Evercore is set to finish 2016 with Wall Street bragging rights.

The small firm is on course to finish the year top as the No.1 boutique investment bank in M&A, according to Dealogic. It ranks 11 overall.

It has been a big year for the firm. It landed roles on two of the biggest deals of the year: Qualcomm’s $47 billion deal for NXP, and CenturyLink’s $33.7 billion deal for Level 3. It hired John Weinberg, part of a Goldman Sachs dynasty, to be executive chairman. And the Evercore share price is up almost 30% in the last 12 months.

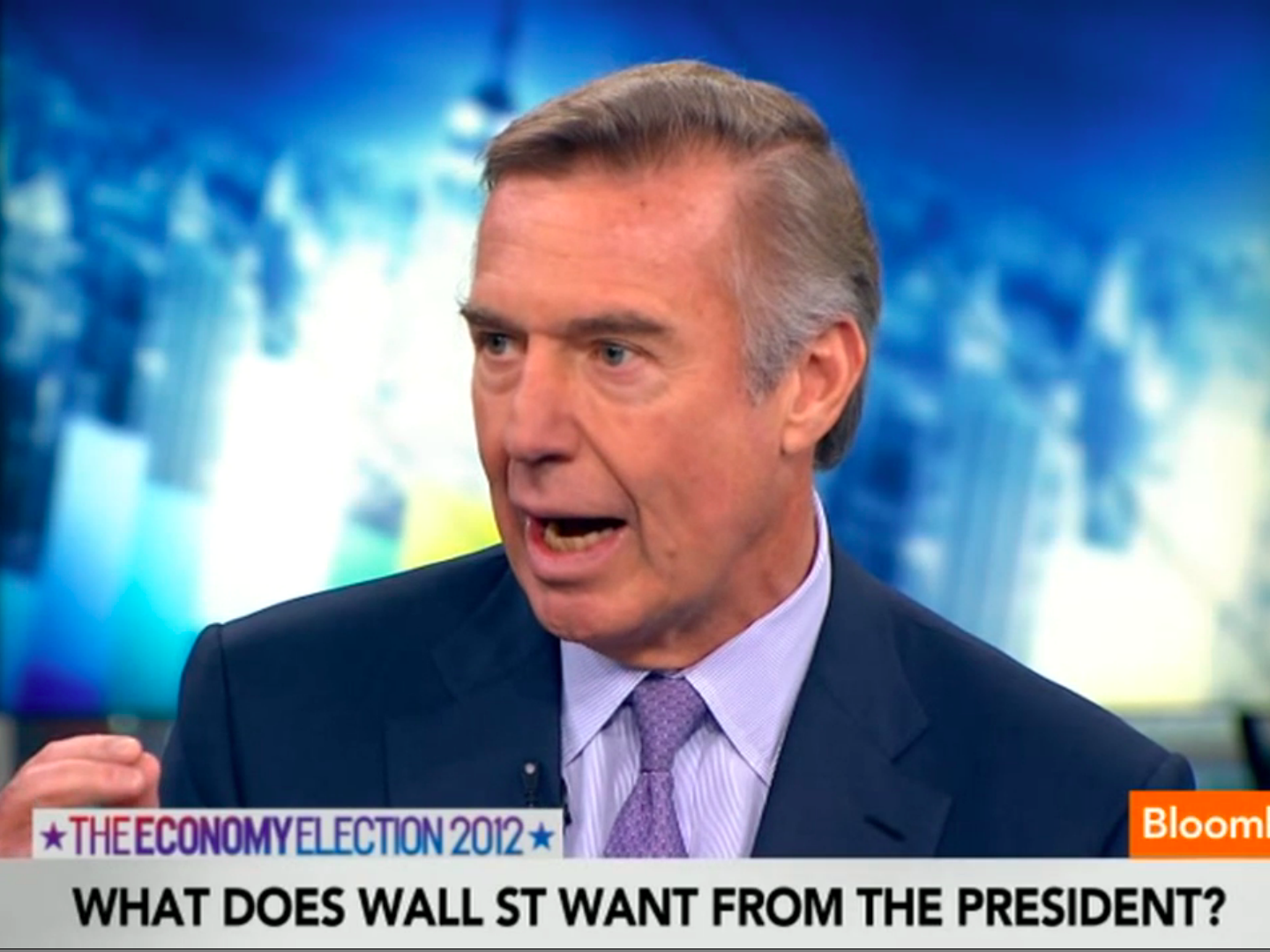

In a presentation to investors earlier this month, Evercore CEO Ralph Schlosstein said that productivity per advisory senior managing director is now ahead of the average productivity of all of its public independent peers.

In plain English, that means Evercore’s top staff make more money than their rivals.

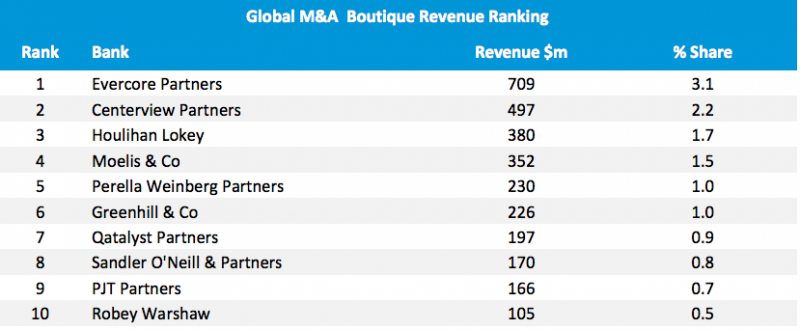

Here are some tables showing Evercore's 2016 M&A performance:

Evercore Partners tops the M&A ranking for boutique investment banks

Evercore is at the top of the revenue ranking too