Happy Friday, Sept. 6th!

Bringing you this week’s fresh batch of healthcare and biotech news is me, Erin Brodwin, subbing for the fabulous Lydia Ramsey while she wraps up her honeymoon festivities.

While my East Coast coworkers mourn the end of summer, the Bay Area is just starting to heat up. Hello, iced coffee – it’s been too long.

Are you new to our newsletter? Sign up here!

Earlier this week, buzzy Silicon Valley microbiome startup uBiome filed for Chapter 11 bankruptcy. The company had previously convinced VCs that testing poop was a business worth $600 million. Among them: Andreessen Horowitz and 8VC, who now own 11% and 20% of uBiome, according to the bankruptcy filing:

Poop-testing startup uBiome was once valued at $600 million by Silicon Valley's top VCs. It just filed for bankruptcy.

Chapter 11 bankruptcy isn't as extreme as other forms of insolvency: uBiome won't be liquidating as it would if it had declared Chapter 7 bankruptcy, for example. Instead, the company is looking for a buyer and attempting to save what it can of the business. That could be tough if uBiome's foundational science is flawed, as insiders previously told me.

Which brings me to my next bit of news: Zachary Tracer and I had the scoop on an unfortunate turnout for uBiome's plans for salvation. The company was going to try selling its only product, a test called Explorer, at CVS stores. CVS, however, told us it's not feeling the deal:

uBiome was banking on CVS selling its tests - but the chain just turned it down

Prospective uBiome buyers face other risks too, as my colleague Emma Court lays out below. Among them: potentially millions of dollars in refunds from health insurers including Cigna, UnitedHealth, and Kaiser. Three of the claims exceed $1 million:

Some of uBiome's largest creditors are health insurers saying they're owed millions in refunds.

And in non-poop-related news, tooth-straightening darling SmileDirectClub is eyeing an IPO. The company's top investors stand to be smiling widely as each of them could make billions from the deal, as Lydia and Emma reported on Tuesday:

SmileDirectClub is set to go public at a $7.9 billion valuation. That could make the startup's top investors into billionaires.

Does SmileDirect's bright news have you wondering what other lucrative startups are trying to transform the way we get care? You're in luck. Check out this round up of leading healthcare unicorns courtesy of Emma and Clarrie Feinstein:

The 19 billion-dollar startups to watch that are revolutionizing healthcare in 2019

- 19 healthcare startups have reached unicorn status, the $1 billion-and-over valuation mark.

- Johnson & Johnson bought robotics surgical company, Auris Health, and health insurance startup Oscar Health announced expansion in 12 new markets for next year.

- Some of the billion-dollar healthcare companies like 23andMe, Tempus, and One Medical are worth watching.

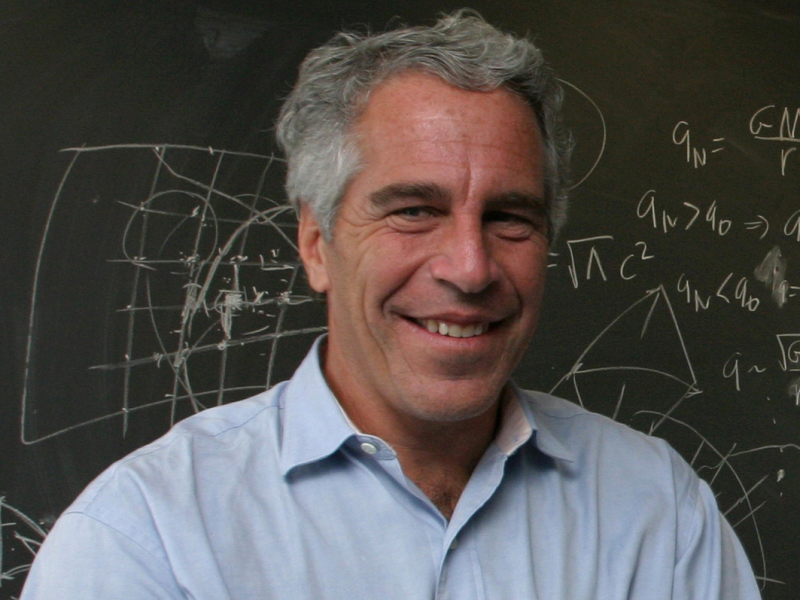

Speaking of bold plans to revolutionize healthcare, I learned this week that Jeffrey Epstein - yes, that Jeffrey Epstein - once had a plan to sequence people's genes and sell the data to drug companies.

That's according to a document obtained as part of a public records request. After outlining his DNA-sequencing plan, the late financier added, "I am not a mad man."

Jeffrey Epstein had a 'Frankenstein'-like plan to analyze human DNA in the US Virgin Islands

I don't want you leaving our newsletter with only thoughts of bad news to fill your weekend, so I'll let you in on some more personal news. My dog, Dax (bonus points if you can guess who he's named after), just got off the waitlist at our SF bureau's WeWork. He'll be starting at his new post on Monday.

- Erin