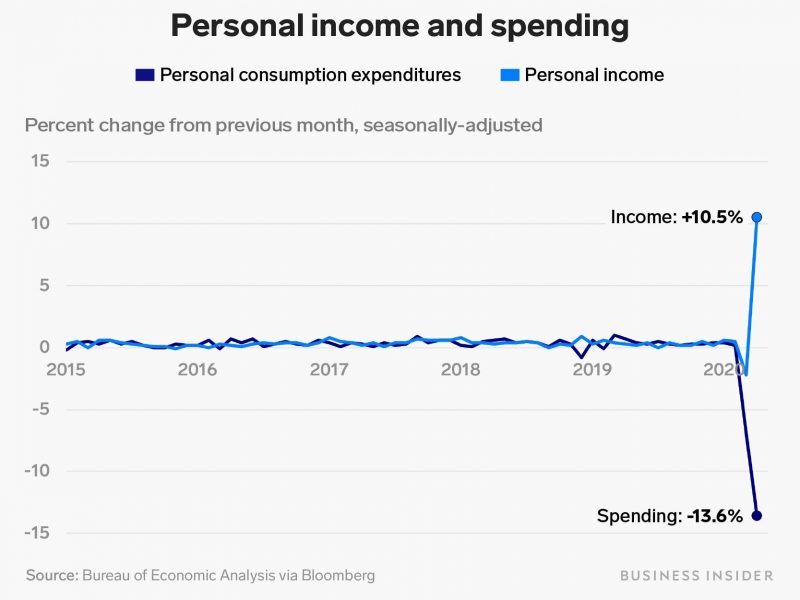

- The Commerce Department released data showing that household incomes rose in April as a result of government aid, combined with a fall in consumer spending that magnified the trend.

- The savings rate also soared to 33% as a share of personal disposable income, a record high.

- A chart below illustrates the effectiveness of federal aid in significantly boosting household incomes during a period of significant economic contraction and reduced consumer spending.

- Visit Business Insider’s homepage for more stories.

As lawmakers debate the extent of further government intervention for another federal spending package, the pandemic continues slamming people’s livelihoods and throwing millions into a world of uncertainty.

Over 40 million Americans have filed for unemployment in the last three months, which has sent the jobless rate soaring to nearly 15%. That trend came as businesses closed their doors to keep the coronavirus from spreading, forcing a wave of furloughs and job losses in the work force.

The federal government initiated new programs aimed at mitigating the fallout, mainly through a $600 boost in weekly unemployment benefits and a one-time $1,200 stimulus check for millions of Americans under the CARES Act in March.

On Friday, the Commerce Department released data showing that personal incomes surged over 10% as consumer spending plunged 13%, the steepest drop ever recorded due to lockdowns keeping Americans at home. Many people also scaled back their spending as they were either furloughed or laid off.

But a stunning chart below illustrates the effectiveness of federal aid in significantly boosting household incomes during a period of severe economic contraction and reduced consumer spending.

The savings rate also skyrocketed 33% as a share of personal disposable income in May, CNBC reported, a record high. It's up from around 13% in March.

What the data relays is the continued effect of the lockdown in April, given that consumption fell nearly 14% as shown in the chart above. It indicated that Americans held onto their money since many businesses remained closed and they also stayed home.

Joseph Brusuelas, chief economist for RSM, said government aid was a critical element in salvaging incomes.

"Lost jobs and income thus far have been partially offset by the $1,200 aid check sent to most citizens and the extra $600 per week distributed to those put out of work due to the pandemic," he wrote in a Friday blog post. "In fact, that is the reason why personal disposable income inside the data has not completely collapsed."

Troy Ludtka, an economist at Natixis CIB Americas, a corporate and investment banking firm, said the development marked a victory for ambitious federal programs designed to aid struggling people.

"This is an unambiguous triumph of countercyclical government spending, which will save the U.S. economy a heap of trouble in the medium to long term," Ludtka told The New York Times.

Still, experts say the trend is likely to be short-lived as there are no additional stimulus checks planned and the ramped-up unemployment payments are set to expire on July 31 without further legislation.

Read more: BANK OF AMERICA: Buy these 13 under-the-radar tech stocks poised to outperform amid flaring China tensions and lasting pandemic damage

Economists are expecting a rebound in spending as states gradually scale back lockdowns and businesses begin to reopen, causing people to amplify their spending.

But there's little prospect of a quick economic recovery, and economists forecast it will take a year or more for personal spending to reach pre-pandemic levels, Bloomberg reported.