Michael M. Santiago/Getty Images

- The stocks of newly public companies tumbled on Tuesday, with many hitting post-IPO lows.

- The Honest Co., DoorDash, Snowflake, Bumble, and Compass were among the stocks included in the sell-off.

- This weak performance comes on the heels of red-hot market activity that's seen more IPOs so far in 2021 than any year in more than two decades.

- See more stories on Insider's business page.

Stock prices of newly IPOed companies tumbled on Tuesday with many hitting their lowest points on record amid a broader market sell-off.

Shares of The Honest Company, which started trading publicly last week, fell as much as 10% to a post-IPO low.

DoorDash fell 5% to an all-time low in early trading before recovering. It now looks on pace to finish the day in the green. However, the food-delivery company is still down more than 30% since the close on its first day of trading in December.

Shoals Technologies, Snowflake, C3. Ai, Bumble, and Compass also hit all-time intraday lows on Tuesday.

Excitement over newly public companies appears to be dying down as investors take profits off the table amid fears of rising inflation.

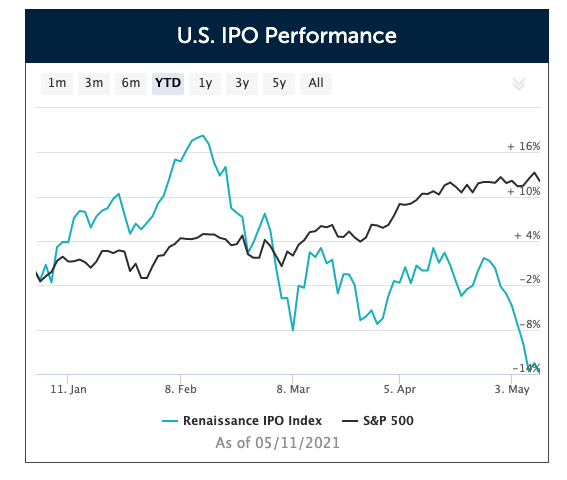

The Renaissance IPO ETF, which tracks an Index of US companies that have recently completed an IPO is down nearly 13% year-to-date. While it started off the year outperforming the S&P 500, the benchmark index is now up 10.4% year-to-date.

This weak performance comes on the heels of red-hot market activity, with 2021 marking one of the hottest years on record for the public-offering market. Data from Refinitiv shows that a global total of 670 IPOs have been recorded so far in 2021, the highest year-to-date tally in more than two decades. Globally, stock exchange debuts have raised a record $140.3 billion, smashing the previous all time record of $91.8 billion, set in 2007.

"The rapid recovery of the stock market, after stocks plunged in response to the spread of COVID-19 last year, encouraged companies to press ahead with IPOs, and investor sentiment about future growth opportunities beyond the pandemic has been key to driving activity this year," said, Lucille Jones, Refinitiv Deals Intelligence Analyst.

With the stock market now pausing off of its all-time highs and rising concerns of inflation, it remains to be seen whether investor sentiment about future growth can continue to drive IPO issuances for the rest of 2021.