Forget the FANGs: Goldman Sachs has adopted a new acronym for the most powerful drivers of the S&P 500 and the Nasdaq.

“While FANG has dominated investor focus, the nature of the acronym has expanded more broadly to encompass mega-cap tech,” wrote Robert Boroujerdi and colleagues in a note on Friday.

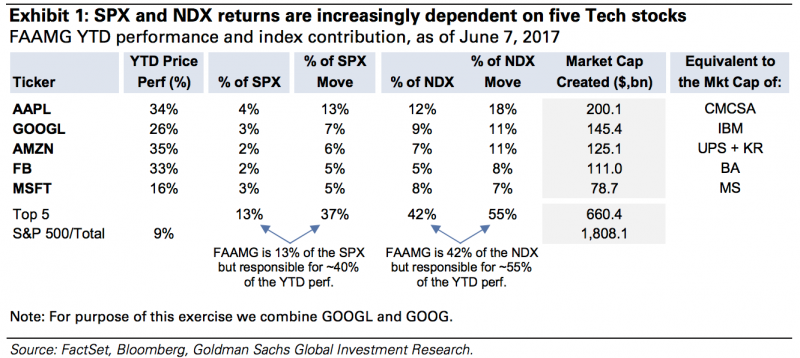

“Indeed, the bigger story in our view is FAAMG – Facebook, Amazon, Apple, Microsoft and Alphabet – a group of five stocks which have been the key drivers of both the SPX & NDX returns year-to date.”

Combined, the FAAMG stocks have added $660 billion in market value this year.

Goldman excluded Netflix, the N in FANG, and Nvidia, the red-hot tech stock that's up 249% in the past year, because they are not yet large enough and are more volatile.

The FAAMG stocks on the other hand are displaying lower volatility, much like the rest of the market is. As its own sector, FAAMG would have the lowest volatility in the market, Goldman says, although that could end up being a problem.

"We believe low realized volatility can potentially lead people to underestimate the risks inherent in these businesses including cyclical exposure, potential regulations regarding online activity or antitrust concerns or disruption risk as they encroach into each other's businesses," Boroujerdi wrote.

Goldman expects passive investors who are chasing a low volatility strategy would move into the FAAMGs. "The fear is that if fundamental events cause volatility to rise, these same passive vehicles will sell and exacerbate downside volatility," the note said.

Back in April, Randy Phinney at Right Side of the Chart wrote about how the FAAMG stocks were leading the Nasdaq and the rest of the market to all-time highs. He noted that FANGs got all the attention probably because the acronym is easier to say.